Meaning and Definition

Financial Planning and Analysis (FP&A) is a finance function focused on performance analysis and future initiatives like budgeting, forecasting, and planning. Unlike other finance roles, FP&A leverages both current and historical data to enhance business performance, prepare management reports, and forecast revenues, expenses, and cash flows. This function is critical for strategic decision-making, ensuring the company’s future objectives are met.

Modern FP&A teams act as business partners, moving beyond traditional back-office tasks to collaborate with stakeholders across the organization.

In a nutshell, FP&A teams help business leaders answer critical questions such as:

What is our current financial position?

What are the potential risks and opportunities in both short-term and long-term strategy?

Where can we invest to achieve our financial goals?

And, are we allocating resources in the right way to maximize growth and efficiency?

Ultimately, FP&A brings together the different metrics from each department such as marketing, sales, operations and HR to help create a robust financial plan for the future.

Why is FP&A so Important?

Since finance is the backbone of a business, FP&A teams need to develop a holistic understanding of each business function.

From management reporting, sales quota attainment, to headcount planning, or owning the budgeting process, FP&A professionals play an essential role in the financial health and success of any organization.

Modern CFOs have enabled their FP&A teams to transition away from being the budget police and instead become true revenue enablers.

If you’re curious about how today’s Chief Financial Officers have evolved beyond being budget gatekeepers and have become strategists, business partners, operators, and trusted advisors to CEOs, you won’t want to miss our CFO Days ’23 event session. In that session, industry leaders such as John Watkins (Founder & CEO, Altima), Michael Bannon (President & CFO, Typeform), and Billy Morris (CFO, Genesis Global) shared their insights on the remarkable transformation of the CFO role. Watch the video below to learn more.

What Does an FP&A Role Do?

Because FP&A has such a fundamental understanding of a company’s financial operations, the role covers both a lot of depth and breadth.

Some of the ways in which FP&A teams are doing this is by:

Complete understanding of business performance. FP&A teams operate across the entire business. This gives them access to the underlying data of each function, helping them understand performance at the most granular level.

Balancing the short-term and long-term strategic planning. Companies need to move quickly, and this means decisions need to happen in real-time. FP&A teams act as unbiased business partners, and help stakeholders balance the trade-offs between short-term execution and maintaining alignment with the long-term strategic plan.

Translating data and insights into clear actions. FP&A teams leverage data to identify the key insights that will drive company performance. Then effectively partner with the rest of the business to turn those insights into a clear and measurable action plan.

How is Financial Planning & Analysis different from Strategic Finance?

While FP&A and Strategic Finance teams share some similarities, they have in the past served as different functions within an organization.

FP&A

Primarily focused on developing the financial models and forecasts that support informed decision-making

Analyzing financial and operational KPIs to identify opportunities and risks

Working closely with other functions to prepare ad-hoc financial insights and decision recommendations

Owning the annual operating plan and departmental budgets

Strategic Finance

Concerned with developing the long-term and overall strategy of the entire business

Understanding and evaluating different market opportunities to uncover new product or business lines

Calculating the financial impact of key business decisions such as potential M&A activities

However, as companies and finance teams are becoming more agile, we are seeing FP&A and Strategic Finance operating as one single team. Day-to-day, this means FP&A is responsible for both the financial planning and analysis remit of the role, as well as directly owning the long-term strategic planning that supports the entire business.

Understanding the FP&A Cycle and Processes

The FP&A team has several responsibilities that range from day-to-day reporting, analysis, and automation, to future-looking initiatives such as annual planning.

All of these responsibilities help:

Bring predictability and operational rigor to the company

Facilitate cross-functional execution between senior management

Ensure operational and financial results are measured, achieved, and any variance understood

To support those responsibilities, FP&A teams follow a framework to understand their data and use it to make better business decisions. The hardest thing in any business is driving consistent performance, however, having a great FP&A cycle will aid this process.

The FP&A Software framework is broken down as follows:

1. Financial and Operational data collection and consolidation

The first step of any FP&A process is to collect the data from the different business systems (e.g. ERP, CRM, HRIS, and data-warehouse) and create an operational single source of truth – this means consolidating your financial, operational, and workforce metrics into a single system.

A best-in-class FP&A team will put a lot of emphasis on correctly defining the operational metrics of a business and on automating the data collection process, moving away from disconnected Excel spreadsheets, and being able to leverage integrations for real-time data updates.

Once the financial data has been transformed and checked for accuracy by an FP&A analyst, teams can now use that data to prepare reporting of visualizations, dashboards, or build driver-based forecasting models.

2. Forecasting and Long-Range planning

After the FP&A team has consolidated the data from each business system, established KPI definitions, and confirmed its accuracy, it’s time to build the company’s forecast and long-range plan.

Forecasting is the process of estimating the future financial performance based on historical data, market trends, and other relevant economic factors.

It is an iterative process of asking questions that help guide the potential business trajectories such as:

What will the business look like if we don’t change anything?

What would it look like if we only changed X or Y?

What is the impact of those decisions in 3-5 years?

To help answer those questions, Finance leaders use different financial forecasting methods such as driver-led models, scenario planning, and what-if analysis to quantify the impact of potential business outcomes and adjust their strategies accordingly.

The Finance team collaborates closely with senior management, breaking down silos and ensuring the forecast model correctly reflects the underlying nature of each department across the company.

A good forecast and long-range plan will:

Agree and establish the capital allocation between the different parts of the business

Establish business unit and corporate target performance

Give credibility to the business strategy (e.g. we have enough resources to afford it)

Set investor expectations

3. Budgeting

Now that the FP&A team has a long-range view of the company’s strategic plan and underlying financials, it is time to cascade this into an annual departmental budget.The budgeting process entails breaking down the financial plan for the upcoming year by months, and rather than a top-down exercise, it is a bottom-up build of the financial plan for the upcoming fiscal year.

A final budget is reflected in the Income Statement, with budgets being allocated all the way down to the individual vendors and account levels,as well as the Balance Sheet and Cash Flow statement.

A good budget will:

Validate the top-down assumptions with the bottom-up budget inputs

Set financial and operational KPI targets at the company level for the upcoming 12 months

Touch every corner of the business, breaking down silos and giving clarity to every business unit. Everything needs to connect back to the P&L

4. Reporting and Performance Tracking

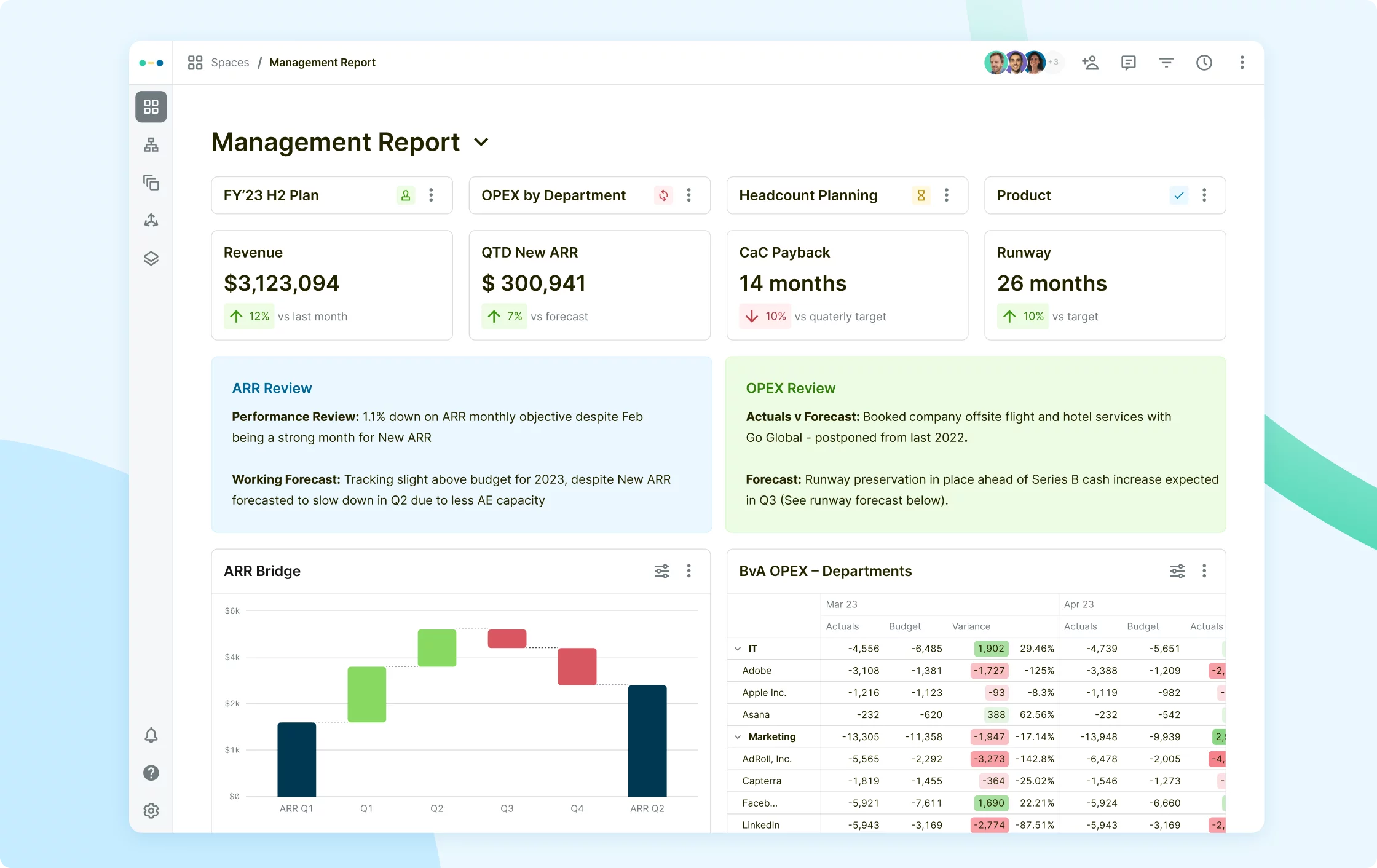

A good report helps FP&A and the rest of the business track their progress against budget, evaluate their performance, and identify any potential areas of improvement.

For that reason, FP&A teams also play a critical role in defining operational metrics, establishing their targets, measuring against them, and identifying any potential areas of improvement.

Management reporting involves conducting a variance analysis to understand which P&L, CF lines, or leading operational KPIs landed in line with the target and which ones did not. Then, delivering the clear insights and problems that need to be fixed to get back on track with the plan.

A good management report will:

Leverage commentary to provide stakeholders with clear reports on what has happened and why

Spot the issues and identify the course of action needed to correct performance

Show a BvA variance analysis for every line item, with detailed OPEX spend at the vendor level

Carefully diagnose the impact that leading operational indicators (e.g. sales qualified leads) can have on lagging indicators (e.g. recognized revenue)

Benefits of implementing FP&A software

The main challenge of FP&A teams owning the planning process detailed above,

is that the finance department spends 75% of their time manually consolidating data, copy-pasting metrics from one spreadsheet to another, and updating stakeholders through back and forth emails.

This means FP&A professionals are left with limited time to be the strategic partners the CFO and the rest of the business needs them to be.

This is why Abacum is an FP&A platform focused on maximizing your business’s most precious resources: time and money.

With Abacum FP&A professionals can:

Save 260 hours a month with off-the-shelf reporting templates, automated BvA analysis, intuitive revenue forecasts and rolling forecasts.

Run a planning process that is 20% more efficient by leveraging streamlined budgeting workflows with approvals and user-level permissions

Ensure Budget to Actual variance <5% your OPEX spend is reduced with vendor-level insights and data-driven planning that keeps your business on track

Have 1 Operational Source of Truth integrate all your business systems for automated data wrangling and consolidations

Building an FP&A team

Finance teams are the engine behind efficient growth. Here is everything you need to know about scaling this corporate finance function, the difference in responsibilities between roles, and how to go from your first hire to IPO.

The key roles within an FP&A team include:

Director or Head of FP&A

Director or Head of FP&A are roles you will most likely see in more mature organizations, often companies that have already raised Series B.

This role reports directly to the Chief Financial Officer, and is accountable for coordinating the FP&A function.

Some of the core responsibilities of the role are:

Building a consistent and predictable corporate FP&A planning process

Creating and owning both the long-term and short-term operating model, forecast, and budget

Delivering key insights to different business stakeholders and supporting the execution of those insights across the business

Being an exceptional business partner, establishing a clear relationship between the FP&A function and the other departments within a business.

Learn more: How to prepare a winning Series B & C data room

FP&A Manager

Depending on company maturity there can be great overlap between the responsibilities of a VP and FP&A Manager. One of the high level differences separating both, is that Managers operate with a more granular view of the business.

Some of the core responsibilities of the role are:

Supporting the CFO or the VP of FP&A with the annual planning process

Preparing and presenting ad-hoc analyses to understand any performance trends

Creating FP&A forecasting models that show the impact of business decisions

Preparing management reports that are on track with month-end closing

FP&A Analysts

FP&A analysts will be into the weeds of the day-to-day, as they collect, analyze and interpret both financial and operational data.

Some of the core responsibilities of the role are:

Consolidating, cleaning, and preparing financial and operational data

Measuring and keeping track of financial metrics and operational KPIs both at the company and departmental level

Preparing data for any ad hoc analysis senior FP&A leadership or executives may need

The Future of FP&A

The emergence of AI and the capability for further automation is sure to elevate and streamline the FP&A process. The growth of ML (machine-learning) and the capabilities of LLM (large-language models) as well as advanced analytics systems provide the ability to handle greater quantities of data and even more in-depth analysis, which is being labelled as “Smart FP&A”.

These tools can alleviate the requirement for time-intensive tasks and instead allow FP&A team members to spend more time on actions that can add value to their organisation – whether that’s conducting or acting upon analysis or developing strategy.

As market landscapes become increasingly competitive, FP&A teams will need to match this by delivering even smarter and faster analysis.

Conclusion

FP&A is a crucial function of any business that explores all aspects of financial performance to inform and develop strategies that alleviate issues and aid business growth. By using FP&A software tools, teams can collect and analyze data, forecast performance, set budgets and track how this is occurring in real-time. FP&A teams provide a fundamental truth to help businesses align with their goals.

If you don’t have the right software to provide this for your business, begin by exploring how Abacum’s software provides solutions for your organisations in your sector.

Frequently asked questions

When do scaling companies need to start building out an FP&A team?

When companies start scaling the business, finance processes tend to fall behind and are only rediscovered when it becomes a necessity for the business.. However, those organizations that start scaling the finance function as early as Series A, or even earlier, can reap the benefits of having a good FP&A team that drives the strategic side of their finance initiatives. According to seasoned professionals, like Peter Specht, this helps the organization be more resilient & better prepared for any possible scenario that may require quick structural changes in the structure or adapting processes. When adding an FP&A team into the mix, companies can actually use financial data to support their leaders & make better business decisions based on valuable, real-time insights.

Which challenges can be solved with an FP&A solution?

Manual data prep: CFOs spend countless hours doing manual tasks on financial data prep. An FP&A tool can help free up time for finance teams so they can shift their focus to more valuable projects such as forecasting and reporting. Lack of agility: Financial leaders need to have the most up-to-date info so they can accurately conduct their budgeting and forecasting. With intuitive FP&A tools, financial planning professionals can maintain data integrity while eliminating common manual errors. Data silos: When data is being sent from different sources, financial planning professionals have to work in overdrive to try and condense all that information into a single report. Mistakes are common, causing longer delays and further setbacks. Outdated data: Not being able to generate accurate insights due to a lack of reliable information is one of the main pain points a finance team will face. A FP&A tool refreshes monthly reports in seconds, helping to maintain data integrity and accuracy across the entire team. Disconnected teams: Having to send back-and-forth emails only lengthens the data retrieving process. This hinders the finance team’s ability to properly analyze data and formulate a comprehensive financial plan.

How does FP&A add value to your company?

FP&A teams monitor the financial health of a company through financial forecasting, analysis, and reporting. In startup and scale-up companies, the FP&A function is typically formed by 30 employees and their work commonly focuses on three key areas: resilience, action and synergy. An FP&A team provides resilience to a company. They bring the ability to adapt quickly thanks to their financial reporting, scenario planning, and data modeling. With FP&A analytics, scaling companies can take action in a strategic way, generating insights based on real-time data that lead to making the right decisions and help the company take action on the areas that need restructuring or reforming. Lastly, when the FP&A team is built strategically, they create a synergy with other teams, sharing valuable predictive analytics, which ensures everyone is working together to make data-driven decisions that will drive the company forward.