Introduction

I turned on the camera to lead my first weekly management review as the company’s finance leader. I was pumped. The key leaders were at the table, and I had structured the material and sent it out beforehand. I had a clear mandate to improve accountability and alignment. Unfortunately, ten minutes into the meeting (paraphrasing):

“Where was this in the material? Why didn’t we talk about X issue? This is ineffective; can we get on with it? Why aren’t we moving faster? Actually, we should go back to the decision we made last week (pricing again, major product issue again, etc). My CRM says differently. We can’t move forward. Our problem is the entire structure of the company!”

The meeting didn’t go well. We hastily cobbled together some action points and ended the call. By the next week, it was painfully obvious: no one had made any real progress. I tried to fix it with new meeting formats, tighter agendas, and even fancier dashboards. But no matter what I did, the process still felt like herding cats. Accountability didn’t stick, and frustration mounted.

After much trial and error, we finally found the structure that delivered results. It simply came down to consistency, clear accountability, shared expectations, and thoughtful pre-work.

There is no debate: Finance should lead these meetings. You have the insights. You have an unbiased view of the org-wide overview. You created the targets. You own the operational model. You have the external investor mindset. You are *most* responsible for providing the reconciled truth. And most importantly, you have the critical eye. You need to take charge of driving these meetings to action.

Why It’s Hard

Running a weekly operational review should be easy, right? After all, it’s just an agenda. Everyone’s a professional. People know their business. But without the right setup and culture, these meetings devolve into time-wasting status updates driven by people’s individual whims.

Here’s where things typically go wrong:

A lack of basic business understanding. People don’t understand how everything fits together. For example, how customer usage should inform the definition of a sales qualified lead (e.g. SQL).

A lack of urgency. We always miss targets. What's the big deal?

Misaligned priorities. Everyone believes their issues are the most important.

Too much or too little detail. Meetings either drown in minutiae or stay too high-level to solve real problems.

A lack of accountability. Decisions are made, but in the next meeting people still haven’t delivered on their commitments.

Been there?

Why the CFO should run the meeting

As stated previously, you have the perspective, insight, mandate, and authority to give the heft to a management review meeting that it needs in order to:

Drive decisions. By providing clear data (reconciled against accounting and systems), you empower others (CEO, COO, CMO, etc) to make decisions based upon a single source of truth.

Drive accountability. In your role as the steward of the company’s financial health, you have the most authority to require clear ownership of tasks and timelines, and to ensure checks against targets.

Manage risk. By owning the financial and operational models, you ensure that these meetings address problems before they snowball.

Improve operational efficiency. By batching discussions, you enable teams to avoid endless ad-hoc check-ins.

Save the CEO time. Your CEO should not be worried about putting together agendas or stressing if the overall business is being monitored appropriately.

Of course, you should loop in other team leaders to present as needed. Maybe you have the COO lead the team through the key operational metrics or the CEO to kick off with a ‘biggest theme of the week.’ That is up to you, but CFOs are best positioned to make this meeting work.

Tip: Remember, you are providing the data for others to make the final decision. Your biggest influence is in shaping the agenda (but as they say, “He who shapes the agenda shapes the decision”).

How to Run an Effective Weekly Operational Review

1. Establish the purpose and timing of the meeting

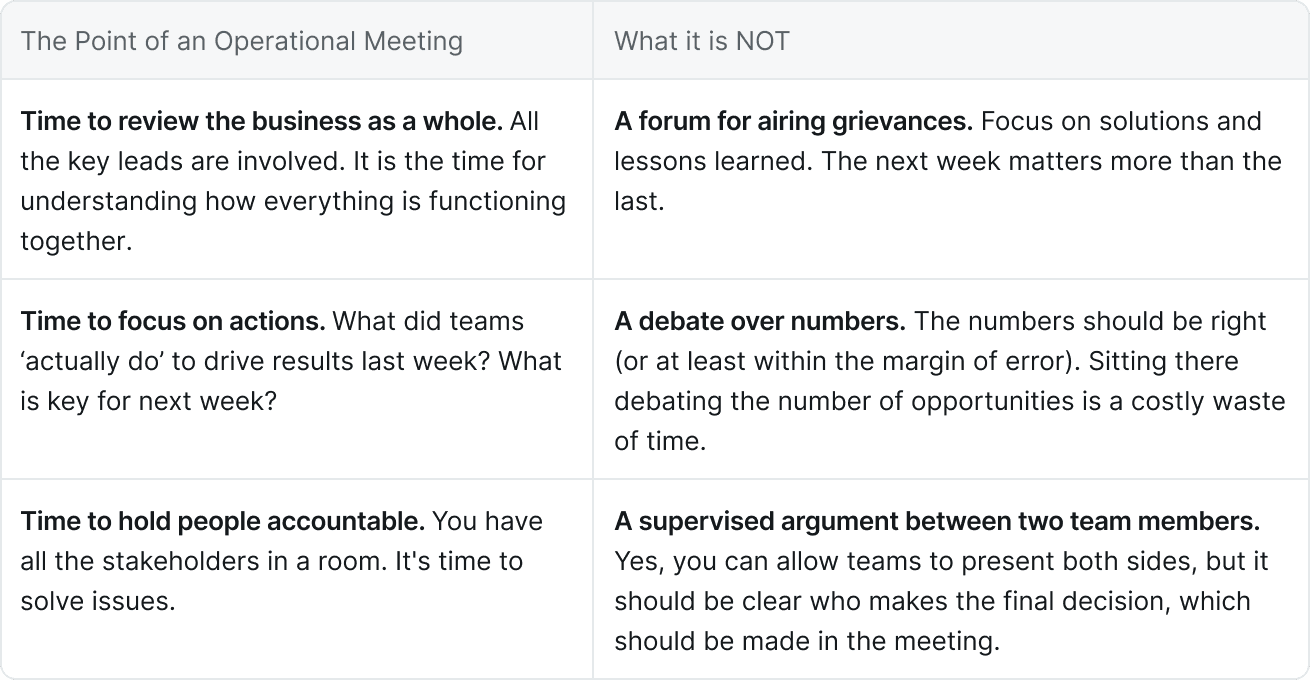

Every operational review should drive action. Establish upfront what the meeting is for and what it is not:

It will take repetition and enforcement to ensure the meeting stays on point. But, by establishing these up front, you are able to steer conversations that don’t abide by these guidelines.

Tip: Keep the invite list tight. This can be hard politically, but only includes the very top-line leadership.Three to four attendees is ideal, with six as the absolute maximum.

2. Clarify who has the final call to move forward

Do you want everyone voting? Probably not in a quick-moving startup. It's much easier to:

Give a discussion period for all major decisions. This allows multiple sides to be presented and people to feel included in the decision.

Move forward if there is clear consensus. If it is something that everyone agrees to, just stop the conversation right there.

Defer to the CEO in any gridlocks. She should make the decision but may delegate it to someone else if necessary. “People team, this is your call.”

There may be uncomfortable decisions, but you need to make ownership clear from the outset. Otherwise, you risk getting stuck or seeking consensus on all issues, which often leads to sub-par decision-making when bold moves are needed.

Tip: In the first meeting, explicitly lay this out to prevent a lot of wasted time. Don’t put it to a vote.

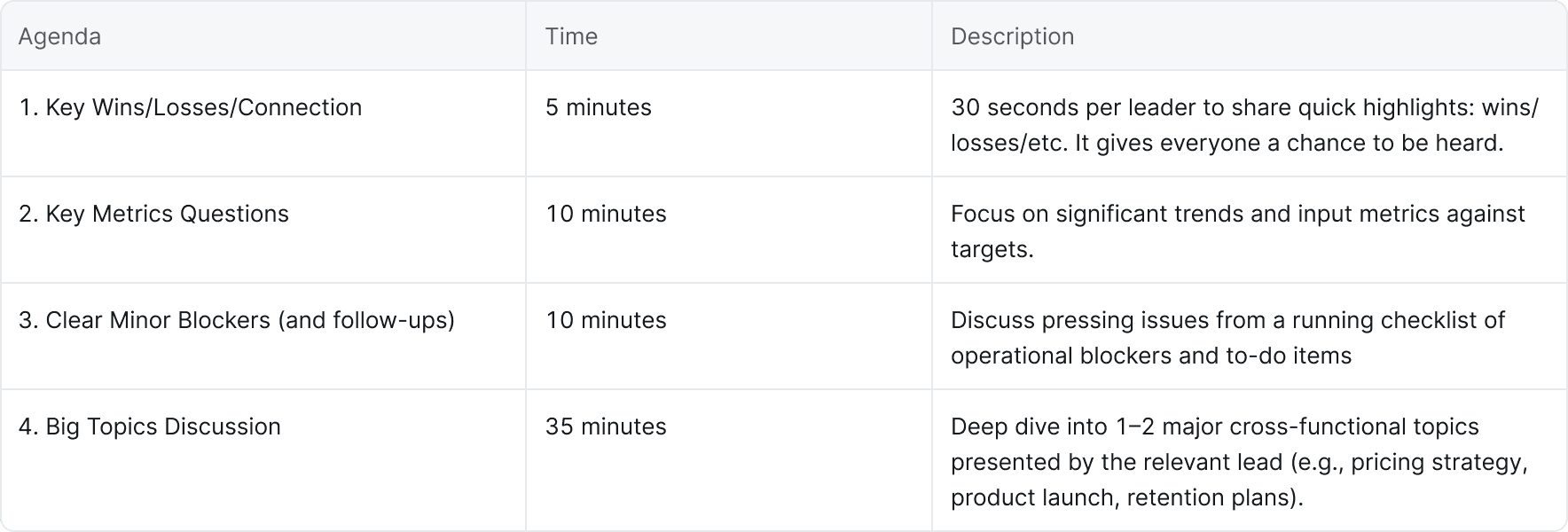

3. Create a non-negotiable structure

Consistency trumps perfection. Use the same agenda on the same document every week so that people get comfortable with the format. If you don’t have any big topics, end the meeting early to avoid it from delving into a free-for-all!

Create a list of blockers during the week. Have everyone send you their blockers via Slack, email, or chat, and update items from previous weeks. It should just be a checklist with short descriptions and owners.

Tip: Calendar out all of your upcoming topics for the next month. You should be able to address them all. If not, be flexible and set another meeting. The meeting schedule shouldn’t be a blocker to quick decisions.

4. Send out a standardized, clear pre-read

As a CFO, you know the numbers, but other people rarely have the same context. It’s up to you to present them clearly and consistently so everyone understands and has time to digest. For the pre-read, you should:

Update the key metrics against targets. Ideally the actuals should come directly from your systems. Either way, you need to have someone double-check the numbers.

Provide the context. You need to clearly explain the numbers and succinctly identify the key reason (what makes up 50-70%) of the change vs. target.

Update the minor blockers and follow-ups. Add new ones that have been sent to you, and cross out completed ones.

Link the material. Ensure everyone has access to any linked ‘Big topic Discussion.’

Make sure the document is clean. Move all the previous meeting notes below the current discussion.

Send the pre-read at the same time each week. Consistency inspires confidence.

The pre-read is essential to getting everyone up to speed. Some people are quicker to spitball; others like to ponder. This levels the playing field so you make the right decisions.

Tip: Send at the same time each morning, and ensure everyone blocks out an hour ahead of the meeting to review the metrics, think about the big picture, read the pre-reads, and comment.

5. Enforce focus during the meeting

You need to keep everyone on topic. This might be painful for the first couple of times, but you have the authority to do it. Your team will eventually appreciate the improved effectiveness.

If a topic is running over… Either ask to park it until the next meeting or schedule a follow-up mid-week.

If a topic is just between two people… Ask them to figure it out offline.

If a person doesn’t participate... Call them out. Full engagement is necessary to ensure alignment and commitment.

If things ramble on… Don’t hesitate to ask the CEO to make the call. That is her job.

You need to keep control of this meeting. There are many points of view and opinions, and people generally appreciate structure and efficiency.

Tip: Link back to the purpose of the meeting (which everyone has hopefully agreed on) as a guidepost.

6. Review the quality of preparation for big topics

Oftentimes, big topics are the most important parts of the meetings: new markets, new product launches, etc. These should be led by the relevant team lead, but to drive a quality decisionmaking for each big topic you should:

Review the material before it is brought up to the group. Make sure any numbers are aligned with your systems, operational models, targets, etc.

Ensure it reflects the key risks. Test the key assumptions. For example on pricing, if you increase the price by X how many customers in the pipeline will you immediately lose?

Confirm they provide more options than just “yes/no.” Each decision should include multiple choices - Option 1, Option 2, Option 3 - along with the presenter’s recommendation. This helps people think creatively, prevents oversimplification, and increases flexibility.

Enforce that they don’t go tooooo long. They should be concise, and avoid wasting everybody’s time explaining context that leaders already know or irrelevant details.

Big topics don’t need a standard structure, as everyone has different styles of thinking. However, a great CFO ensures the material leads to the best decision.

Tip: Try to keep the *big topic* decisions to one page each. Append any supporting data.

7. Recap and follow-up

Of course, the meeting’s true value lies in what happens afterward. To drive accountability:

Send a summary. It should include an overview of decisions, next steps, and responsibilities. Keep the structure consistent to ensure people can focus on content rather than adjusting to new data formats.

Update your models. If any changes were made in the meeting, ensure your operational model / budget / reforecasts reflect the key decisions made.

Include an accountability reminder. The team will review incomplete tasks at the start of the next meeting. Tag people and make it clear they will be responsible for an update next week.

This is an easy step, but is often delayed due to the rush of completing the meeting. Send this either on the same day or the following morning.

Tip: Send a sanitized summary to the entire company or discuss performance at your next company all-hands. Everyone knows when these meetings occur and is curious about the outcomes.

In Conclusion

The CFO should lead this meeting as the key stakeholder responsible for the company’s financial health. This isn’t a one-time effort. The structure will need to evolve over time as you refine it to better serve your business. Consistent follow-ups on actions, addressing misses, and diving into the numbers are essential to making this process work.

Once this “muscle” is exercised regularly, teams will become more engaged in decision-making, target-setting, and overall company direction. These improvements will ultimately make monthly and quarterly planning far more effective.

A well-run weekly management meeting should streamline operations, reduce the need for other meetings, and drive meaningful action.