Introduction

In an era of economic uncertainty, efficient growth, and rapid business changes, cash flow prediction is more critical than ever for small and medium-sized businesses (SMBs). The very survival of a business can depend on its ability to accurately forecast its future cash flow and prepare for the various financial scenarios that the future requires.

What is cash flow forecasting software?

Cash flow forecasting software allows businesses to project future cash inflows and outflows, helping them better manage their cash flow and financial resources. It utilizes real-time data and sophisticated financial modeling to provide both accurate and reliable forecasts.

More than just a replacement for traditional Excel spreadsheets, cash flow forecasting software has become an indispensable tool for businesses seeking a competitive edge in today’s demanding market. It offers the power, flexibility, automation, and precision that even the best modeled spreadsheets simply can’t match.

What are the advantages of using software for forecasting cash flow?

Compared to using traditional spreadsheets, cash flow projection solutions offer numerous advantages:

Real-time Forecasting: The software provides real-time updates of financial data, ensuring that businesses have the most accurate information at their fingertips at all times.

Improved Accuracy: The sophisticated formulas used by the cash flow forecasting software greatly reduce the risk of human error, providing FP&A teams with both accurate and reliable forecasts.

Efficiency: By automating the cash flow forecasting process, the software saves time and resources, allowing FP&A teams to focus on strategic decision-making rather than getting bogged down in data entry and calculation.

Risk Management: The software allows businesses to create multiple cash flow scenarios and assess the potential impact of various financial decisions, hence helping them manage their financial risks more effectively.

Why is a cash flow forecast important?

A cash flow forecast is a roadmap that guides businesses towards their financial objectives. It is a key component of cash flow management best practices, and helps FP&A teams provide valuable insights into a business’s financial health and helps them identify potential issues before they become serious business problems.

With a cash flow forecast, businesses can:

Plan Ahead: By predicting future cash inflows and outflows, a cash flow forecast allows businesses to plan for upcoming expenses, avoid potential cash shortfalls, and make the most of financial opportunities.

Make Informed Decisions: A well prepared cash flow forecast provides the information businesses need to make informed decisions on their investments, expenses, and other financial or operational matters.

Increase Confidence: For CFOs, VPs of Finance, and FP&A managers, a reliable cash flow forecast can instill confidence in their financial decision-making, enhancing their ability to guide the business towards its financial goals with certainty and clarity.

In a rapidly changing business environment, cash flow software provides the tools SMBs need to navigate their financial challenges and seize any opportunity that arises. In this current landscape it’s not just about surviving – it’s about thriving.

And for SMBs looking to gain a competitive edge, it’s clear that cash flow forecasting software is more than just a tool – it becomes a game-changer.

Best cash flow forecasting tools in the market:

The following softwares offer varying degrees of complexity, integrations, scalability, and pricing options, allowing businesses to choose the one that best fits their business goals and budget. Implementing the right cash flow forecasting solution can greatly enhance the ability SMB businesses have to effectively manage their finances, make informed decisions, and achieve their growth objectives.

In our breakdown of the best cash flow forecasting software, we include a summary, differentiation features, and our expert opinion on each, making it easy for every FP&A team to make the best buying decision for their business.

1. Abacum

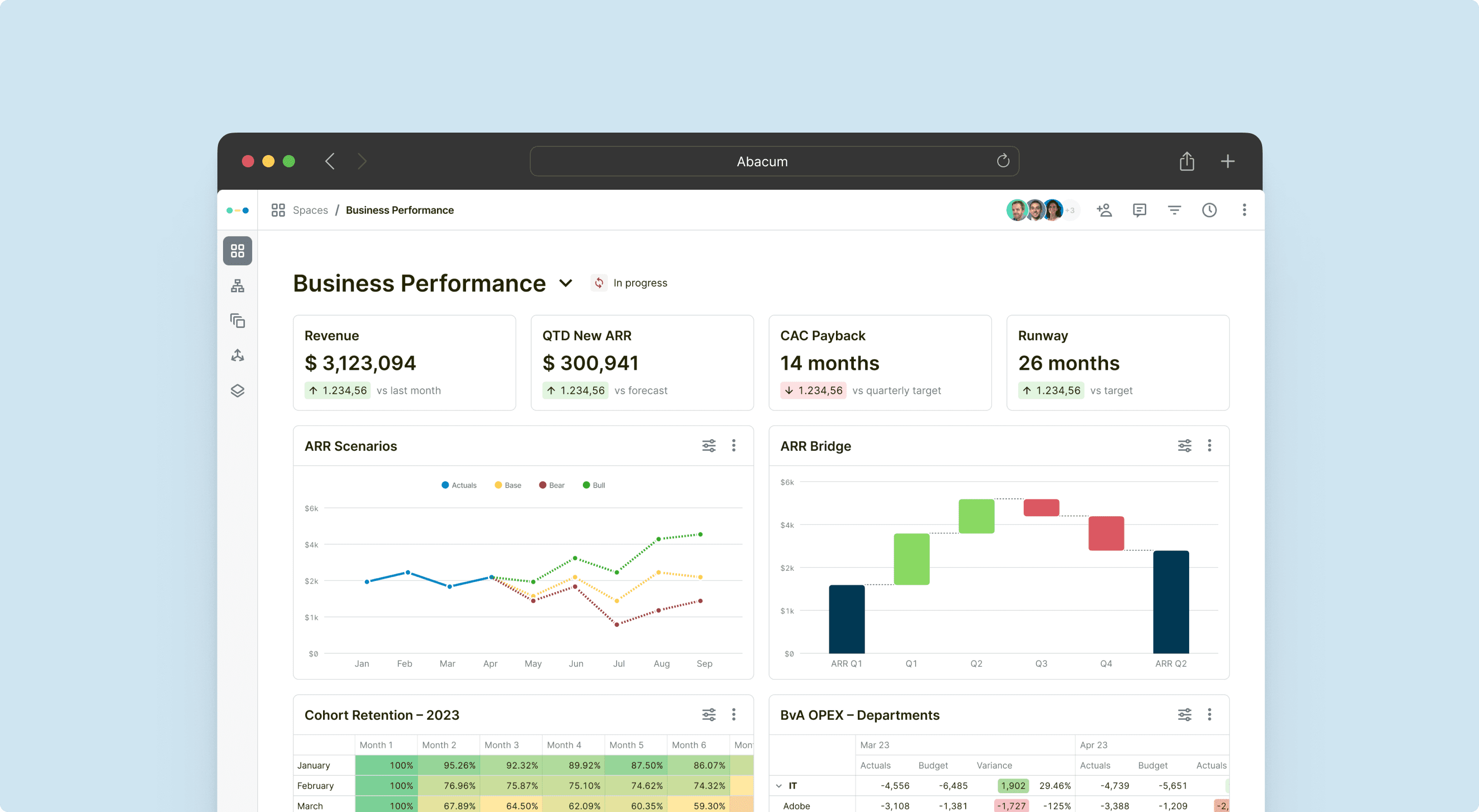

Product Overview: Abacum is a cash flow forecasting software that serves as an essential multiplier for CFOs, VPs of Finance, and FP&A managers in making data-driven decisions.

Core Features: Abacum’s strength lies in its ability to provide real-time cash flow metrics, its powerful data and reporting automation features, and more importantly its intuitive dashboarding options.

Suitable for: With its advanced yet intuitive features, Abacum is well-suited for small and medium-sized businesses and Financial Planning & Analysis teams that value accuracy, efficiency, and working with the leading cash flow forecasting software in the market.

Accounting Integrations: Abacum provides seamless and self-serve integrations to NetSuite, Sage, QuickBooks, Xero, and several other leading accounting providers.

Pros: Abacum is praised for its functionality, allowing for accurate cash forecasting and automation. It supports robust business decisions with real-time data and scenario analysis features help teams understand the impact of any possible decision. This cloud-based solution also facilitates efficient cash position tracking, important for stakeholder communications, and leverages AI to automatically consolidate and allocate banking transactions in your cash flow forecast.

Cons: While Abacum offers many benefits, it might not be suited for small-sized businesses with limited business cash flow.

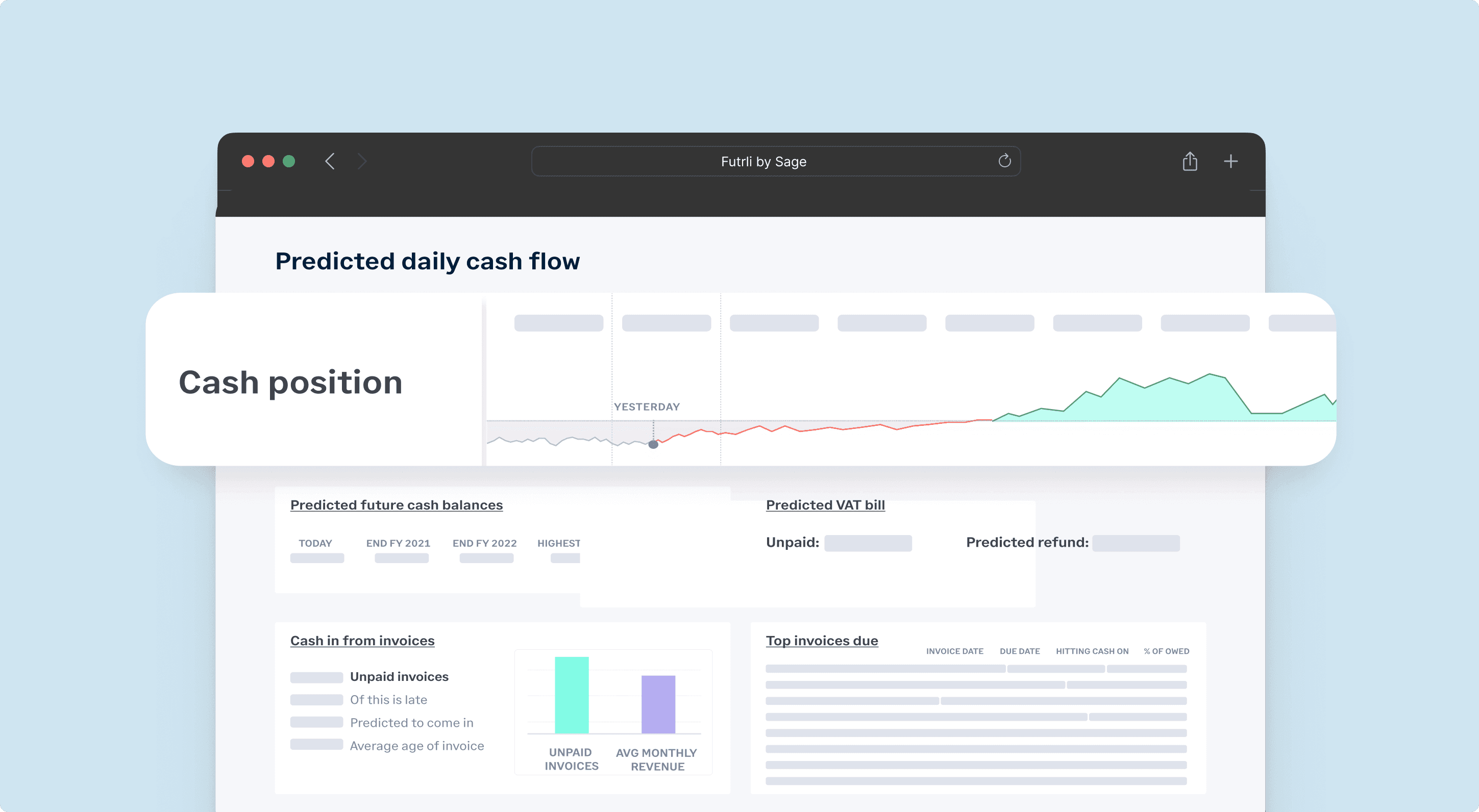

2. Futrli by Sage

Product Overview: Futrli offers a business planning and cash flow prediction platform tailored for small businesses and finance advisors.

Core Features: Futrli excels in cash flow forecasting and business planning.

Suitable for: The platform is ideal for small businesses and financial advisors who require a solution that supports both planning and forecasting.

Accounting Integrations: Futrli supports integrations with popular accounting platforms such as Xero and QuickBooks but does not support integrations to other ERPs such as NetSuite or Microsoft Dynamics.

Pros: Futrli provides functionality that supports small business owners in planning and forecasting.

Cons: Although Futrli has robust features, it may have limitations in terms of treasury management and the ability to drill down to certain KPIs. Furthermore, the transition from spreadsheets to a cloud-based solution can be time-consuming for some users.

Learn more:

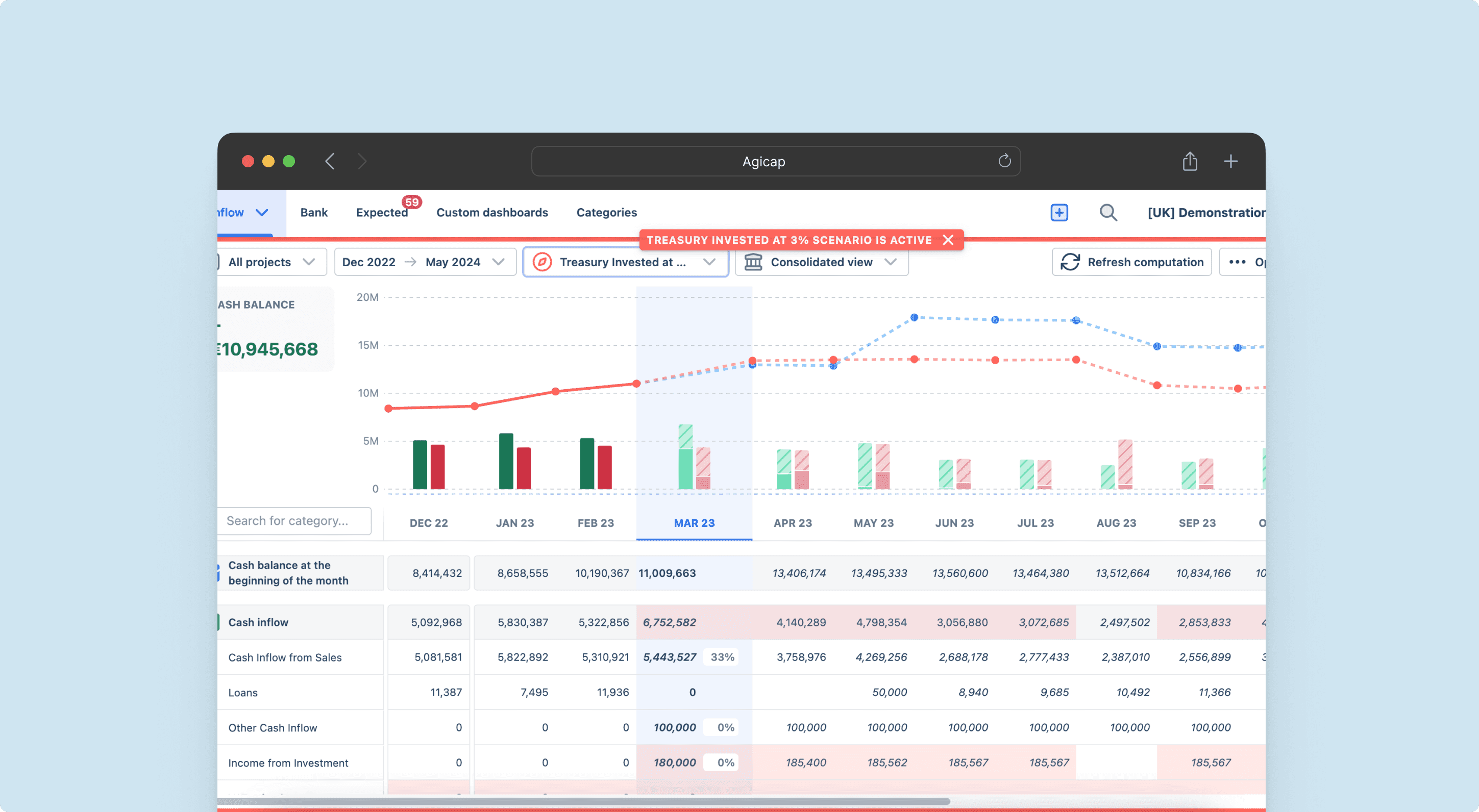

3. Agicap

Product Overview: Agicap is a robust cash flow management solution designed for small and medium-sized businesses.

Core Features: Key features of Agicap include cash flow monitoring, scenario planning, and automated cash flow calculations.

Suitable for: Agicap is best suited for SMBs and FP&A teams that need to manage cash flow effectively and plan for various financial scenarios.

Accounting Integrations: Agicap integrates seamlessly with QuickBooks, Xero, and Sage and other leading accounting solutions.

Pros: Agicap offers automated cash flow calculations and scenario planning, which are beneficial in managing the cash position. It also supports integrations with popular accounting software, enabling efficient consolidation of financial data.

Cons: There might be a lack of detailed KPIs tracking, and some users might find the initial setup to be somewhat complex and time-consuming. Agicap is only limited to treasury management so users require additional software for their planning and budgeting requirements.

Learn more:

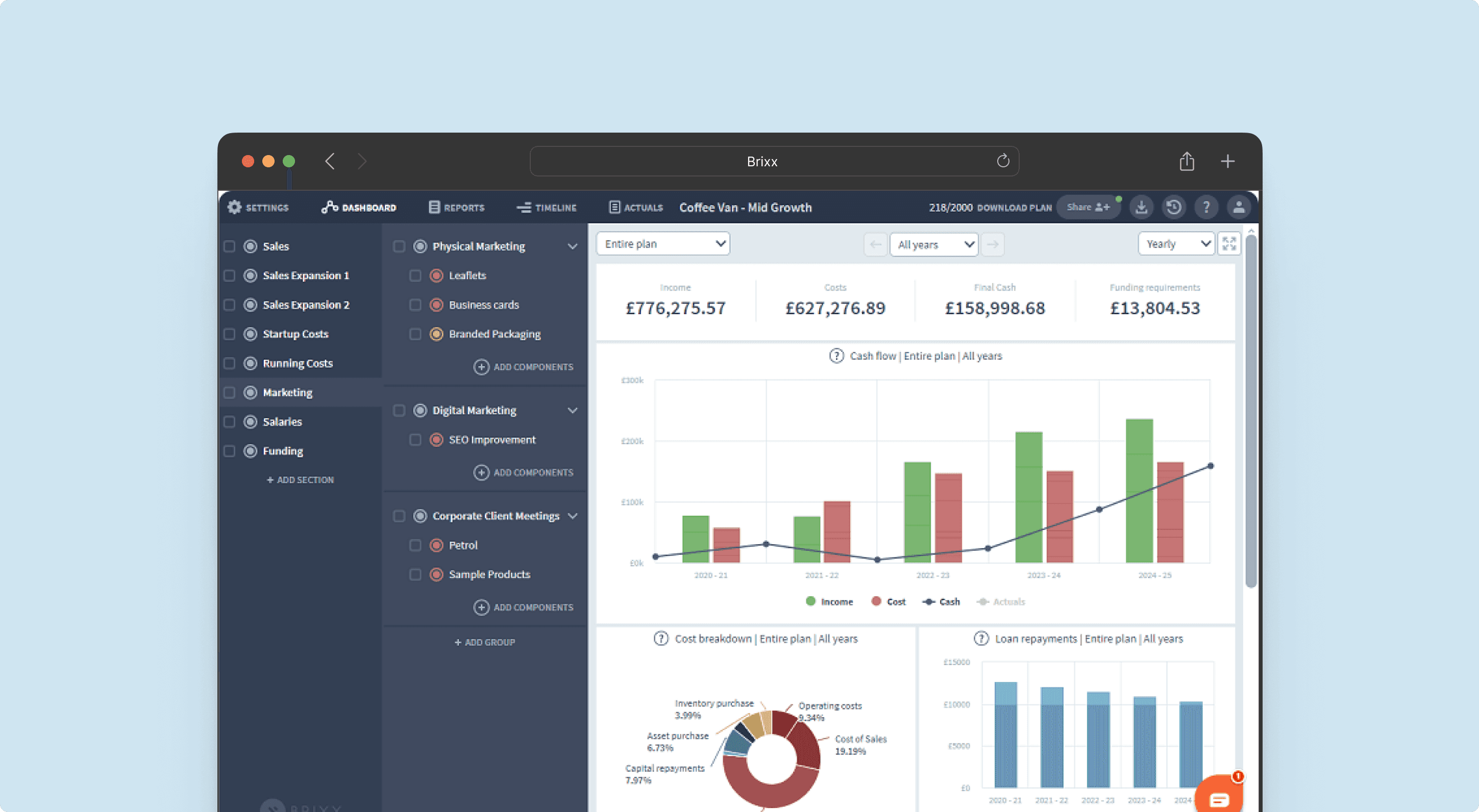

4. Brixx

Product Overview: Brixx is a comprehensive solution providing financial forecasting, reporting, and budgeting for startups and small businesses.

Core Features: Brixx is particularly strong in cash flow forecasting, budgeting, financial reporting, and scenario planning.

Suitable for: Ideal for startups and small businesses, Brixx offers a user-friendly platform for financial planning and management.

Accounting Integrations: Brixx supports integrations with QuickBooks and Xero.

Pros: Brixx stands out with its user-friendly platform for non finance experienced users, offering forecasting, budgeting, and financial reporting features. This helps business owners have a real-time understanding of their financial situation without becoming financial experts.

Cons: Some users may find limitations in its ERP integration capabilities and its ability to cater to more complex treasury management needs.

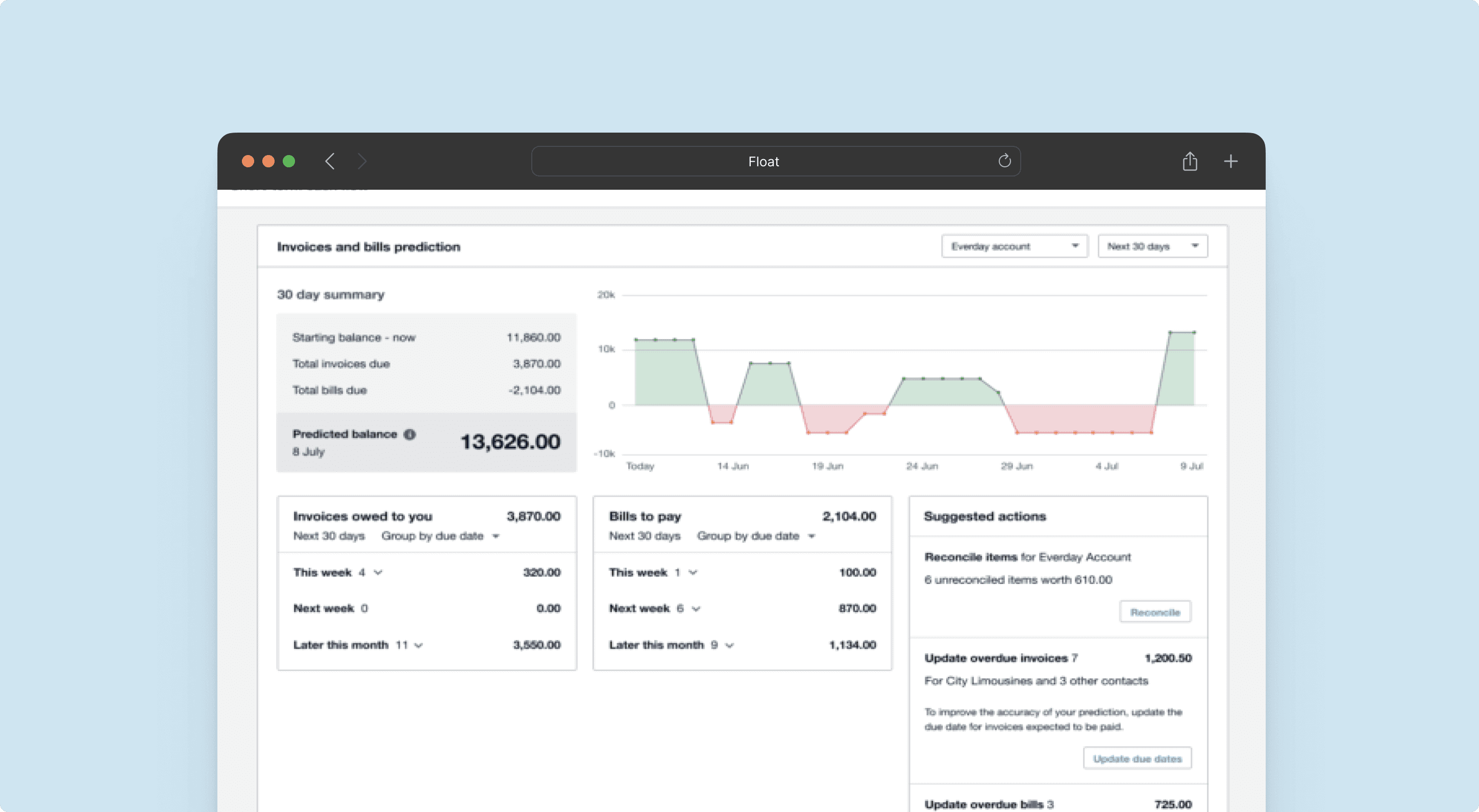

5. Float

Product Overview: Float offers an effective cash flow forecasting solution for businesses and advisors that operates as an add-on to several accounting solutions.

Core Features: Float helps small business owners create cash flow forecasts that are more accurate, always up to date and take a fraction of the time to prepare when compared to spreadsheets.

Suitable for: Float serves businesses of all sizes, as well as financial advisors who need a reliable forecasting solution that easily serves as an add-on to an accounting solution.

Accounting Integrations: Float integrates with Xero, QuickBooks Online, and FreeAgent.

Pros: Float offers excellent cash flow forecasting, budgeting, and reporting, which can lead to more accurate business decisions. It also supports integration with popular cloud-based accounting platforms.

Cons: The software may be less suitable for businesses requiring advanced treasury management features, or support for mid-market ERP integrations. In addition, there may be limitations in functionality and the level of detail in drill-down analysis or user permissions. Users have also mentioned that most of the features that Float provides come standard with every accounting software so oftentimes there is no need to implement Float in the first place.

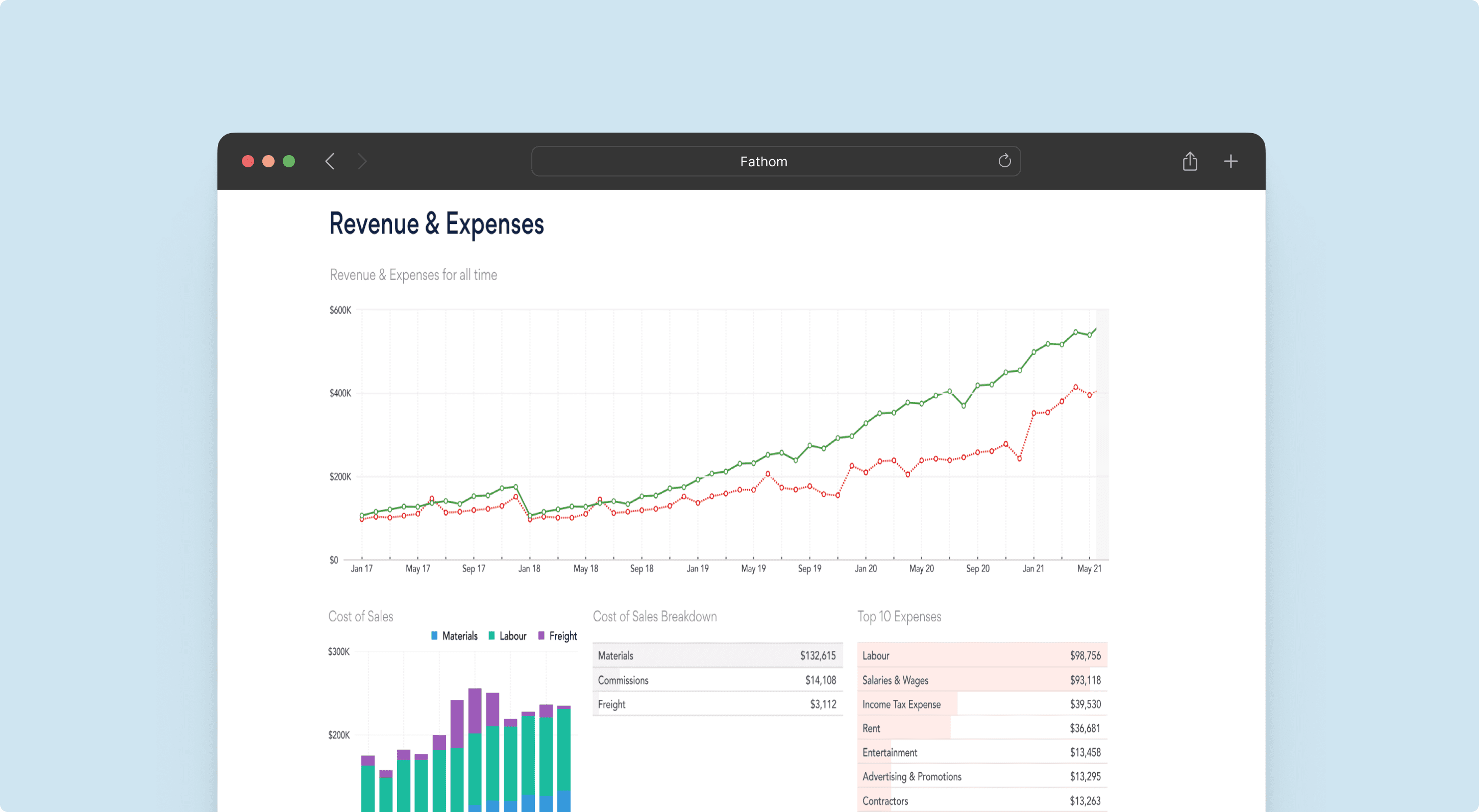

6. Fathom by The Access Group

Product Overview: Fathom transforms accounting data into accounting insights, offering businesses the tools they need for efficient cash flow analysis.

Core Features: Fathom excels in cash flow forecasting supporting three-way cash flow analysis.

Suitable for: With its wide range of features, Fathom is ideal for small businesses that are using entry-level accounting solutions and require more detailed analysis.

Accounting Integrations: Fathom supports integrations with QuickBooks, Xero, and MYOB. They do not provide any integrations to mid-market ERPs such as NetSuite, Sage, or Microsoft Dynamics.

Pros: Fathom transforms raw accounting data into accounting intelligence, providing deep financial analysis capabilities. It supports integration with popular accounting systems, allowing for a more consolidated view of financial data.

Cons: While offering a wide range of features, Fathom may not be as user-friendly for less tech-savvy business owners, the migration process can be time-consuming, and it comes with limited visualization capabilities required for cash flow reporting.

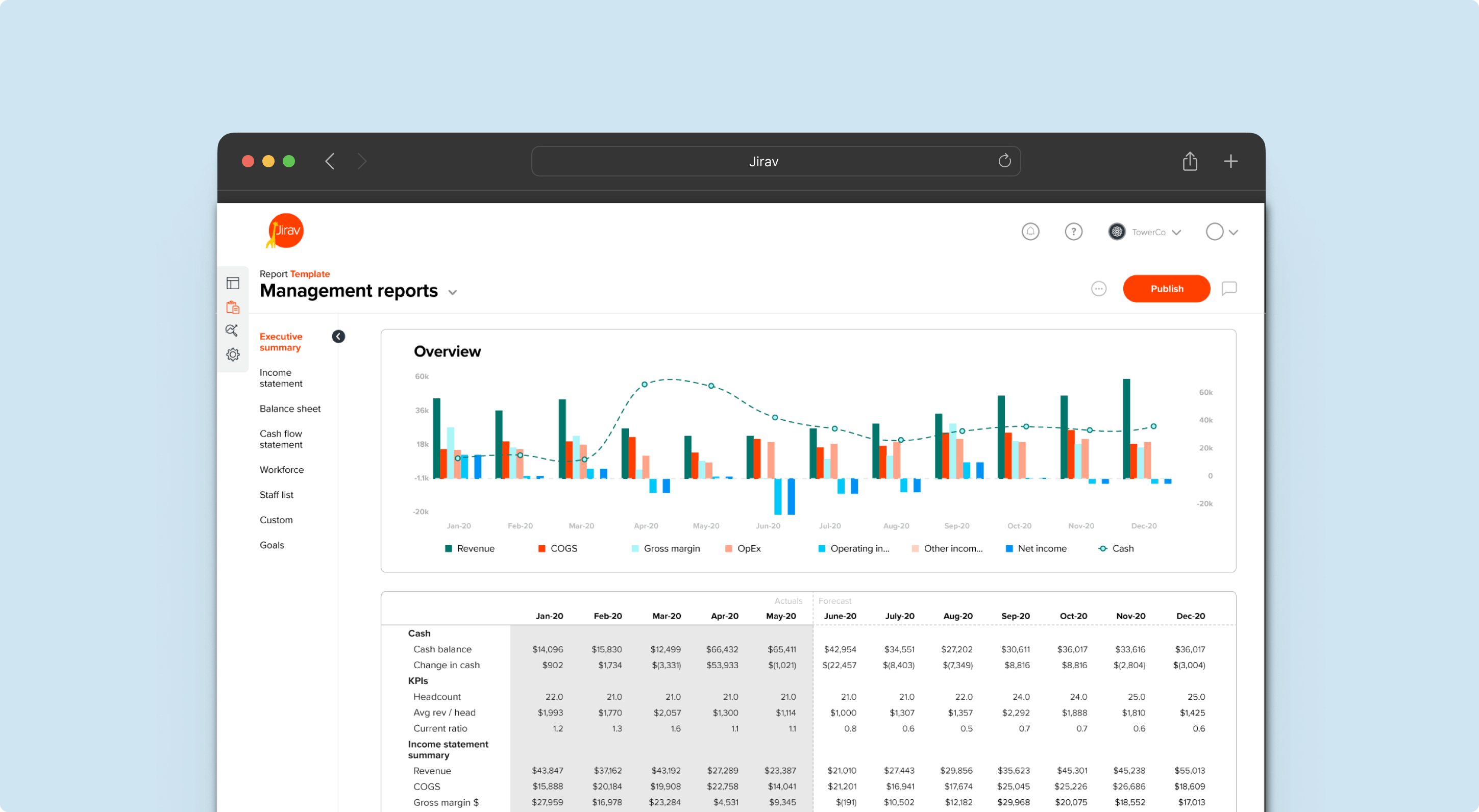

7. Jirav

Product Overview: Jirav provides a cash flow forecasting solution for small and medium businesses that helps them migrate from spreadsheets to a cloud-based solution.

Core Features: Jirav’s features encompass cash flow forecasting, budgeting, reporting, and analytics.

Suitable for: SMBs and FP&A teams will find Jirav useful due to its comprehensive financial planning tools that can streamline their budgeting, forecasting, and reporting processes.

Accounting Integrations: Jirav offers integrations with QuickBooks, Xero, and NetSuite.

Pros: Jirav offers comprehensive features that enable businesses to monitor their KPIs effectively. The cloud-based solution facilitates access to real-time data, supporting the formulation of accurate cash forecasts.

Cons: Some users might find Jirav’s extensive features overwhelming initially, there could be limitations in its ability to perform detailed drill-down analysis, and dashboards are missing reporting.

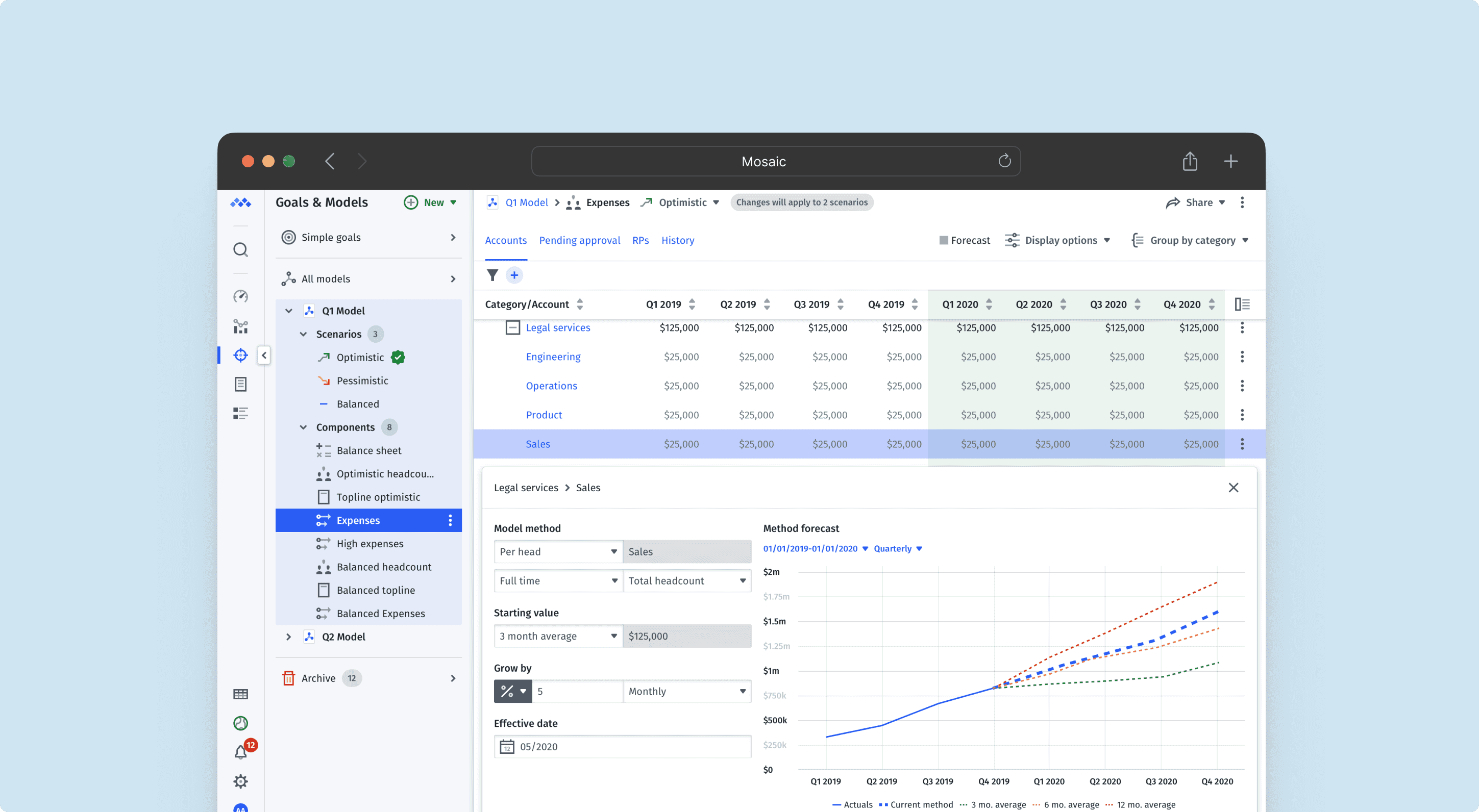

8. Mosaic

Product Overview: Mosaic is a strategic finance platform that has been built for SaaS businesses.

Core Features: Mosaic is able to provide cash flow forecasting, scenario planning, and comprehensive financial insights.

Suitable for: Mosaic presents a platform that supports strategic financial planning and management for SaaS businesses.

Accounting Integrations: Mosaic offers integrations to Xero, QuickBooks, Sage, and NetSuite.

Pros: Mosaic provides robust cash flow forecasting and scenario planning features. It supports strategic financial planning and management, facilitating business owners in making informed decisions.

Cons: The software may lack more advanced functionality and may not provide extensive capabilities for tracking KPIs or managing treasury operations. Mosaic is furthermore only suitable for SaaS business models, limiting its use for other mid-market businesses.

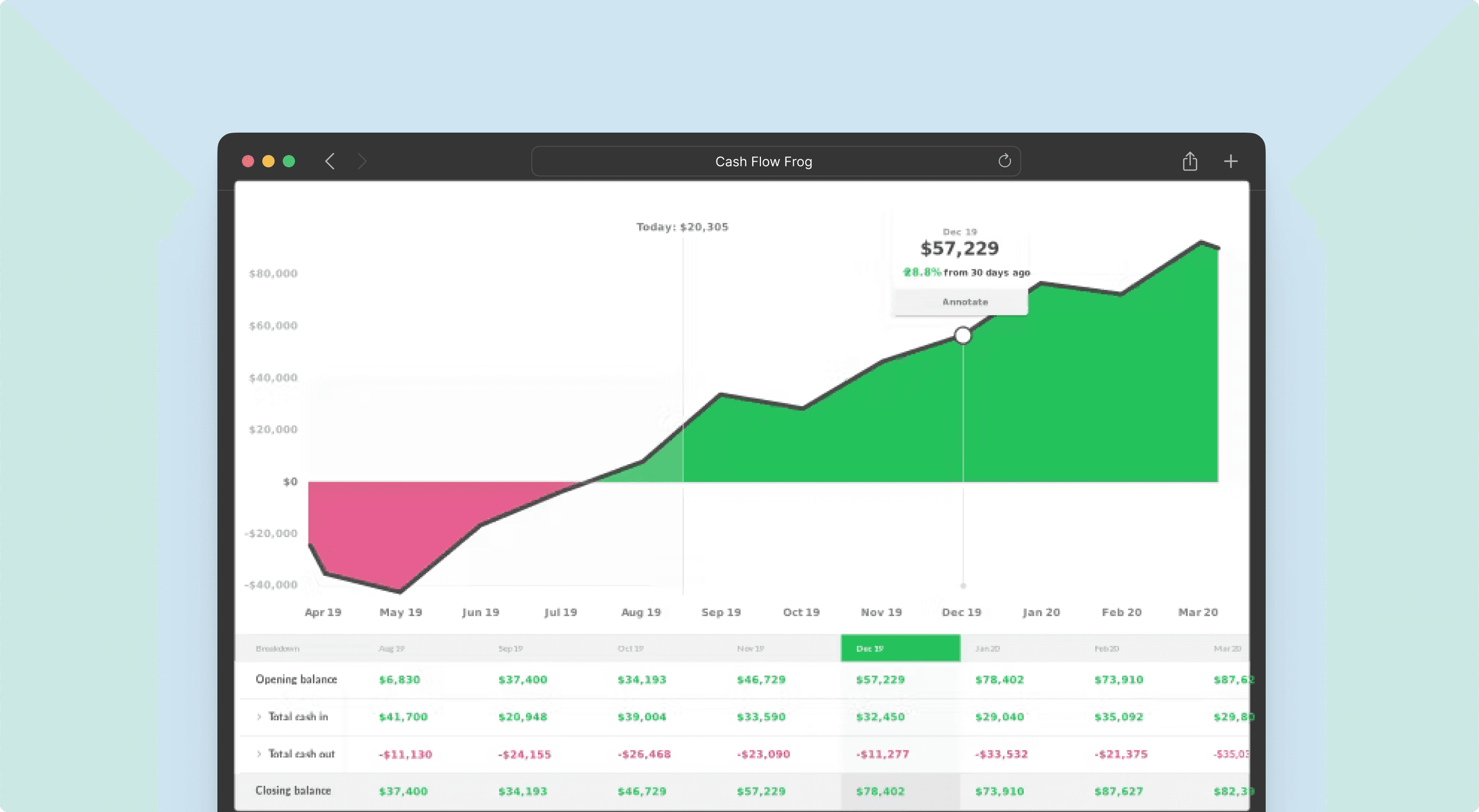

9. Cash Flow Frog

Product Overview: Cash Flow Frog provides a simple and intuitive cash flow forecasting and management solution designed specifically for small businesses.

Core Features: The platform excels in cash flow forecasting, offering alerts and reminders to keep businesses on track.

Suitable for: Given its simplicity and intuitive interface, Cash Flow Frog is particularly suited for small businesses that require a straightforward cash flow management solution without a background in accounting or finance.

Accounting Integrations: Cash Flow Frog supports integration with QuickBooks and Xero.

Pros: Cash Flow Frog provides an intuitive interface, making it an accessible tool for small business owners. It offers simple cash flow forecasting and management solutions that allow users to keep track of their cash position effectively.

Cons: The software may lack more advanced functionality and may not provide extensive capabilities for tracking KPIs or managing treasury operations.

10. Excel / Google Spreadsheets

Product Overview: Excel and Google Spreadsheets provide versatile platforms for manual cash flow forecasting and analysis, offering a high degree of customization.

Core Features: The key features of these platforms are they offer a high degree of flexibility, allowing users to create customized cash flow models.

Suitable for: While these tools can be used by businesses of all sizes, they are particularly useful for startups and small businesses that require a high degree of customization in their cash flow forecasting and are not ready to implement a dedicated cash flow forecasting solution.

Accounting Integrations: These platforms do not have direct integrations with accounting software, requiring manual data entry or the use of additional tools to import financial data.

Pros: Excel and Google Spreadsheets offer a high degree of customization that can cater to specific business needs.

Cons: While they are powerful tools, they do not support direct integration with accounting or ERP software, which can lead to time-consuming manual data entry. Also, they do not provide real-time updates, making it difficult to maintain an accurate cash position.

Picking the best option for your business needs

After comparing all these solutions, it’s evident that choosing the right cash flow forecasting software depends on the specific needs and circumstances of each business. Remember that the best software for your company will provide the right balance of functionalities, integration capabilities, and ease of use that aligns with your business processes and objectives.

So take the time to consider these factors and choose a cash flow forecasting software that best supports your business’s financial planning and cash flow management needs. Whether you’re a business owner or an FP&A professional, investing in the right software can be a game-changer in driving your company’s financial performance and success.

Why Abacum stands out as the best cash flow forecasting software

Abacum has been designed with the specific needs of small to medium-sized businesses and financial planning and analysis teams in mind. In the current marketplace where a range of options exists, it is essential to choose a cash flow forecasting software that not only offers robust functionality but also meets your unique business requirements.

Abacum shines brightly in this regard. It provides real-time updates, a feature that Excel or Google Spreadsheets lack, thereby ensuring your cash position is always automatically up-to-date. Real-time data access is crucial in today’s fast-paced business environment, and it is an area where based on user reviews some other cash flow software, such as Brixx and Cash Flow Frog, can fall short.

Moreover, Abacum takes into consideration the limitations of treasury management often seen in tools like Futrli and Float, and has designed a software solution that supports accurate cash forecasting and risk management with Artificial Intelligence, aiding in strategic business decisions and financial innovation.

Abacum’s solution is comprehensive and streamlined. It caters to the essential needs of SMBs for their cash flow management while ensuring ease of use, a crucial factor that can sometimes be overwhelming in poor-UX software like Jirav.

In essence, Abacum has successfully taken the challenges and limitations presented by other software on the market and created a solution that truly addresses the needs of businesses and FP&A teams. The functionality of Abacum, its capability to offer real-time data, seamless integrations, and user-friendly interface all contribute to its status as the best cash flow forecasting software in 2023.