It was like Christmas morning. Our team had worked tirelessly over the past several months to complete the best top-down, bottom-up collaborative budget ever made. The board toasted our plans. We celebrated.

Two weeks later, that celebration felt like a distant memory. We had a short window to hit our revenue targets during Q1, and we missed. Badly. We were trending toward a 40% revenue shortfall due to a lower transaction volume than anticipated, with no opportunity to recover until the next year as it was a seasonal business. Suddenly, the entire budget was in shambles. We had to offset the miss somewhere (read: reduce costs), which is when the hangover hit in full force. Nobody believed the current budget, so we couldn’t hold anyone accountable for their commitments. Nobody wanted to re-budget because they had already made compromises. Restarting the entire process was untenable.

The disdain from the rest of the organization was palpable: “Why did you believe the Revenue team commitments?!”

The after-effects lingered for a year. We implemented temporary hiring freezes, made off-spreadsheet agreements, and told ourselves we would sneak back to target. It didn’t work. Even worse, we demoralized everyone by reporting against the original budget throughout the year.

I’ve seen this scenario play out repeatedly, especially in startups or scale-ups where uncertainty is the norm. Everything is “unproven,” “unbacked,” or “I believe…” So why would such companies insist on trying to report against a full-year or even a half-year budget?

Here are the arguments that I’ve heard for sticking with a static budget:

“Planning takes time away from doing.”

“We need to think long-term to succeed.”

“The board requires it.”

“It’s tough enough to set any targets. Do you realize how many stakeholders there are?”

“Who wants to budget more?”

Whenever I hear these objections, I realize people are picturing an outdated organizational process from two decades ago. This perspective overlooks the ease of updating forecasts, the challenges of perfect long-term projections, and the value of having teams work toward a live reforecast.

Tip: Many teams needlessly separate their budget from their “operational model.” A future guide will discuss how to merge these into one model.

What is a rolling forecast process?

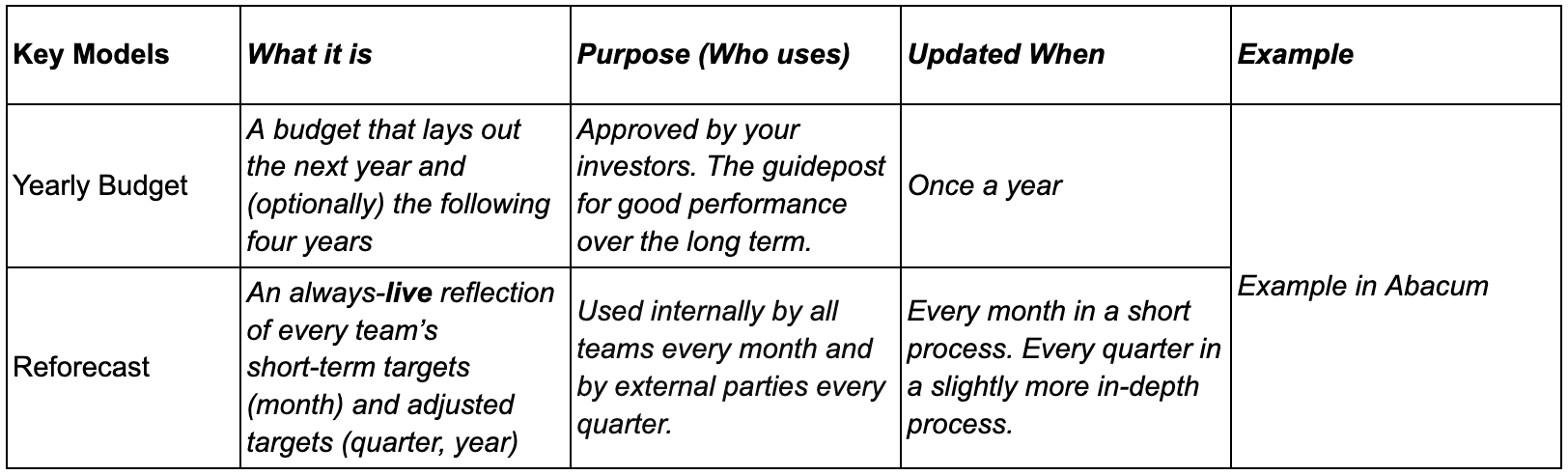

A rolling forecast is a budgeting approach that involves reforecasting every month with the executive team. You maintain two primary models:

The yearly budget serves as a reference for commitments to external parties and outlines what long-term success should look like.

A reforecast updated each month which serves as live targets to the entire company. Once a quarter, you present this reforecast to the board as your quarterly goals.

The structure of both models should be incredibly similar, only differing in time frame if necessary.

In chart form, this looks like:

This means you will complete a static budget each year and a live reforecast each month in an exec meeting. This reforecast is your Swiss Army knife; it allows you to clearly show everyone.

What is my sales goal this month? Look at the reforecast.

What is my NDR goal for the month? Look at the reforecast.

How will I know if I performed well this month? Look at the reforecast.

What is our strategy for this month? Look at the reforecast.

Updating the reforecast frequently lets you use the operational model as the primary tool for aligning the business. This prevents teams from having to calculate their own targets based on last month’s misses or, worse, burying targets among other management prioritization tools.

Tip: The reforecast and yearly budget will equal at the beginning of the year. However, they will always diverge after a month of actuals. As a result, it’s best to consistently refer to the ‘reforecast’ internally when discussing targets or goals for the month, quarter, or year.

Why you should use a rolling budget process

There is a reason that rolling budgets have become particularly recommended even for large companies. A well-done process allows you to:

Move quickly. Your targets should move as quickly as your tactics. A live reforecast ensures your team can cohesively adapt.

Simplify. Static budgets often lead to a bevy of multiple, overlapping spreadsheets like “expectations,” “projections,” and “budget v1.2 etc.” Using one live reforecast reduces confusion by streamlining everything into one clear document.

Iterate 3x-12x faster. Frequent updates help you learn from mistakes and make your planning more accurate over time. Smaller, quicker iterations (made possible with good software) also reduce volatility by focusing on shorter timeframes.

Reflect current information. Key data like actuals, pipeline, and SQLs change monthly. Rolling reforecasts let you adjust quickly, avoiding the demoralization of working towards outdated or impossible targets.

Spot problems earlier. Regularly updating targets based on new data helps you identify upstream issues before they hit the bottom line.

Better assess opportunity costs. Rolling updates allow you to compare new options at the same time each month rather than on a one-off basis to improve decision-making.

Impress investors. Investors care about results, not rigid adherence to a static budget. Rolling budgets let you focus on explaining what happened and how you’re fixing it, rather than why you missed a target.

In today's world, moving from a static budget to a monthly rolling forecast is one of the most impactful moves you can make as a finance leader.

The essentials to getting people onboard

1. Clearly lay out your forecasting structure

To keep things quick, you need to make sure you focus the executive team around what matters in each financial plan. You want to focus on the short-term. Plans more than three months out will be very rough. Focus on what you can control.

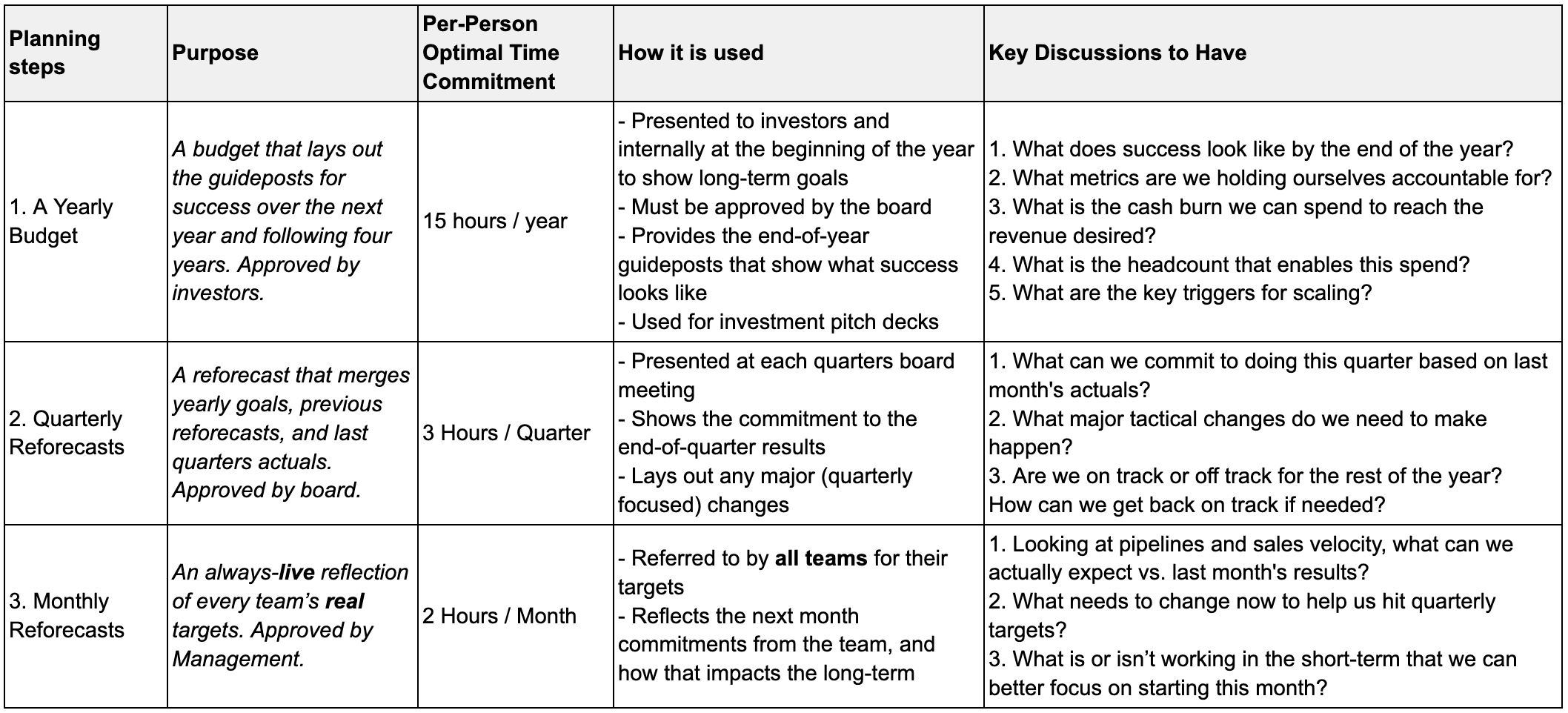

You should plan three types of budget/reforecast updates a year:

Now, this isn’t a full budget walkthrough, for that you can see our guide here. Instead, the above table shows the focus of each planning session.

Tip: Why even have static budgets? Answer: They are useful to show long-term accountability to your external parties, provide guideposts for your rolling forecasts, and assess your long-term prospects.

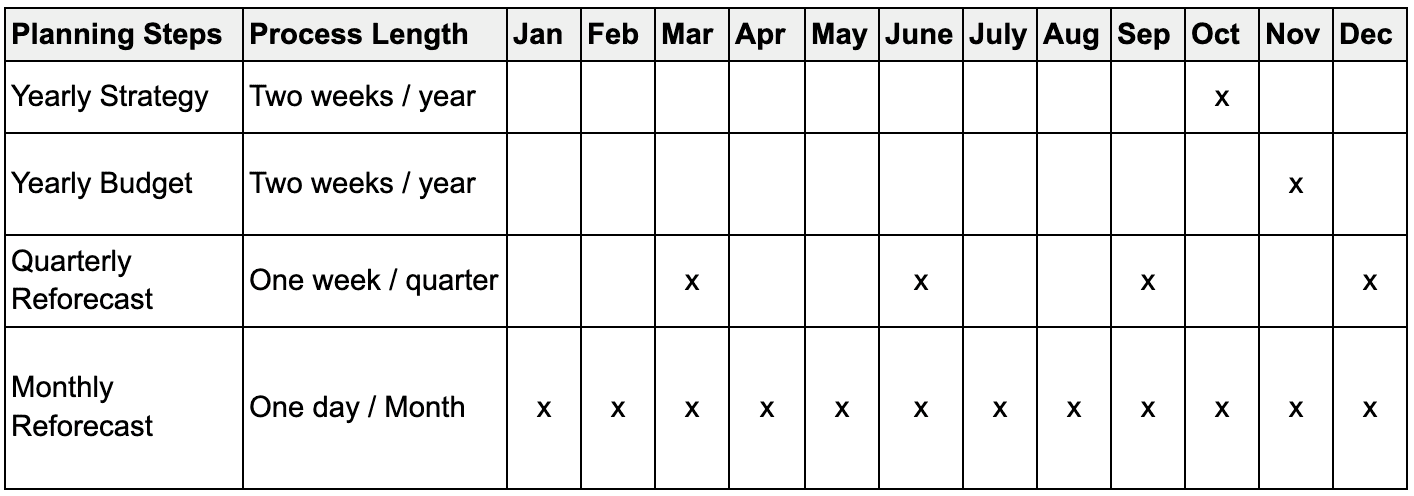

2. Calendar the process cleanly

Maybe this section is a tad pedantic, but consistency in this process gives the team confidence. Design a simple calendar to clearly show when each budget/reforecast will be completed.

Obviously, this is just a sample as you could have different fiscal years.

3. Go the extra mile to explain the benefits

Set the expectation that the reforecast will be updated monthly alongside actuals. The reforecast is the key benefit of the whole process, but it will take buy-in to review and update. At mid-size companies, this should be completed at the executive level.

Share the fundamentals of this approach. Budget for general guidance. Reforecast for live targets (what really matters).

Share the benefits. Walk through the reasons listed at the start of this section. Emphasize that more rapid updates make planning quicker (fewer decisions, shorter timeframes).

Show the reforecast. Walk through the model you’ve built and commit to making it the single source of truth for all questions about goals and targets.

Don’t expect people to immediately embrace rolling forecasts. You may hear some grumbling about “more budgeting” or “I hate budgets.” However, after going through the process a few times, people will see the value of spending an hour or two each month to maintain clear targets for the company.

Tip: Use 12x as a motivating factor. Monthly updates provide 12 opportunities to improve each year compared to static annual budgets.

The tactics of creating the yearly budget and reforecast

Now that you have the buy-in, you need to build the models and run the meetings to get effective results and commitments. Again, this is not an exhaustive list but rather the key things to think about when going through each process.

1. Build the strategic foundation for your yearly budget

Start with the basics. Clarify your overall strategy and set the framework for performance. You probably have most of this, if not, get it done.

Identify two primary drivers for your company. Don’t use ARR, but instead focus on things that will *lead* to higher ARR (such as qualified sales pipeline creation or NDR development).

Dive deep into key actions that influence those drivers. Identify the actions that directly influence the drivers, i.e., input metrics such as the number of new marketing events, customer calls, or new features.

Commit to these metrics. Focusing on taking one metric from good to great is often more effective than achieving uneven performance across many metrics.

Obviously, there is a lot more to do in this process (strategy sessions, company input, department head budgeting process, etc), but keep the focus simple. It can be much more effective to take one metric from good to great rather than uneven performance across many metrics.

Tip: Keep a strong eye on ARR / Net Cash Burn to ensure efficient growth. This will keep the entire company honest.

2. Create the yearly budget

Use the strategy discussions to create a baseline model that combines operational (funnel, pipeline, headcount) metrics with financials ( PL, BS, CF) and includes an overview on metrics that resonate with investors.

Start with a straw-man 12-month budget. Split it out by quarter, month, and team linked to your primary drivers.

Review with the team. You should sit down with each team to go through the budget’s ramifications and update the details. Take care that everyone treats this process differently.

Avoid going too granular on things that don’t matter. Nobody cares about potential coffee expenses in seven months. Aim for direction, not perfection. 80/20. Use a pie chart of expenses and revenue to help the team understand the bigger picture.

Go deep into the things that do. Dive into what will drive the key metrics that you have identified. An example would be listing out the top 100 current customers potential upsell by quarter.

Put a lot of focus on the next month. And then build out from there. You want to start out hitting your targets. The reforecast will evolve based on what you achieve.

Build a clear metric overview. This static budget will be heavily used by external parties. Make sure you line up the budget against best-practices to give yourself realistically aggressive targets.

Get external alignment. Present this to the board (usually with a ppt) and then the company as a whole.

Remember, your business can look significantly different after just one additional month. Creating the initial yearly budget gives you long-term guideposts, but the reforecast is where the magic happens.

Tip: Keep a sharp eye on cash projections. Revenue targets may fluctuate, but cash flow is within your control. Be conservative with cash collection estimates (say flat % increase based on past) and overestimate expenses (add a 10% buffer to start) to ensure your runway stays intact.

3. Reforecast after month one!

Schedule your reforecast for the second day of the following month. By this time, you can gather sufficiently accurate actuals and ensure that 95% of the time, your monthly targets are reliable. You are committing to providing the company live targets and if you let a single week go by then 25% of the time your reforecast is wrong.

This should be your general timeframe:

Update models on the last day of the previous month. Identify any changes that the results will have through the next eleven months.

Send out pre-reads on the same day. Send out pre-reads on the same day, including actuals, variances from the last reforecast, and suggested changes.

Discuss with the executive team. The executive team should review the pre-reads, make any suggestions before the meeting, and be ready to make decisions on any budget changes.

Finalize decisions on the 2nd day of the month. Hold a management meeting to agree on the upcoming month’s targets. If there are any big deviances, have the accountable leader list why things changed so drastically from any previous commitment.

Full transparency after the meeting. Send an email to the entire company with a link to the reforecast (that is where they can always find their targets!) and explain any major changes.

The goal is to do this quickly. The first time you do this you will base this on the budget you just put together for the year so not that much will have changed. Rinse and repeat each month.

Tip: Make sure you are tracking both input and output metrics (discussed more in the next section)

4. Complete a quarterly reforecast at the end of the first quarter

At the end of the quarter, you have a chance to step back and review your results. You shouldn’t have that much of a change from your reforecast from the previous month. However, this is your time to commit to your next quarter's result.

To do this properly:

Repeat the steps above. Follow the same process but invest more time in each by focusing on the quarter, not just the upcoming month.

Focus on the bigger questions. What tactics need adjustment? How far are we off our yearly commitment? What is the most critical priority moving forward?

Release to the board. Release the updated quarterly budget to the board as soon as possible to give your key stakeholders the context. No need to wait for a full meeting.

Release internally. Send the updated reforecast to the company and celebrate any wins from the previous months.

The difference in the quarterly and monthly reforecast is an opportunity to take a slightly longer step back, focus on quarterly changes, and get a commitment from your board.

Tip: Your investors will receive quarterly board updates from each of their portfolio companies (10+). Committing to give updates on the first (rather than procrastinating) allows you to have their full focus.

5. Share the reforecast model so well that people know their targets in their sleep

Transparency builds trust. Don’t forget to provide a clear dashboard that shows the live reforecast across the organization and how the team is performing against it. Some tips:

Same place every time. Just keep the same link and format. Only the numbers should change. This makes it easier to digest.

Make sure it's consistent with other tools. Oftentimes, teams put targets into their sub-systems tools to help operationally. Make sure that any reforecast update is changed in each tool

Have team leaders present to their team. Often, the best way to learn is to teach. Team leads should walk through the numbers with their team every week.

Display the reforecast on the wall and put the link to it everywhere. You need everyone to understand the full picture. That takes time, consistency, and repetition repetition repetition…. If you don’t, people will start making other tools/spreadsheets/etc and ruin the goal of cohesive progress.

Tip: Public accountability is a strong motivator. Sharing consistent results with your investors and board demonstrates reliability, which builds trust.

In conclusion

By keeping a live reforecast, you can unlock enormous benefits by spending less time budgeting, simplifying your target setting process, and providing easy clarity to everyone in the company. Rapid iteration helps you deliver on your commitments, a growing company’s greatest superpower.

Stories from the Trenches: Inside insights from Abacum’s team of seasoned finance professionals, sharing real tales of tackling financial challenges head-on.