Budgeting the traditional way is becoming out-dated, with old frameworks that use aging data, assumptions and indicators no longer capable of providing an agile budgeting strategy. This can leave you with inflexible budgets that are disconnected from your strategy and operations – or deprive you from finding future opportunities and new methods of real-time resource deployment.

By introducing a Target Operating Model (TOM), or TARGET framework, into your budgeting process, you can more effectively align the process with your strategic objectives. We’ll explore what a TOM is, then break down our framework for utilising TARGET for better budgeting.

What is a Target Operating Model?

A Target Operating Model is a framework for ideal operation in a business or process. They describe how a certain operation should be organised, performed and managed to best meet desired business objectives. Target Operating Models can be created and utilised for a number of different functions, processes or operations at all levels of business operation, from individual components to the entire running of the organisation.

In short, they provide a clear blueprint and set of instructions for an operation to best deliver on its business objectives in a clear and transparent method that all members of the operation have visibility on.

There are a number of different TOMs, each designed for different processes and business objectives. Our TARGET framework has been developed to best help finance teams run their budgeting processes.

What is Our TARGET Framework?

Our target operating framework provides a step-by-step approach to aligning your strategic objectives with budgeting. We have split out the “target” into an acronym that represents a wholistic budgeting process.

Following the TARGET Framework, steps TARG are performed in depth during budgeting season, then E and T throughout the year.

Here is an overview of our target model for budgeting:

T: Translate Objectives

Convert high-level strategic objectives into specific, actionable goals.

A: Align Departments

Ensure all departments align their plans with the strategic objectives.

R: Resource Allocation

Allocate resources effectively to support strategic objectives.

G: Generate Metrics

Establish KPIs to measure progress towards goals.

E: Evaluate Performance

Regularly assess performance against strategic objectives.

T: Tweak and Improve

Continuously refine and improve plans based on feedback and data.

Let’s break down each of these individual sections in more detail to learn how they can be best-utilised and applied to budgeting.

Applying the TARGET Operating Model to Budgeting

T: Applying the MOST Framework to Translating Objectives

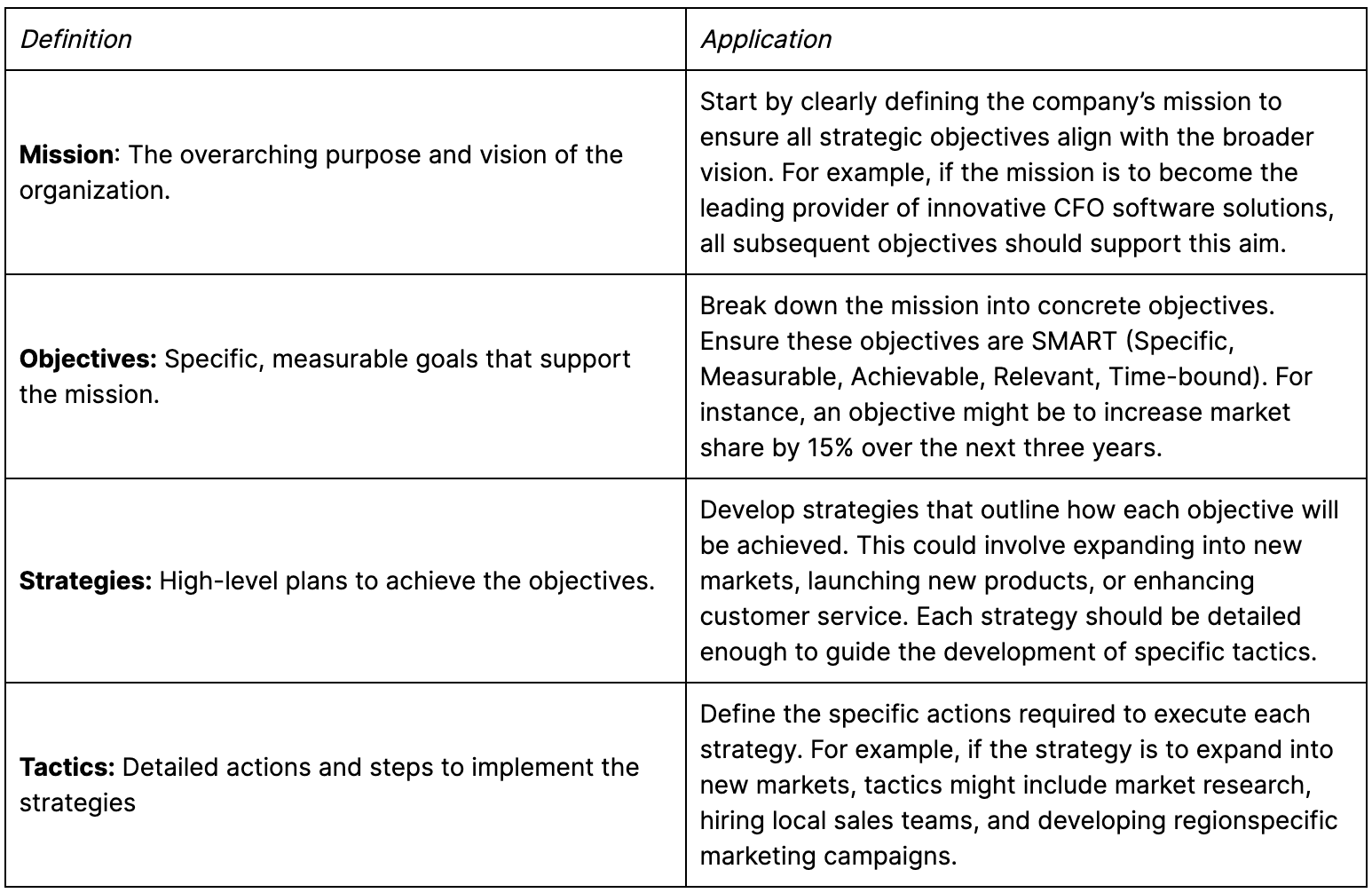

Translating objectives can be achieved best through the “MOST” framework (Mission, Objectives, Strategies, Tactics), which is a powerful tool for translating high-level strategic goals into actionable plans. We’ve seen firsthand how more finance teams are applying this simple framework to boost their strategic decision-making abilities.

A: Example Questions for Aligning Departments

Engaging with department leaders is crucial for aligning the budgeting process with strategic objectives. Here are some general questions for each department to gather insights and ensure their plans align with overall company goals.

What additional resources (personnel, tools, training) do you need to meet your goals?

What emerging trends or opportunities in the market do you think we should capitalize on?

Are there any challenges when it comes to measuring performance, we could help you with?

If I asked you to cut costs by 10%, what would you cut?

What risks do you foresee in your department, and how do you plan to mitigate them?

Are there any external factors that could impact your department’s performance?

Are there opportunities for cross-departmental collaboration that could enhance your efforts?

Alongside these questions, you should also tailor questions to specific departments. For instance, asking your Sales department about the resources they would need to increase quota attainment, or asking Marketing about the campaigns they have for next year and the budget they require for them.

R: Planning Effectively with Scenario Planning

Introducing scenario planning is key for successful resource allocation, offering a structured approach to anticipate various future environments.

Imagine presenting a scenario where a market downturn is predicted, and you’ve already allocated resources to cost-cutting measures and efficiency improvements. Or another scenario forecasting rapid growth, where you’ve planned investments to scale operations and expand market reach. Scenario planning isn’t just a tool; it’s your secret weapon for driving strategic success and making a lasting impact on your company’s future.

What is Scenario Planning?

In its simplest form, this uses a series of plausible future environments to assess how each scenario could impact the strategic goals or resources of your business. Scenario planning is holistic and considers multiple factors such as economic conditions, market trends, regulatory changes, and technological advancements.

G: Example Metrics to Generate

Here we’ve provided some common non-finance metrics by department.

Key guidelines.

Align with North Star Metric: Every metric should tie back to your primary strategic objective.

Quality Over Quantity: Select the most critical metrics; while it’s tempting to track numerous KPIs, too many metrics can be distracting and create unnecessary overhead. Do not boil the ocean!

Avoid Composite Indexes: Use clear, individual metrics to understand what you are measuring. Composites can hide underlying trends.

By concentrating on a clear set of metrics, you can better manage and drive performance, making your metrics truly actionable and impactful. This focused approach helps maintain clarity and alignment, driving more effective decision making and strategic execution across the entire organization.

E: Evaluating Your Budgeting

After the budgeting process, maintaining performance and accountability is crucial.

As a finance leader, elevate your role to become an agent of performance. Actively engage in business partnering by scheduling regular performance meetings with key stakeholders. Arrive armed with insightful data and actionable recommendations. Drive meaningful discussions and maintain a close connection with the business to understand its ongoing dynamics and challenges.

To operationalize this, you can utilize tools like dashboards, templates, and scorecards. However, always remember that the core aim is to drive impactful performance and align actions with your strategic goals.

T: Achieving Continuous Improvement

Continuous review of the budget in the latest context is essential for adapting to changes and optimizing performance. Regular forecasting is not only a tool to test if the budget is still valid but also a means to enhance predictability, update your execution plan, accelerate performance, and manage investor expectations.

Decide which methodology is better for your business.

A Step-by-Step Checklist for the TARGET Framework

Translate Objectives

Understand company’s strategic positioning

Gather & review company’s historical financial & operational data

Review the company’s mission and vision statements (optional, but useful to

make sure that objectives are in line with company’s long-term vision)

Consult with key stakeholders to identify strategic goals

Align objectives with the company’s strategic goals and operational needs

Ensure objectives are specific, measurable, achievable, relevant, and timebound (SMART)

Understand which objective is the most important (North Star Metric)

Break down high-level objectives into specific, actionable goals

Align Departments

Schedule alignment meetings with department heads

Identify key operational inputs (drivers) of objectives

Identify key operational inputs (drivers) of costs and capital expenditures

Define departmental KPIs and plans

Ensure departmental KPIs and plans align with strategic objectives

Resource Allocation

Translate company plan & departmental plans into mathematical model that

reflects inputs & outputs (driver based model)

Sanity check model to ensure financial outcomes are sound, then adjust

resources & objectives as necessary to reflect the reality of the business

Break down departmental budgets

Generate Metrics

Conduct departmental and management reviews of the draft budget

Collect and incorporate feedback

Present the final budget for executive approval

Implement tracking system to continuously monitor KPIs and objectives

Schedule regular performance check-ins

Tweak and Improve

Communicate the approved budget to all departments

Regularly track performance against the budget

Make adjustments to budget as needed

Achieving Efficiency with the TARGET Framework

By using the TARGET framework to structure your budgeting process, you can budget more effectively to help your organisation align your budget with strategic goals while being more flexible in your resource deployment.

For more information about better budgeting processes, take a look at our complete business budgeting guide.