In today’s fast-paced business environment, effective forecasting is essential for informed decision-making. So how can you create forecasts that truly drive decisions?

Julio Martínez, Abacum Co-founder and CEO, and Christian Wattig, FP&A Educator, recently joined forces to answer this question. With their combined expertise and extensive experience, Julio and Christian defined three approaches that the best FP&A teams are using:

Bottom-up and top-down combined

Actionable driver-based forecasting

Rolling forecasts with a narrow focus

In this article, we’ll take a look at each approach and how they impact strategic decision-making across the business. Don’t miss out on their full conversation for more firsthand forecasting insights as well as strategies you can use to become a better business partner.

1. Bottom-up and top-down forecasting combined

“The magic happens in that conversation where both of them meet.”

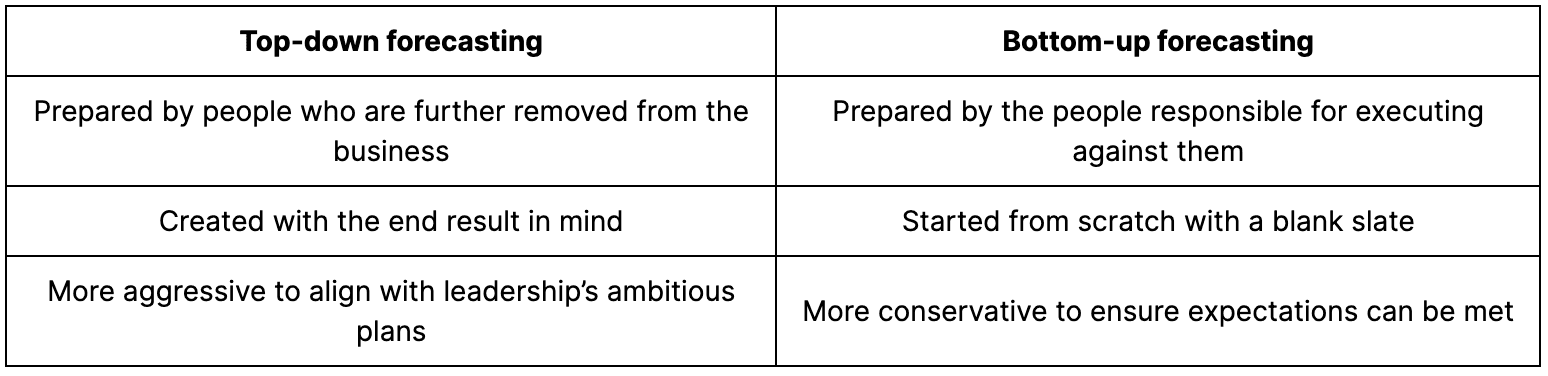

When you combine top-down and bottom-up forecasting, you ensure that your forecasts are both aspirational and grounded in operational realities. For Christian, one of the strongest arguments for combining these forecasting approaches is that each one has its own biases:

If you consider bottom-up and top-down forecasting to exist at opposite ends of a spectrum, “the magic happens in that conversation where both of them meet,” says Julio. “This is where the FP&A team is really driving better decisions for the company.”

Christian explains: “Most likely, your top down sales forecast will be higher than your bottom up sales forecast, for example. And that’s a fantastic conversation starter, because you can go to the Head of Sales and say, look, we’ve done the top down and arrived at a different conclusion. Why don’t we sit down and compare our assumptions to understand the difference?”

By creating space for conversations that align leadership’s strategic objectives with practical insights from the business teams on the ground, you can prepare forecasts that are realistic and achievable.

2. Actionable driver-based forecasting

“A model that’s easy to maintain, understand, and keep up to date.”

Driver-based forecasting connects financial outcomes directly to key business drivers, allowing for more precise and actionable forecasts. By focusing on the main factors that impact business performance, companies can more effectively manage risks and make informed decisions.

This kind of forecasting is particularly beneficial for creating multiple financial scenarios based on varying performance levels of these drivers. It’s little wonder that Christian’s a big fan of this approach:

“Driver-based forecasting is one of my absolute favorite forecasting techniques because it’s so useful for decision-making and agility. It’s a powerful forecasting method that combines deep business understanding with a model that is easy to maintain, understand, and keep up to date.”

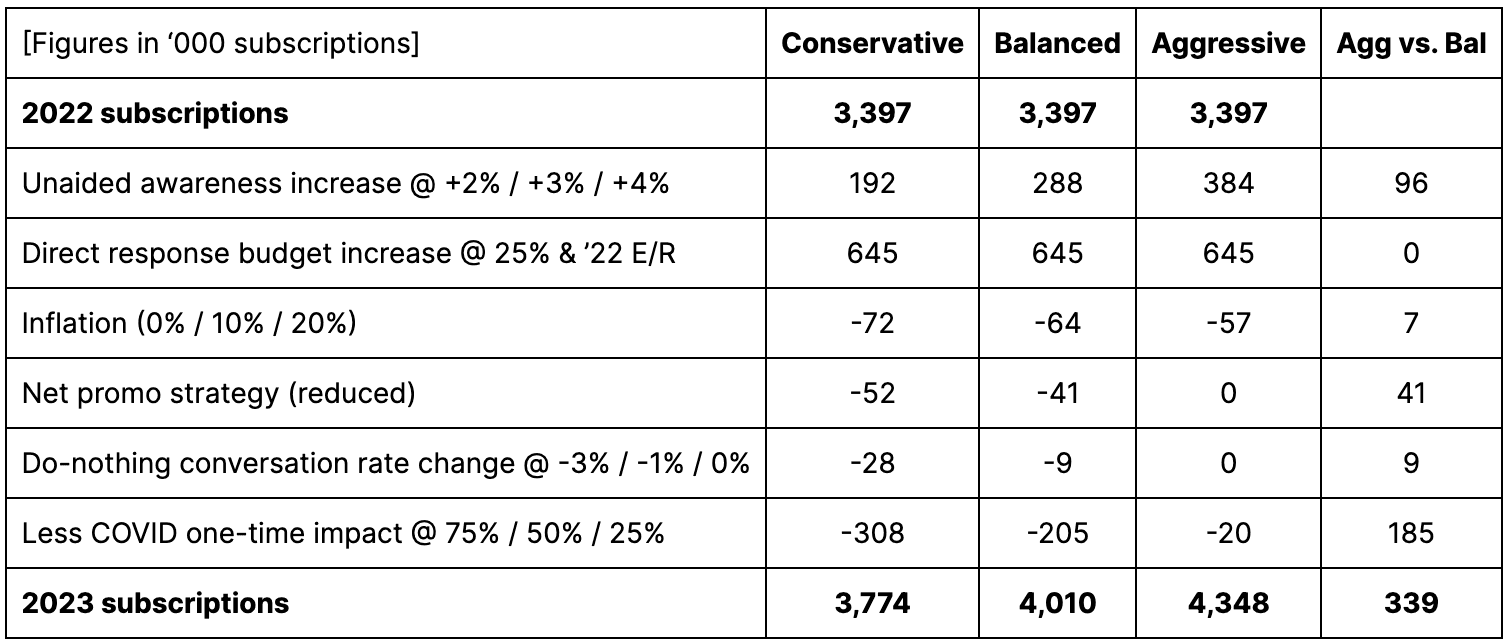

Make sure you watch the full video for Christian’s step-by-step example of driver-based forecasting for a SaaS company. Here’s a quick look at some of what he covers:

“It may happen that you say, 4 million new subscriptions in 2023. But the expectations from the board, investors and senior leaders is that we need to get more than that; at least 4200.

Now, with a driver-based forecast, you don’t need to go back to the drawing board because you can discuss the drivers that you feel more comfortable taking a risk in. And this story becomes very easy to tell because you can show the board investors that, because you believe in unaided awareness and less impact on inflation, it’s a calculated risk.”

3. Rolling forecasts with a narrow focus

“Narrow the focus to parts of the business that really move the needle.”

It’s a popular debate: are rolling forecasts worth the time and effort? Yes, says Christian, absolutely – but only when it makes sense, and never as a replacement for annual planning.

There’s no doubt that rolling forecasts provide ongoing visibility and adaptability, which are crucial in a rapidly changing business environment. However, it’s essential to maintain a balance with traditional annual planning processes to ensure that long-term strategic goals aren’t overlooked in favor of short-term adjustments.

Let’s take a look at some of the advantages of rolling forecasts:

Enhanced visibility: Rolling forecasts provide visibility into the first quarter or even further, allowing businesses to see potential outcomes and adjust strategies early.

Flexibility: They offer a dynamic approach to forecasting, updating regularly instead of adhering rigidly to an annual plan. They support better decision-making by providing up-to-date financial and operational data that reflect the current business environment.

Engagement and rigor: Maintaining rolling forecasts involves engaging business teams continuously, which adds rigor to the planning process.

Of course, there are disadvantages of rolling forecasts, not least of which is the time and people resources you need to invest in them. If they’re taking up a lot of time without actually driving business decisions, then they might not make sense for your team.

But before throwing in the towel, it’s worth investigating why your rolling forecasts aren’t driving decisions. Julio and Christian argue that the root of the problem might be the complexity of your model.

Here’s why Christian suggests narrowing the focus of your rolling forecast to the parts of the business that actually move the needle:

You’ll have more time to deep dive into those key drivers.

You can look at it each month to learn what works and what doesn’t.

It’s easier to do a proper variance analysis to see what’s useful and accurate.

Simpler models are easier to finetune, optimize, and iterate on.

There’s less risk of error such as under-researched assumptions or incorrect formulas.

If it’s easier for the business to understand, they’re more likely to get behind it.

So, what’s the right way to use rolling forecasts to your advantage? By combining them with traditional annual planning processes, and keeping your model as simple as possible. And if rolling forecasts don’t make sense for your FP&A team, then the advantage is in choosing not to use them at all.

More forecasting insights

Don’t miss out on all the insights that Christian and Julio shared during the live webinar. Watch the video for these and a great Q&A session where they dive into bottom-up vs top-down forecasting in more detail; the best further reading for driver-based forecasting; rolling forecast advice; and more.

We host new webinars all the time, featuring experienced CFOs, FP&A experts and business leaders from around the globe. Make sure you sign up to stay up to date. Subscribe for weekly updates or check out our Upcoming Events. And, if you’re looking to upgrade your forecasting process, explore how the functionality of Abacum’s forecasting software can help scaling finance teams take the next step.