Introduction

The budgeting process within enterprise businesses is often quoted by FP&A teams as being essential while simultaneously being extremely burdensome for their company. This process tends to be lengthy, monotonous, and very manual (e.g. copy-pasting data), accompanied by office politics and tensions between finance teams and business unit leaders. Relying on manual, spreadsheet-based budgeting processes is no longer enough to support the agile approach to planning companies need to succeed in 2025. This is why it is essential for companies to invest in the correct software tool. Within this guide, we have reviewed a range of business budgeting software suitable for enterprise budgeting software needs, as well as tools for small businesses that are looking to improve their budgeting and forecasting processes. Within each business budgeting software we have reviewed, we have given an indication of the level of suitability based on business size, including small, medium, large and enterprise.

By adopting the right software tool, FP&A teams can eliminate the pain typically associated with budgeting, and foster a more collaborative and agile experience for all budget owners involved.

“By 2026, Gartner forecasts the financial management software market to be valued at $24.4 billion, growing at a CAGR of 9% from $16.3 billion in 2021. This would make the financial management software category the fastest-growing segment in the enterprise business planning market.”

According to Gartner

By adopting cloud-based accounting and finance platforms, FP&A teams gain access to immediate process upgrades, exceptional scalability, rapid and cost-effective automation, and seamless application integrations.

The adoption of budgeting and forecasting automation is on the rise within FP&A departments, as teams are recognizing the significant advantages it brings. Business planning automation offers enhanced value with minimal effort, enabling FP&A to generate real-time reports without the need to manually search for information. This not only reduces errors but also allows ample time for data analysis.

In our breakdown of the best business budgeting software for various sized companies, we include pricing, differentiation features, and our expert opinion on each, making it easy for every FP&A team to make the best buying decision.

What is Business Budgeting Software?

Budgeting software is a tool that automates the budgeting process, improving efficiency and accuracy in financial budgeting while reducing the workload on finance teams and employees.

A company that relies on Microsoft Excel for budget management is significantly more prone to making mistakes, considering that approximately 90% of spreadsheets contain errors.

In order to solve this problem, companies can turn their way to a business budgeting software. These tools are taking over the status quo of Excel spreadsheets, templates in G-sheets, and regular meetings with team members to go over a spreadsheet nobody understands. These new tools are designed to streamline all financial planning workflows.

Business planning software tools are highly valuable to assist FP&A departments in planning, forecasting, and managing the company’s finances. These tools can range from simple spreadsheets and dashboards to advanced budgeting and forecasting software tools capable of automating financial reporting and generating financial statements such as profit and loss statements, balance sheets, and cash flow reports.

The Benefits of Budgeting Software for all Business Sizes

The primary objective of a business budgeting tool, regardless of its features, is to save time and help businesses deliver on their annual budget. Implementing a budgeting software will deliver several benefits to FP&A teams, for example:

Being able to plan and forecast budgets across the entire business.

Integrating planning and budgeting with real-time reporting dashboards.

Managing cash flow and operations effectively.

Enhancing transparency and collaboration in financial planning with budget owners.

Informing business strategy and decision-making with financial data and operational insights.

Staying on track with financial goals.

Budgeting software offers diverse benefits across business sizes. Here’s how it optimizes financial management:

How Budgeting Software Benefits Enterprise-level businesses

Enables seamless planning and forecasting across departments and subsidiaries.

Integrates real-time reporting for informed decision-making.

Streamlines cash flow management and enhances collaboration at a company level.

How Budgeting Software Benefits Corporate Businesses

Centralizes budgeting processes and automates tasks.

Provides visibility into financial health and variance reporting.

Empowers decision-makers with actionable insights.

How Budgeting Software Helps Small Businesses

Simplifies budget creation, expense tracking, and forecasting.

Offers user-friendly interfaces and affordability.

Optimizes financial performance for long-term sustainability.

“Half of the mid-market businesses surveyed did not create an official budget in 2020, indicating that some business owners may view budgets as unnecessary or overwhelming. However, the adoption of a business budgeting software can greatly simplify the budgeting process by automating tasks and freeing up valuable time for other business operations.”

According to Clutch

Features to Consider When Researching Business Budgeting Tools

Selecting the right budgeting software is crucial for businesses of all sizes, but the needs and priorities can vary significantly depending on the scale of operations. Whether you’re a large enterprise, a mid-sized company, or a small business, choosing the appropriate budgeting solution requires careful consideration of various factors. Here, we’ll outline the essential criteria to evaluate when assessing the suitability of a budgeting platform for your business, categorized by the size of the enterprise.

Enterprise and Corporate Level:

For larger enterprises and corporations, scalability, customization, integration capabilities, advanced reporting, analytics, and stringent security measures are paramount. The chosen software must efficiently handle vast amounts of data, seamlessly integrate with existing systems, provide sophisticated reporting tools, and adhere to industry standards for data security and compliance.

Mid-sized Businesses:

Mid-sized businesses require budgeting software that balances functionality with affordability. Ease of use, cost-effectiveness, collaboration tools, and scalability are key considerations. The software should offer a user-friendly interface, flexible pricing options, features for real-time collaboration, and the ability to scale as the business grows.

Small Businesses:

Small businesses prioritize affordability, accessibility, basic financial management features, and responsive customer support. Cloud-based accessibility, essential financial tools, affordability, and accessible customer support are crucial factors to consider. The software should offer basic features for budget creation, expense tracking, and cash flow management while being cost-effective and easy to use. Responsive customer support is essential for resolving any issues promptly.

Business budgeting software not only streamlines financial management and budget variance reporting, but also enables FP&A teams to uncover valuable cost-saving recommendations.

These software solutions often offer a range of essential features, including income and expense tracking, report generation, budget creation and management, and financial forecasting. By leveraging these capabilities, businesses from small to enterprise can gain better control over their finances and make data-driven decisions to drive growth and profitability.

Here are the 10 best budgeting tools for businesses:

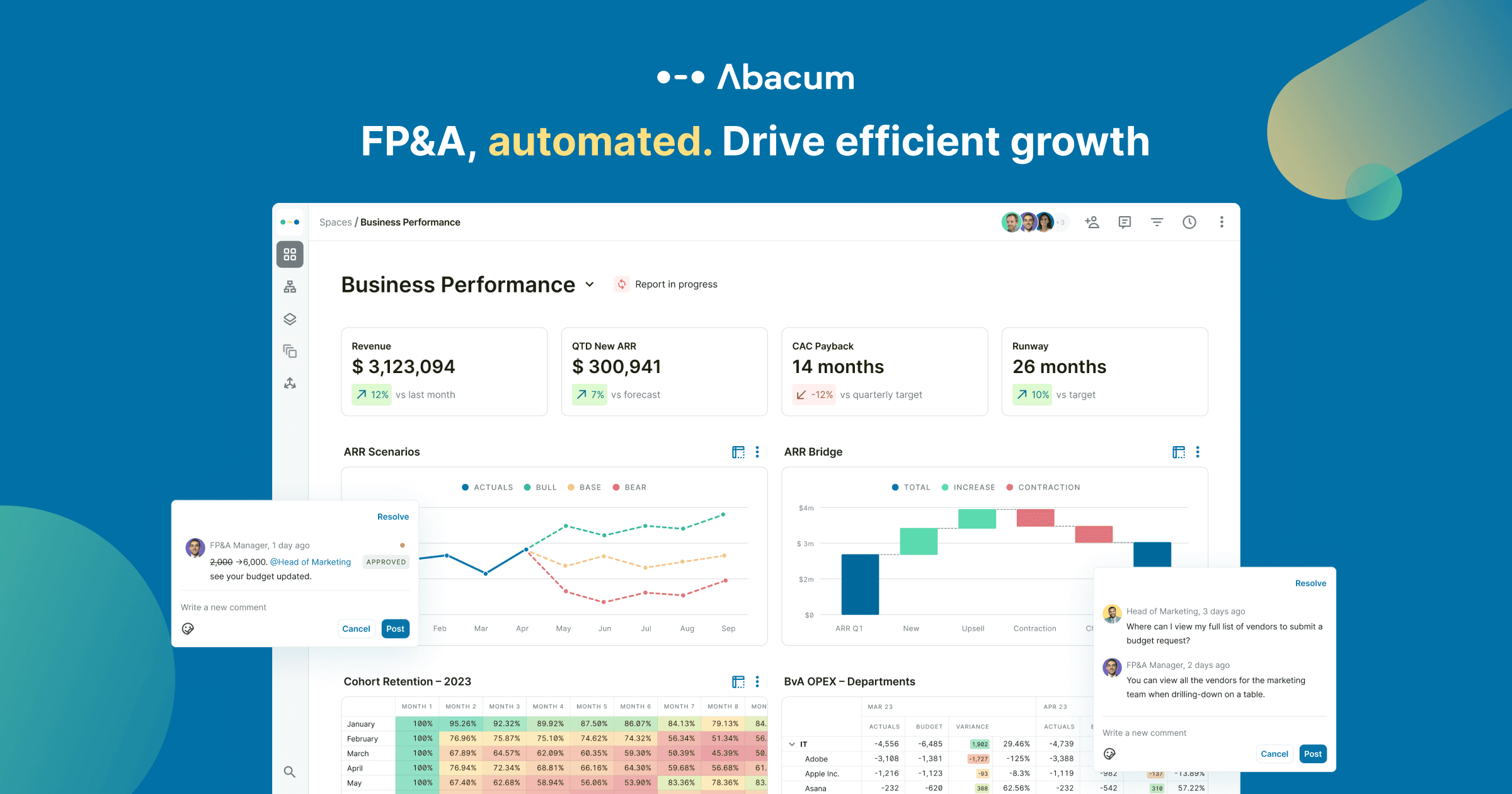

1. Abacum

Abacum is revolutionizing the field of corporate business performance and budgeting software tools with its extensive integration capabilities (ERP, CRM, HRIS) and intuitive visualization interface.

By simplifying decision-making processes, Abacum empowers businesses to effortlessly share insights, automate budgeting workflows and tasks, streamline leadership approvals, and merge bottom-up and top-down forecasts or budgets. With quicker access to insights and enhanced analytics, Abacum automates core budgeting processes and consistently delivers tangible value to its users.

Abacum provides unique benefits compared to ERP systems by offering budgeting add-ons and serving as a centralized platform for the entire organization’s data. By integrating with HRIS for people planning and CRM for sales capacity models, Abacum acts as the single source of truth, enabling comprehensive insights and analysis for financial planning and forecasting.

Business Software Size: Enterprise level solution

Price: Tailored pricing plans are based on unique business requirements.

Great for: Mid-market companies looking for a best-in-class budgeting solution. With its flexibility, Abacum can tailor to the needs of a wide range of business industries.

Advantages: Abacum can help FP&A teams drive an efficient budgeting cycle with faster revenue forecasts, vendor level budgeting, and headcount planning capabilities.

Feature Highlight: Structured budgeting workflows that make driving budget owner accountability seamless with custom roles, budget approvals, and core collaboration functionalities.

G2 Rating: 4.8/5

Learn more: What is the difference between Abacum & a BI tool?

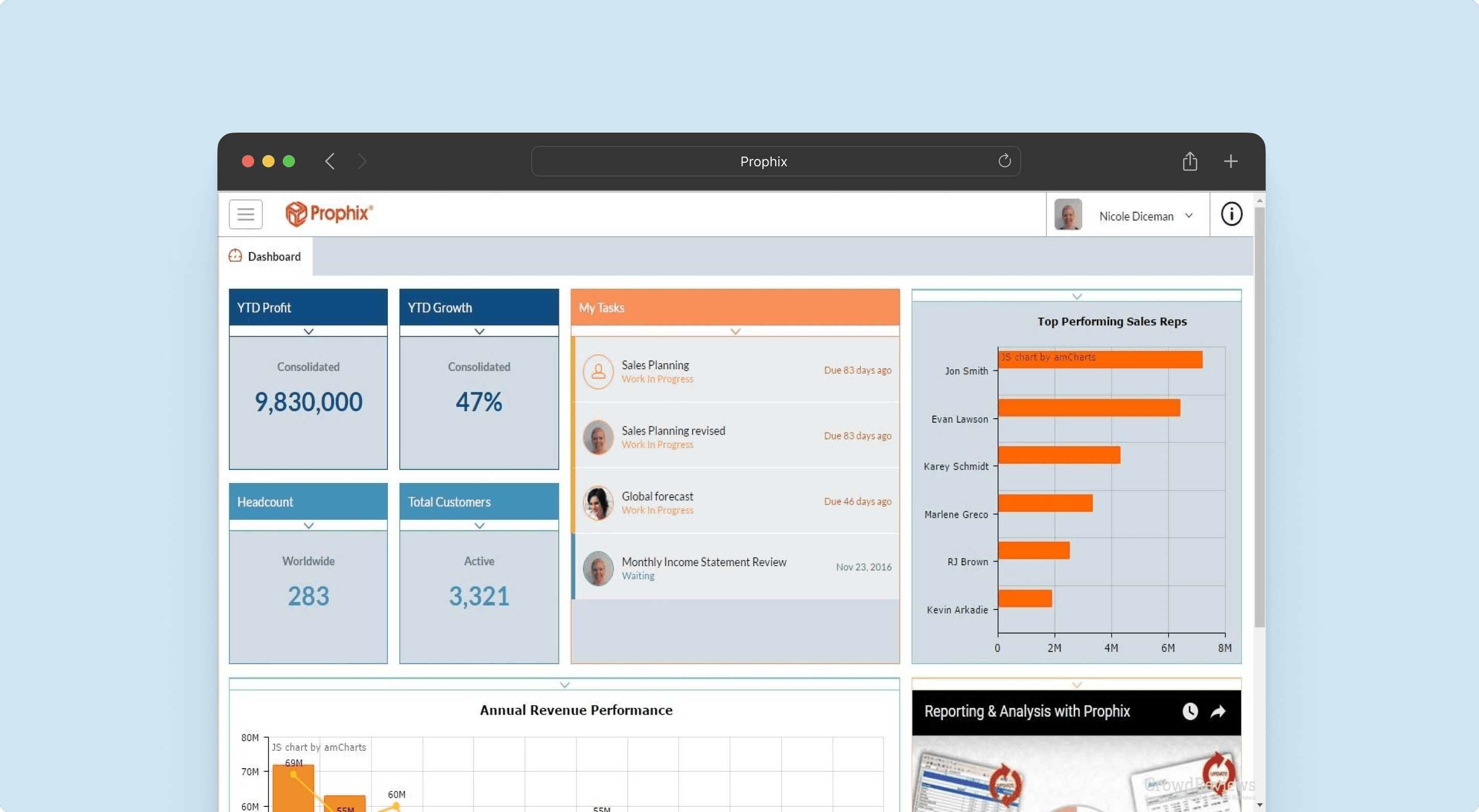

2. Prophix

Prophix is a financial planning and analysis software that empowers organizations to streamline their budgeting, planning, and forecasting processes. Prophix offers a user-friendly interface and robust functionality that helps enterprise businesses eliminate manual spreadsheet-based processes, reduce errors, and enhance collaboration across departments.

Business Software Size: Enterprise level solution

Price: Cost only available via a custom quote.

Great for: Finance teams at large enterprises.

Advantages: Its integration coverage and the flexibility it provides to create dimensions, mappings cover the enterprise business needs for strategic planning.

Feature Highlight: Budgeting features like the Detailed Planning Manager, which allows users to easily budget at different levels.

Customer Complaints: Though customers appreciate the budgeting features, limited dashboard functionalities, and platform speed make it challenging to present final budget figures across the business.

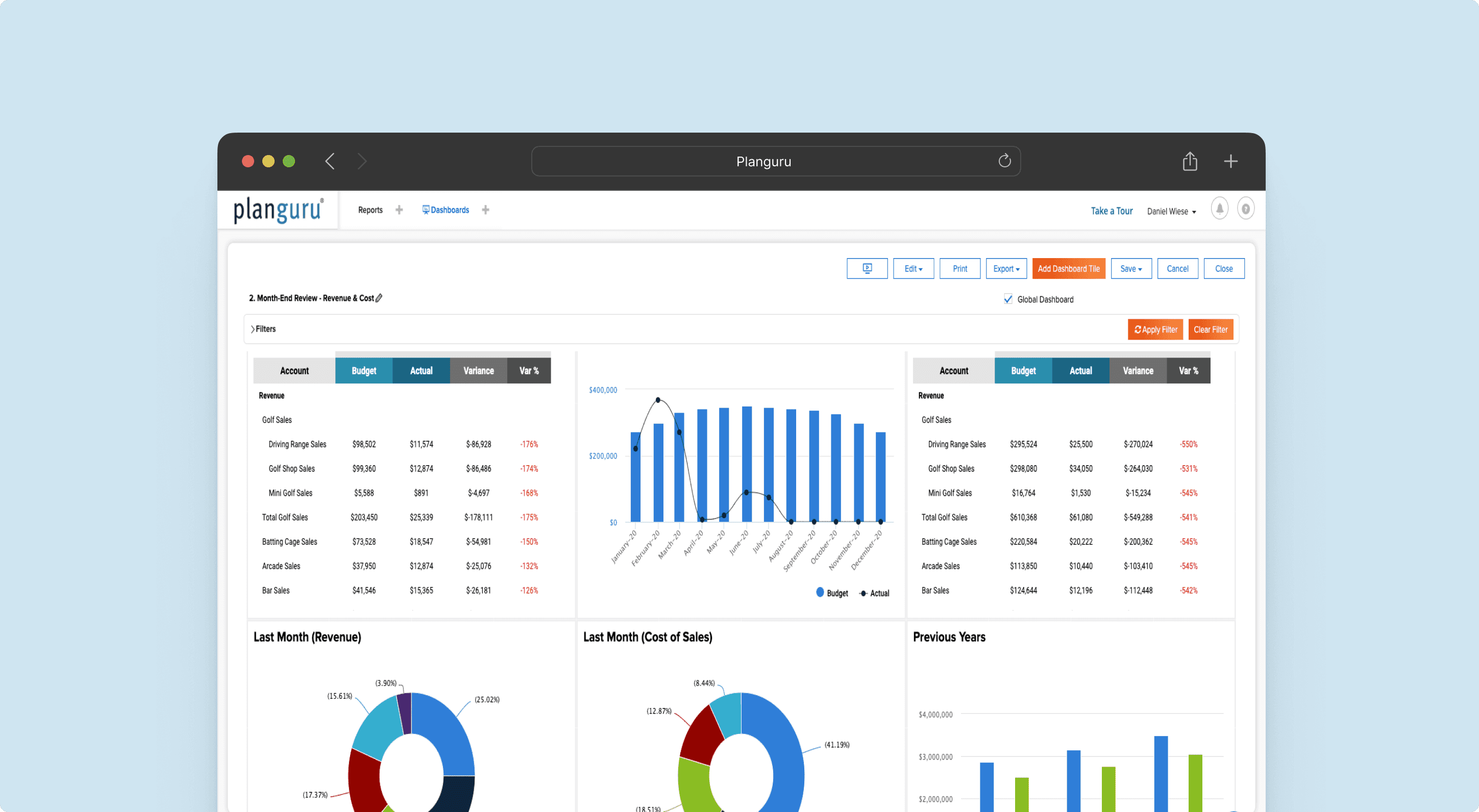

3. Planguru

Planguru is a forecasting and budgeting software solution that targets small and medium-sized businesses as well as nonprofits. They provide a simple solution for budget planning and forecasting.

Business Software Size: Small and medium sized businesses.

Price: Planguru offers 2 pricing plans:

Single-entity, which starts at $99/month.

Multi-department consolidation starts at $299/month.

Great for: SMBs with simple budgeting processes and forecasting methods, that are using Xero or Quickbooks online as an ERP.

Advantages: Planguru perfectly covers the business needs of SMB customers.

Feature Highlight: Customers appreciate the ability to consolidate multiple divisions, as well as the forecasting analytics and rolling forecast features. The direct integrations with Quickbooks Online and Xero support the data needs of small-sized businesses.

Customer Complaints: Customers comment that some of the features are only available in the desktop version and not in the cloud-based version of Planguru. This limitation hinders FP&A teams in their collaboration with budget owners.

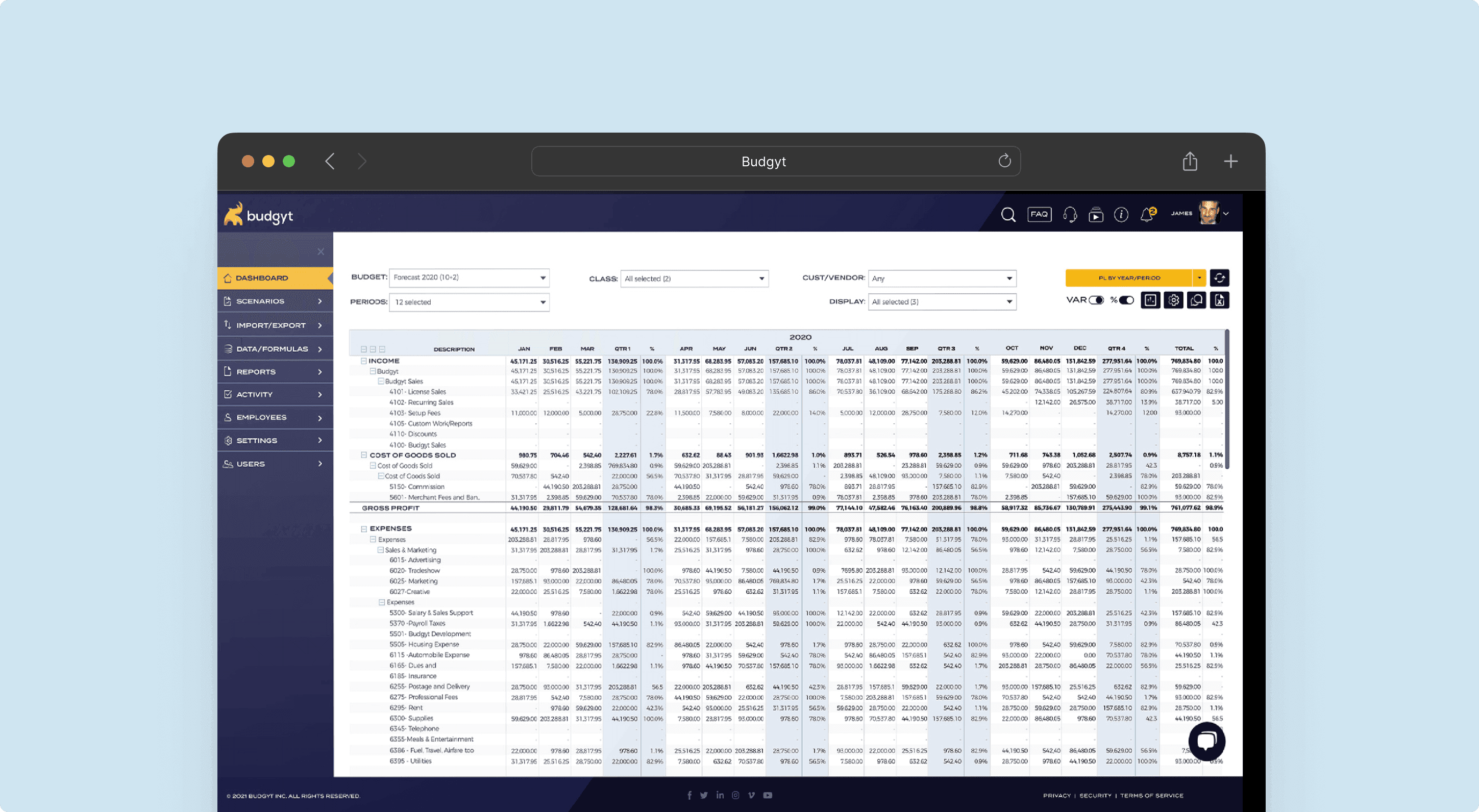

4. Budgyt

Budgyt is an FP&A solution with the selling point of simplifying budgeting, forecasting, and performance management for small business owners and their businesses.

Business Software Size: Small businesses.

Price: They offer four pricing plans that depend on the number of budgeting departments each business has.

They also offer custom pricing options for non-profit and for-profit businesses:

Easy, $399/year for 10 budgeting departments.

Plus, $699/year for 25 budgeting departments.

Pro, $999/year for 50 budgeting departments.

Enterprise, upon request.

Great for: SMBs that already have a well defined budgeting process in which the number of departments will stay consistent.

Advantages: A simple and intuitive interface that simplifies the reporting, budgeting, and forecasting workflows.

Feature Highlight: Users appreciate the role-based users permissions.

Customer Complaints: Customers have struggled with the lack of customizable reports and limited people planning capabilities.

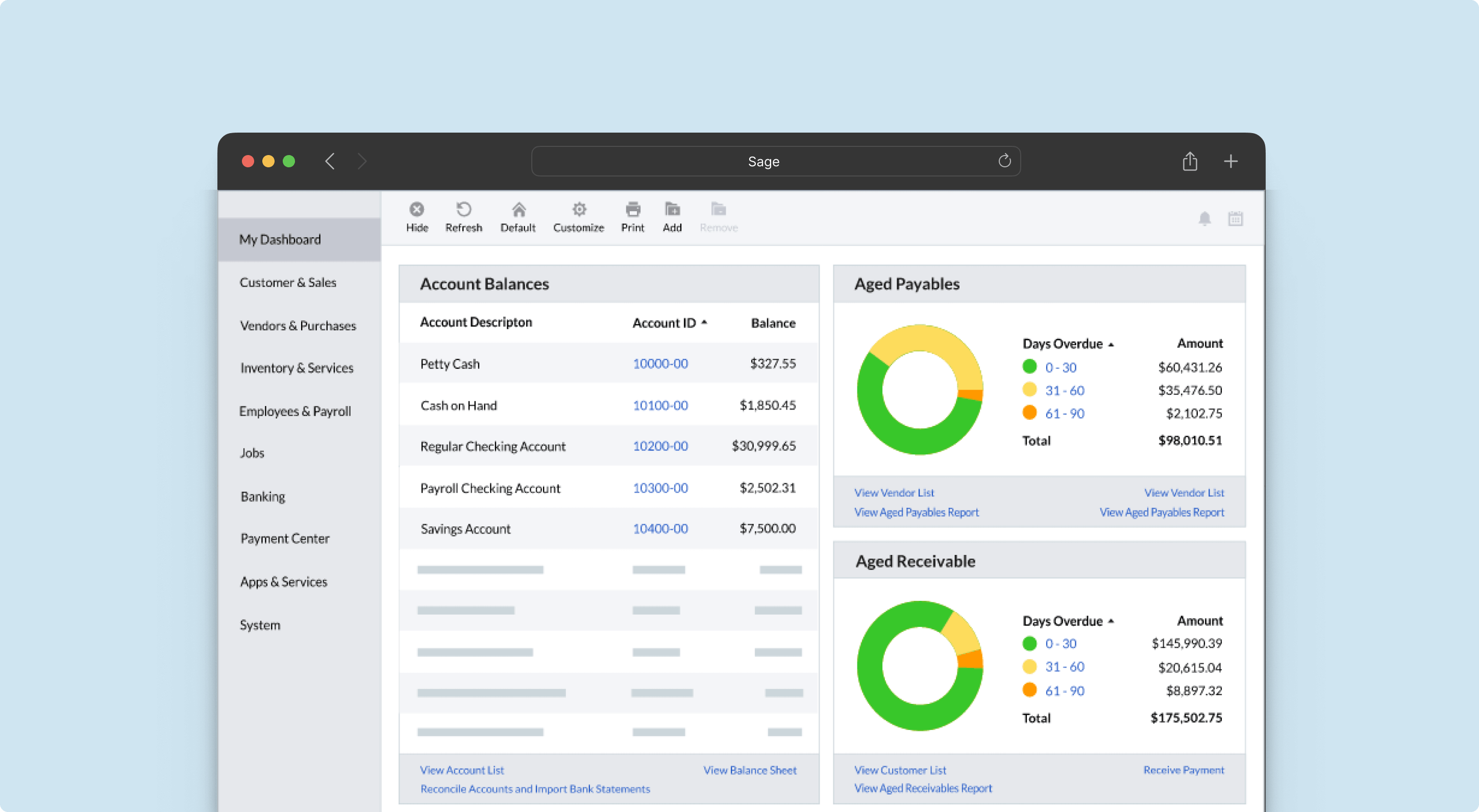

5. Sage

While at its core Sage is a provider of accounting software, it also offers business budgeting capabilities with its Sage Intacct Planning features. This means Sage has the potential of being the single accounting and budgeting platform for enterprise customers, as it supports project management, bookkeeping, expense management and cash flow forecasting functionalities.

Business Software Size: Small and medium sized businesses.

Price: Price upon request.

Great for: Sage as a business budgeting software is best suited for businesses that are already using Sage as their accounting provider.

Advantages: The versatility of being both an accounting tool as well as a budgeting solution, supporting the FP&A needs of enterprise customers.

Feature Highlight: Customers appreciate the scenario capabilities and the ability of being able to export financial reports and dashboards into PDFs.

Customer Complaints: The UI is limited and not very customizable, making budget owner adoption challenging within its customer base.

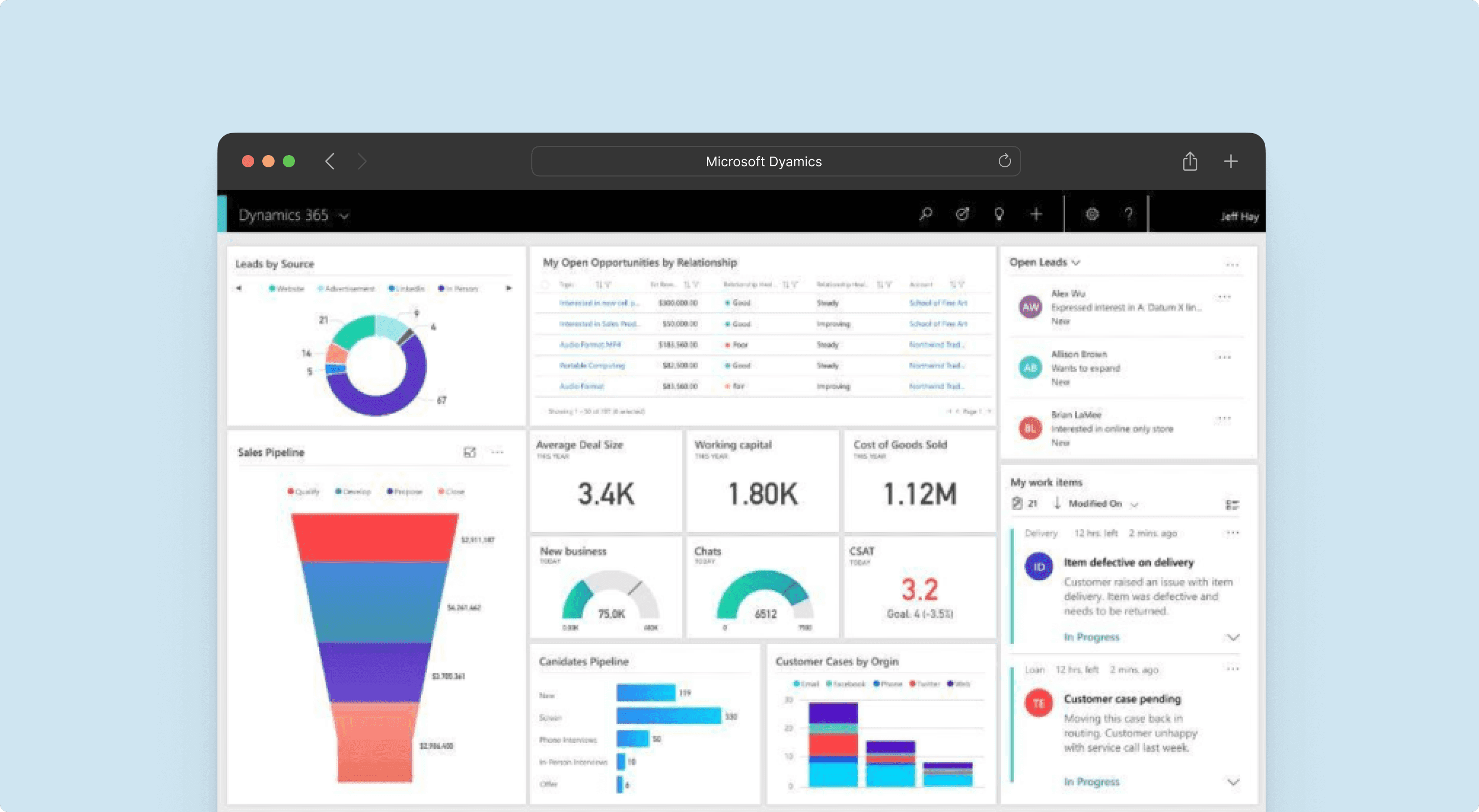

6. Microsoft Dynamics

Microsoft Dynamics is Microsoft’s effort to address the ERP and CRM market. While these are their main value propositions from which they acquire the majority of their customers, they also provide plenty of different modules to manage diverse aspects of business processes like finance, sales or marketing.

Its budgeting tool, Microsoft Dynamics Finance enables businesses to effectively manage their finances. With real-time visibility, seamless integrations, and advanced forecasting capabilities, Microsoft Dynamics can help FP&A teams streamline the budgeting process, enhance accuracy, and promote collaboration across departments.

Business Software Size: Enterprise level businesses.

Price: Microsoft Dynamics offers two pricing packages:

Business Central Essentials, which costs $70/month per user.

Business Central Premium, which costs $100/month per user.

Great for: Enterprise customers that are already well connected with the Microsoft suite of products.

Advantages: Microsoft Dynamics provides standard modules that cover the budgeting needs of most enterprise businesses.

Feature Highlight: Flexible budgeting scenarios, automated calculations, and real-time updates, empowering finance teams to make informed decisions and adapt company budgets as needed.

Customer Complaints: Customers comment on both the cloud and mobile version of the application having slow response times and frequent development issues. The lack of core collaboration features is also highlighted by customers who use Microsoft Dynamics for its people planning capabilities.

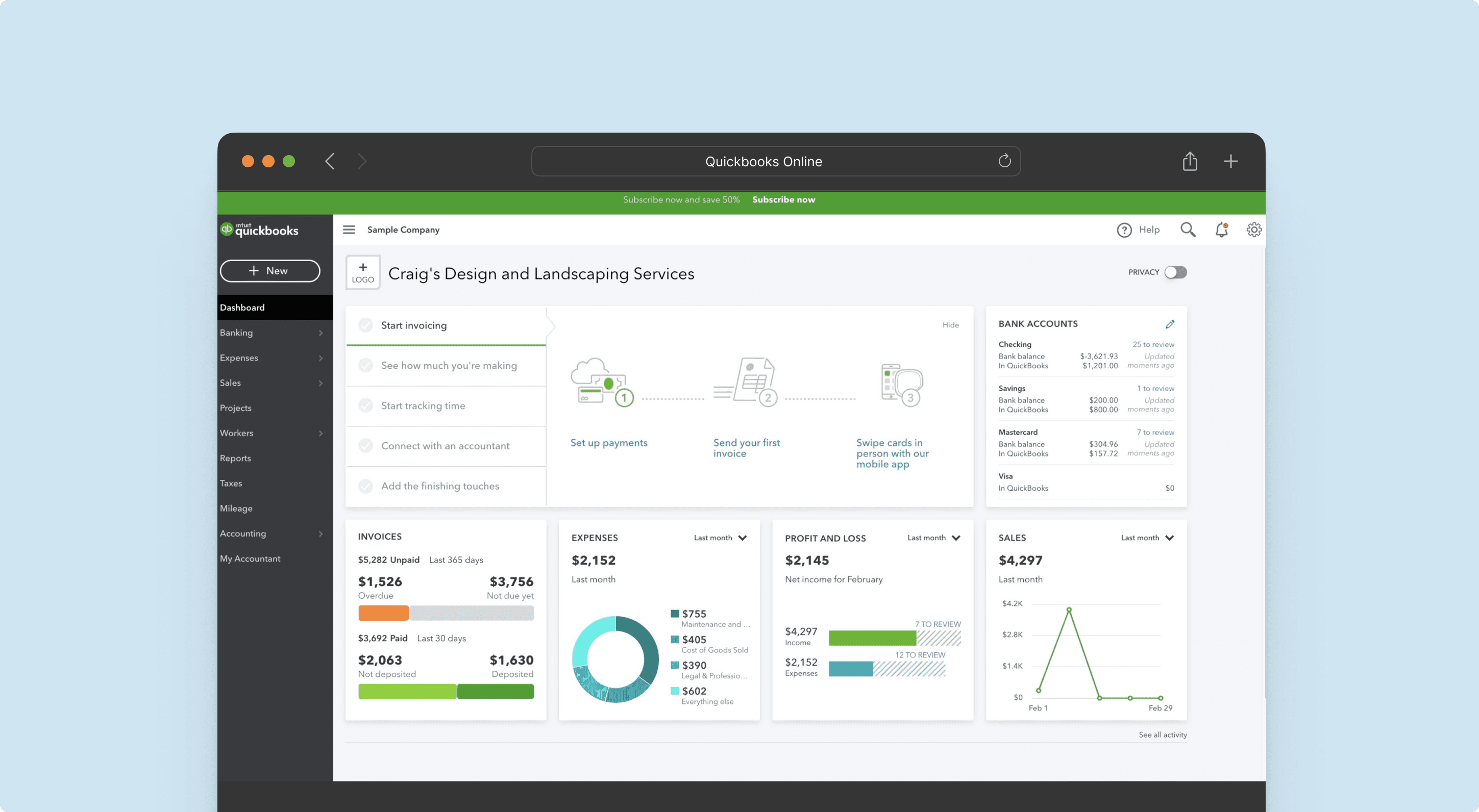

7. QuickBooks Online

QuickBooks Online is a cloud-based accounting software designed for small businesses and self-employed individuals. It offers a range of features that simplify budgeting, expense tracking, invoicing, and financial reporting.

Business Software Size: Small businesses.

Price: It offers four different pricing plans:

Simple, which starts at $30/month for one user.

Essentials, currently at $50/month for three users.

Plus, $85/month for five users.

Advanced, $200/month for more than five users.

Great for: QuickBooks Online is ideal for small businesses and self-employed individuals who require an intuitive and user-friendly budgeting solution. It caters to a wide range of industries and is suitable for businesses looking for an accounting software that is both affordable and accessible.

Advantages: It has a very user-friendly UI which makes it very easy to navigate. It integrates seamlessly with third-party applications, while also being able to carry out expense management and categorization.

Feature Highlight: One notable feature of QuickBooks Online is its budgeting tool. It allows users to set up and monitor budgets, track BvA, and gain insights into the financial performance of the business.

Customer Complaints: Customers comment that there is a high learning curve associated with using QuickBooks Online, particularly for small businesses with limited in-house accounting and finance experience.

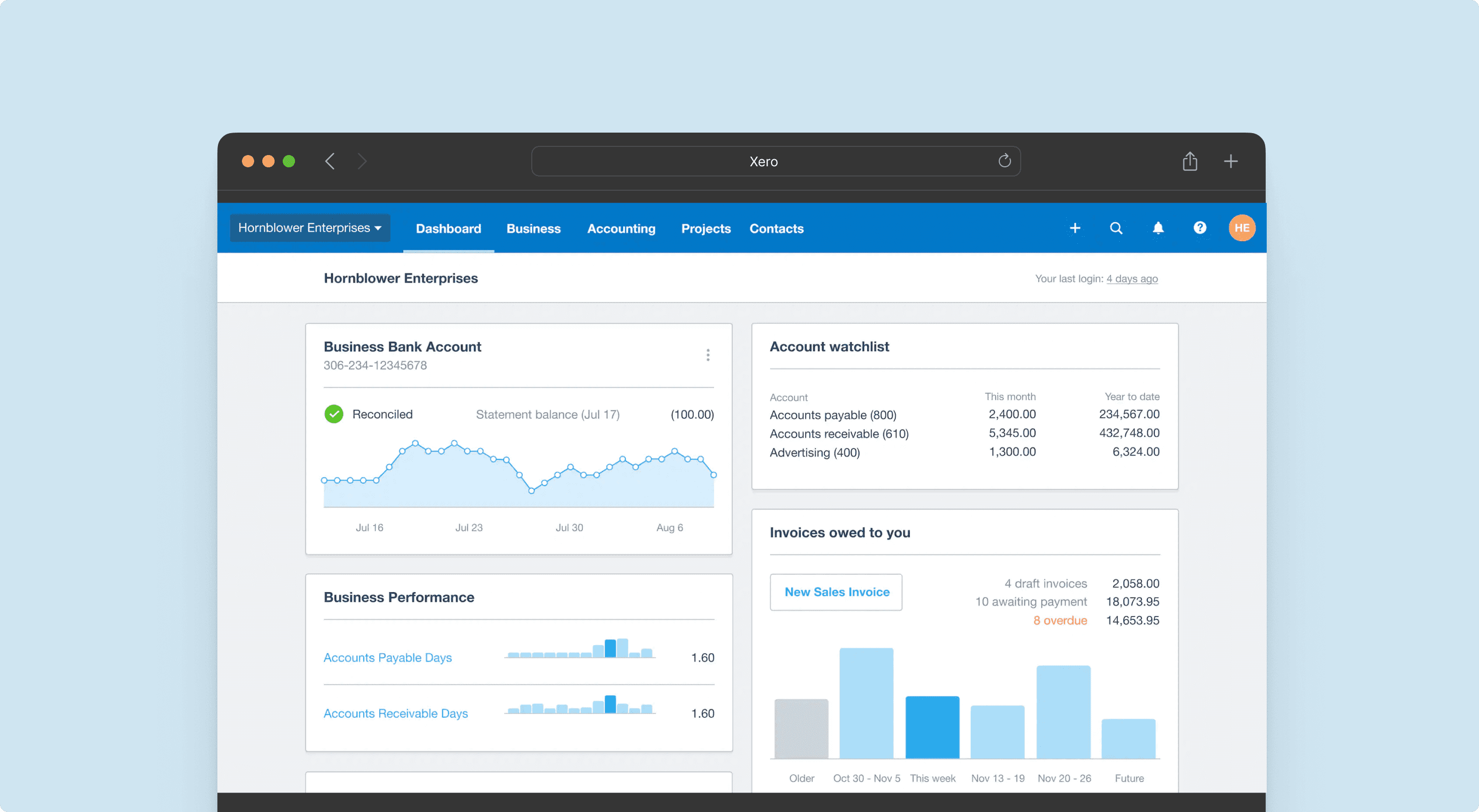

8. Xero

Xero is a cloud-based accounting software known for its robust budgeting capabilities. It provides businesses with efficient tools to manage their finances and streamline their budgeting process.

Business Software Size: Small and medium sized businesses.

Price: Cost only available via custom quote.

Great for: Xero is ideal for small to medium-sized businesses looking for an intuitive and user-friendly budgeting solution. It caters to a wide range of industries and provides a comprehensive set of tools for financial management.

Advantages: Streamlined budgeting process where Xero simplifies budget creation, tracking, and monitoring, enabling businesses to stay on top of their financial goals. It provides FP&A with real-time insights into their budget performance.

Feature Highlight: One notable feature of Xero is its flexible budgeting tool. It allows businesses to create budgets based on various criteria such as timeframes, departments, or projects. Users can set budget goals, track actual expenses against the budget, and generate reports to assess budget performance.

Customer Complaints: Some common customer complaints regarding Xero are the limited number of dimensions, and the lack of customization in its dashboarding capabilities.

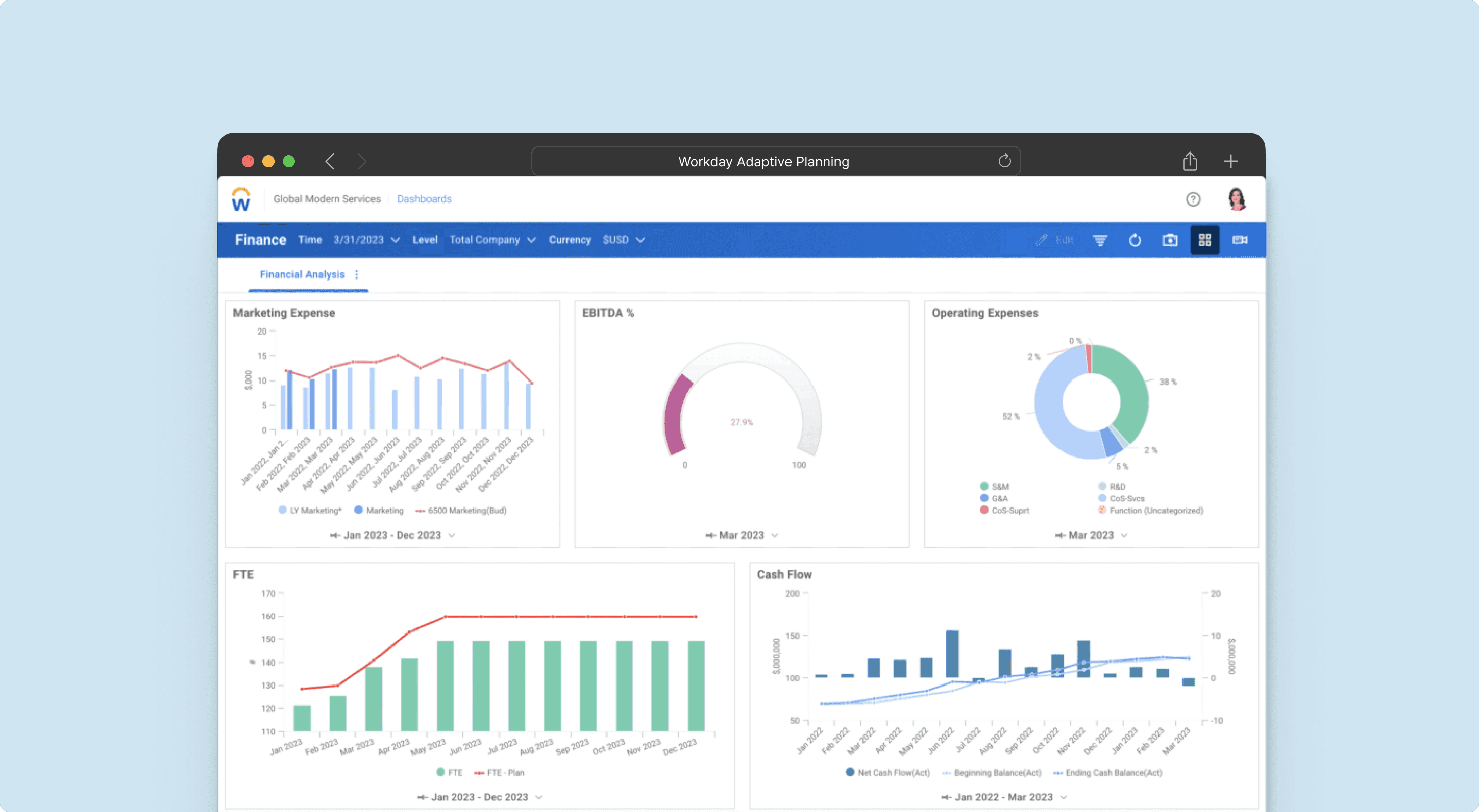

9. Workday Adaptive Planning

Workday Adaptive Planning is a versatile enterprise planning management software that enhances data analysis and decision-making across departments. It connects with ERP systems, GLs, and spreadsheets, automating forecasts and generating insightful management reports.

Business Software Size: Enterprise level businesses.

Price: Cost only available via custom quote.

Great for: Large enterprises seeking a comprehensive tool for various functions. Workday Adaptive Planning excels at handling extensive data, which sets it apart from other applications.

Advantages: Workday Adaptive Planning offers unparalleled cross-functional capabilities, empowering finance teams to become strategic business partners.

Feature Highlight: Workday recognizes the interconnectedness of workforce management, labor metrics, and FP&A. It integrates employee information with financial data, delivering valuable insights for both HR and FP&A departments.

Customer Complaints: While customers appreciate the versatility of Workday, some struggle with its slow calculation speed and limited customization options. The inability to accommodate irregular or manually-added data inputs poses challenges for organizations with unique requirements.

10. Excel/Google Spreadsheets

Business Software Size: Small and medium sized businesses.

The status-quo. They need little to no presentation as they are probably the most commonly used tools for budgeting purposes. Whether it’s Excel, developed by Microsoft, or G-sheets developed by Alphabet/Google.

While these products are extremely powerful and provide a lot of flexibility, as your business grows you will probably encounter some limitations that come with them and that might hold down your finance team.

A business budgeting software like the ones showcased here can help alleviate some of those pains by automating data ingestion automatically instead of manually, driving collaboration with the different stakeholders of a budgeting process or being able to easily use multi-dimensional modeling to build bottom-up and top-down forecasts and budgets.

Learn more:

Excel for Finance: take your financial automation to the next level

3 top Excel automation tools to drive finance teams productivity

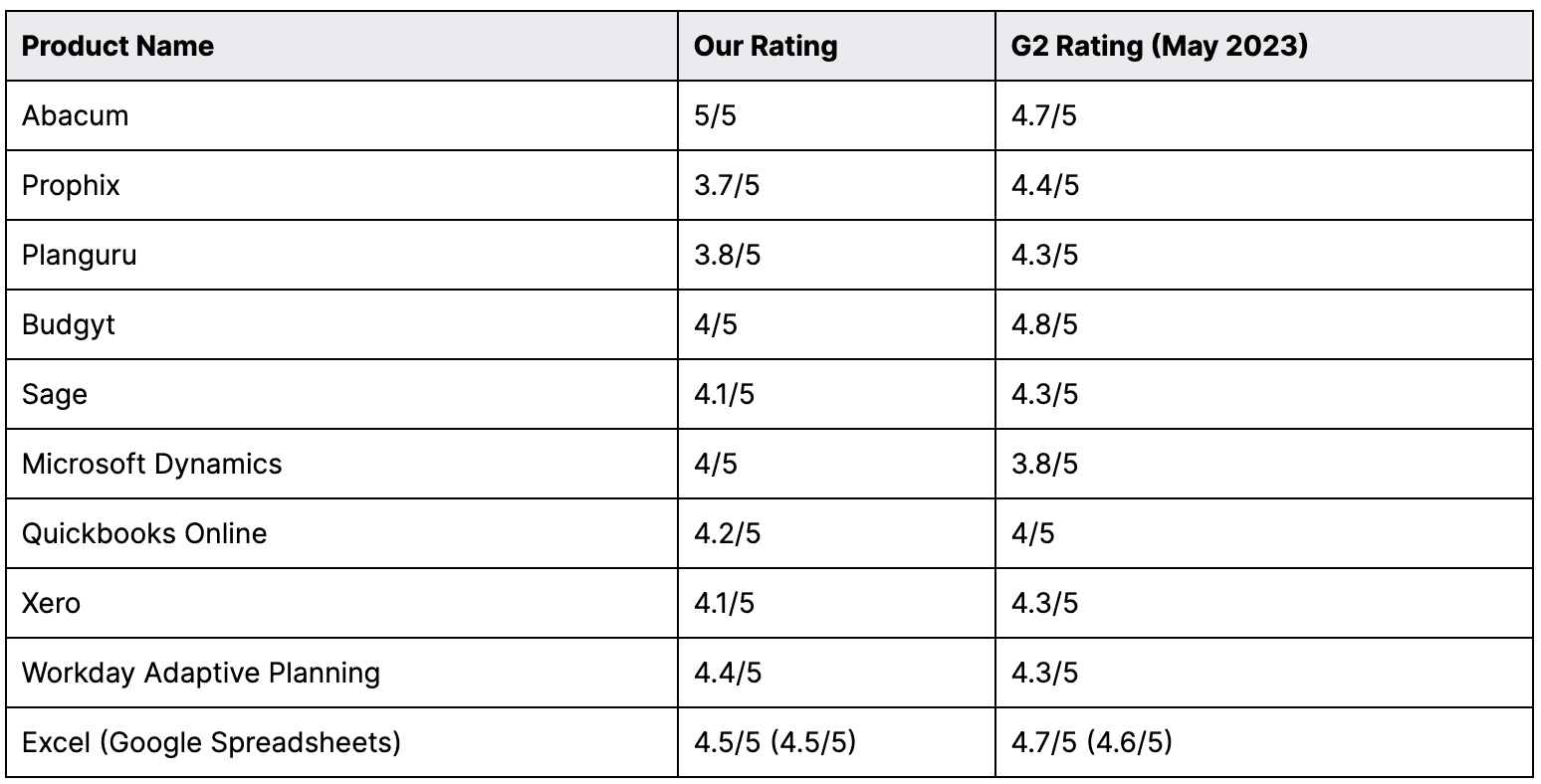

Rating Overview for Budgeting Software Tools

For a quick overview of how these different budgeting tools compare, our helpful table below provides an overview of the software. We’ve included our own assessment as well as a rating based on validated user reviews on the G2 platform (updated for January 2025).

Ultimate Budgeting Software: Abacum

Designed for mid-sized businesses, Abacum provides companies with a complete budgeting solution that can be fully integrated into company processes.

If you are still not sure which budgeting software is right for your business, Abacum is the perfect solution. It is the leading mid-market budgeting software for companies across several industries.

The core reasons Abacum’s budgeting software performs the best are:

Abacum’s in-house implementation team makes sure you’ll always have the support and training to complete your budgeting process in time.

Abacum is designed to be user-friendly and intuitive. Unlike other tools that demand technical prowess from budget owners, Abacum provides intuitive workflows.

The exceptional UX and UI of Abacum drive stakeholder adoption across the business.

Features like automated data wrangling, integrations with various data sources, data reconciliation ensure FP&A teams are focused on what matters as well as using different budgeting methods such as top down vs bottom up.

Overall, Abacum’s budgeting software solution stands out for its flexibility, efficiency in revenue forecasts and budgets, and the ability to analyze operational and financial KPIs in real-time. It offers comprehensive features to support budgeting and financial planning, making it the recommended solution for fast-growing startups and scaleups.

What To Do Next

Evaluate Your Business Needs: Take some time to assess your company’s specific requirements and objectives regarding budgeting software. Consider factors such as scalability, integration capabilities, ease of use, and affordability, aligning them with your business size and industry.

Explore Further Resources: Dive deeper into the world of financial management and budgeting by exploring additional guides and resources. Consider reading more insightful content from Abacum, to gain further insights into best practices, emerging trends, and innovative solutions in the field.

Alternatively you can read more information on budgeting software for smb’s in 2025

Get in Touch for Personalized Assistance: If you’re still unsure about which budgeting software solution is best suited for your business, don’t hesitate to reach out for personalized assistance. Contact the experts at Abacum for tailored recommendations and guidance based on your specific needs and circumstances.