Introduction

Financial management encompasses different processes that are an essential part of the everyday life of businesses and FP&A teams. Among those processes is financial planning.In this field, a financial planning software for SMBs plays a pivotal role in streamlining and enhancing the planning process. By leveraging technology, these software tools empower businesses to optimize the utilization of financial resources and ensure long-term financial security by offering budgeting, forecasting, and performance tracking tools, thus empowering SMBs to make informed decisions and drive growth.

Overall, implementing financial planning software is a strategic process that empowers organizations and FP&A teams to take control of their finances, make informed decisions, and work towards achieving their financial objectives. In this post, we are going to focus on financial planning software for SMBs.

The market size of financial planning software was $3.7 billion in 2021. It is projected to experience substantial growth and reach $16.9 billion by 2031, with a compound annual growth rate (CAGR) of 16.6% from 2022 to 2031.

Lately, money has been poured into advanced technologies like AI, robotic process automation, to enhance customer experience, improve financial performance, and boost operational efficiency.

Why is financial planning so important?

Planning processes are central for businesses as they provide a framework for setting financial goals and objectives, guiding decision-making, and ensuring strategic direction. It helps businesses allocate resources effectively by assessing available financial resources and optimizing their utilization to support various activities.

Financial planning also involves creating budgets and forecasting future scenarios, enabling businesses to anticipate income and expenses, planning for cash flow needs, and identifying potential risks and opportunities. By conducting risk analysis and scenario modeling, businesses can effectively manage financial risks, develop contingency plans, and make informed decisions.

Additionally, financial planning allows businesses to evaluate their financial performance, track key performance indicators, identify areas for improvement, and make goal-based decisions. It plays a vital role in determining capital needs, evaluating investment options, and assessing financial viability. Moreover, financial planning facilitates transparent communication with stakeholders, instilling confidence and fostering trust.

In summary, comprehensive financial planning enhances financial stability, profitability, and long-term success for businesses.

What is business financial planning software?

When it comes to financial planning tools, one important distinction to have in mind is their end user, as their features might differ from one solution to another.

Taking into consideration the end user we can find planning solutions for:

Financial planning software for Individuals – Mainly tailored for personal finances. Softwares that are user-friendly and empower the user to achieve their financial goals and have better insights over their personal capital, whether taking care of retirement accounts, investment accounts or accomplishing their savings goals. Often they provide free versions, from where they will try to improve conversion to their paid plans.

Financial planning software for Financial Advisors – Since financial planners can admonish both individuals and businesses they require solutions that support advanced planning. Things like tax planning, social security, or liabilities fall under the necessary features to satisfy the client’s needs.

Financial planning software for Businesses (SMBs & Enterprises) – Businesses usually have multiple tools from which they need information in order to carry out their financial planning. Therefore, integrations and automation become very important features.

For most of these users whether they are individuals using spreadsheets or companies with complex spreadsheets, the go-to solution for financial planning is Excel but with the right financial planning software companies can significantly improve their financial planning processes and outcomes.

While Excel is a widely used tool for financial modeling and analysis, it comes with some constraints that software solutions might solve, like real-time updates for your financial data and KPIs, being your single source of truth, and ensuring accurate and reliable information for informed decision-making. Hence, dedicated financial planning software offers numerous advantages and can enhance a company’s financial planning in several ways.

Why do you need a financial planning tool and what are the benefits?

Financial planning software programs for businesses are tools designed to help businesses manage and analyze their financial information, forecast future financial scenarios, and create financial plans. The term can be used interchangeably with FP&A software.

It typically offers a range of features and functionalities to assist businesses in making informed financial decisions and optimizing their financial performance. Trying to quicken their processes as much as possible while providing a robust but flexible solution that can adapt to their business needs.

Overall, business financial planning software helps businesses streamline their financial planning processes, improve accuracy in forecasting, and make data-driven financial decisions. It provides a centralized platform to manage and analyze financial information, leading to better financial control and long-term success.

Learn more about Financial planning and analysis in our comprehensive guide on what is FP&A.

How to choose the best Financial Planning Software

When selecting financial planning software, it’s crucial to conduct thorough research and consider various factors. You should start to create a list of vendors, good places to start are G2 and Capterra.

Here you will be able to see customer reviews for the different vendors. After you have a list of 5-10 vendors, we recommend proceeding with the first demos. Afterward, scope the list down to 2-3 that best suit your needs.

Here’s some points to help you choose the best solution for your needs.

Review Features and Benefits

Evaluate the features and benefits offered by different financial planning software solutions. Consider whether they align with your specific financial needs and objectives. Look for functionalities that fit your needs such as budgeting software tools, forecasting capabilities, investment analysis, and reporting features to ensure comprehensive support for your financial planning efforts.

Determine price point and available budget

Set a clear budget for investing in financial planning software and compare it with the pricing of various options available in the market. Consider both upfront costs and ongoing subscription fees.

View customer history and reviews

Research the reputation of financial planning software providers by reviewing customer testimonials, case studies, and online reviews.

Prioritize Privacy & Security

Prioritize the privacy and security of your financial data when selecting a financial planning software solution. Ensure that the software provider adheres to industry-standard security protocols and compliance regulations.

Best financial planning software tools in the market:

The following planning tools offer varying degrees of complexity, scalability, and pricing options, allowing businesses to choose the one that best fits their needs and budget. Implementing the right financial planning software tool can greatly enhance a mid-sized business’s ability to effectively manage its finances, make informed decisions, and achieve its growth objectives.

In our breakdown of the best financial planning tools, we include pricing, differentiation features, and our expert opinion on each, making it easy for every FP&A team to make the best buying decision.

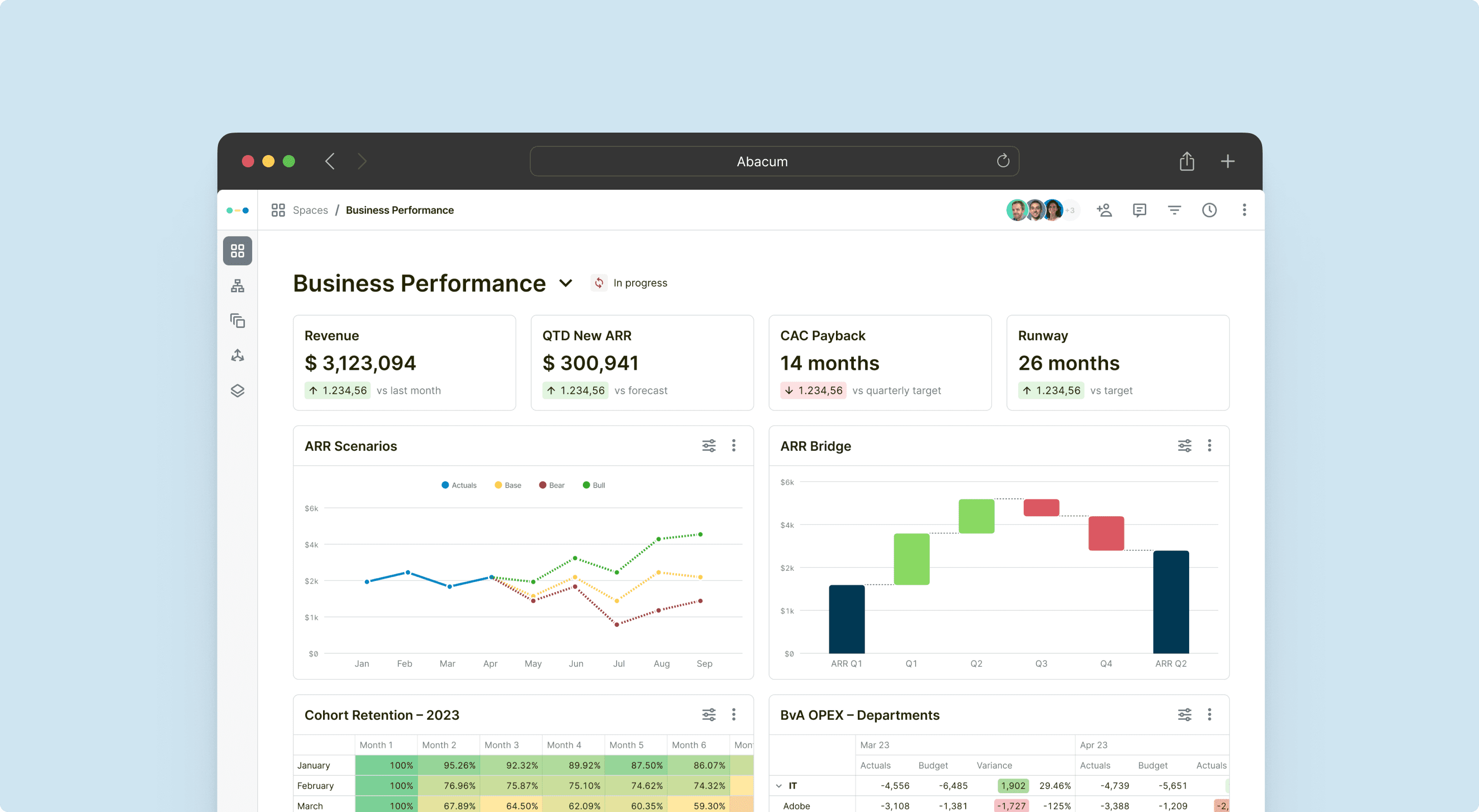

1. Abacum

G2 rating (September 2023): 4.8/5 See all our G2 reviews

Summary: Abacum empowers businesses with faster scenario analyses, automated budgeting workflows, streamlined leadership approvals, and effective consolidation of bottom-up and top-down forecasts. By providing faster access to insights and enhanced analytics, Abacum automates essential budgeting processes, consistently delivering tangible value to its users.

Abacum stands out as the premier choice in financial planning software, offering a comprehensive solution tailored to the needs of businesses. With a keen understanding of the challenges faced by finance teams, Abacum was developed to empower users with intuitive tools and advanced functionalities. From automated data consolidation to customizable dashboards, Abacum streamlines financial planning processes, enabling users to make informed decisions with confidence and agility. With its cloud-based platform and seamless integration with Excel and Google Sheets, Abacum provides unmatched flexibility and accessibility, ensuring finance teams can collaborate effectively from anywhere.

Key features: Headcount planning, what-if analyses, vendor-level budgeting, reporting templates, budget approvals, and core collaboration functionalities are some of the core features for Abacums financial Planning Software.

Top Features:

Granular Modeling Capabilities: Abacum provides sophisticated granular modeling capabilities, enabling in-depth analysis at the most detailed level of financial structures.

Complex Scenario Planning: Abacum facilitates effortless complex scenario planning, accommodating multifaceted assumptions and variables for a comprehensive understanding of financial outcomes.

Automated Data Consolidation: Abacum automates the consolidation process, seamlessly merging data from diverse sources to ensure accuracy and efficiency in analysis.

Customizable Dashboards: Abacum allows users to customize dashboards to their specific needs, enabling easy visualization of complex financial insights.

Collaborate with Non-Finance Stakeholders: Abacum fosters collaboration beyond finance teams, providing a platform for seamless communication and data sharing with stakeholders across departments.

Other features:

Streamlined Implementation: Abacum’s dedicated implementation team ensures you receive continuous support and training, enabling you to complete your financial planning process on time

Flexible Integrations: Abacum offers extensive and flexible integrations with popular applications, ensuring seamless connectivity and data exchange across platforms.

Native Excel and Google Sheets Compatibility: Abacum’s compatibility with Excel and Google Sheets provides users with a familiar environment for data manipulation and analysis.

Real-time Forecasts: Abacum lets you stay ahead of the curve by making sure your forecasts are always up to date with the most current data.

Customized Planning Templates: Abacum offers customizable templates that provide an intuitive way to prepare your financial plans.

Exceptional UX and UI: Abacum boasts an outstanding user experience (UX) and user interface (UI), driving widespread adoption among stakeholders across your organization. Abacum prioritizes user-friendliness and intuitiveness.

Multi-Currency Support: Abacum allows users to evaluate financial data in multiple currencies, facilitating comprehensive analysis in a global business environment.

User-Based Controls: The platform offers robust user-based controls, ensuring data security and integrity through permissions management and audit trails.

Centralized Formulas and KPIs: Abacum provides a centralized repository for formulas and key performance indicators (KPIs), streamlining calculations and reporting processes.

Detailed Drilldown and Audit Trail: Users can easily drill down into data and access detailed transaction-level information, supported by comprehensive audit trails for transparency and accountability.

Effective Reporting and KPI Analysis: Abacum empowers users with powerful business reporting and KPI analysis tools, facilitating informed decision-making and strategic planning.

Comprehensive Financial Planning: With its comprehensive feature set, Abacum supports various aspects of financial business planning, from budgeting and forecasting to scenario analysis and reporting.

Robust Security Measures: Abacum prioritizes financial data security and privacy, implementing robust measures to safeguard sensitive financial information. With advanced encryption protocols, secure data storage practices, and stringent access controls, users can trust Abacum to protect their confidential data from unauthorized access or breaches, ensuring compliance with industry regulations and standards.

Advanced Features: Abacum empowers FP&A teams by automating data wrangling, integrating with diverse data sources, and facilitating data reconciliation.

Access to Real-Time Data: Abacum ensures access to real-time data, empowering agile decision-making and proactive financial management for a competitive edge in dynamic market environments.

Who is this tool for: Abacum is best suited for FP&A managers at mid-market startups and scaleups that are in need of a robust but flexible planning solution.

Support options: Abacum offers a fully dedicated support team, plus resources like an academy, or in-depth updates on new features.

NEW Product Release! Model, forecast and plan your headcount in one place with Abacum 🚀 📊

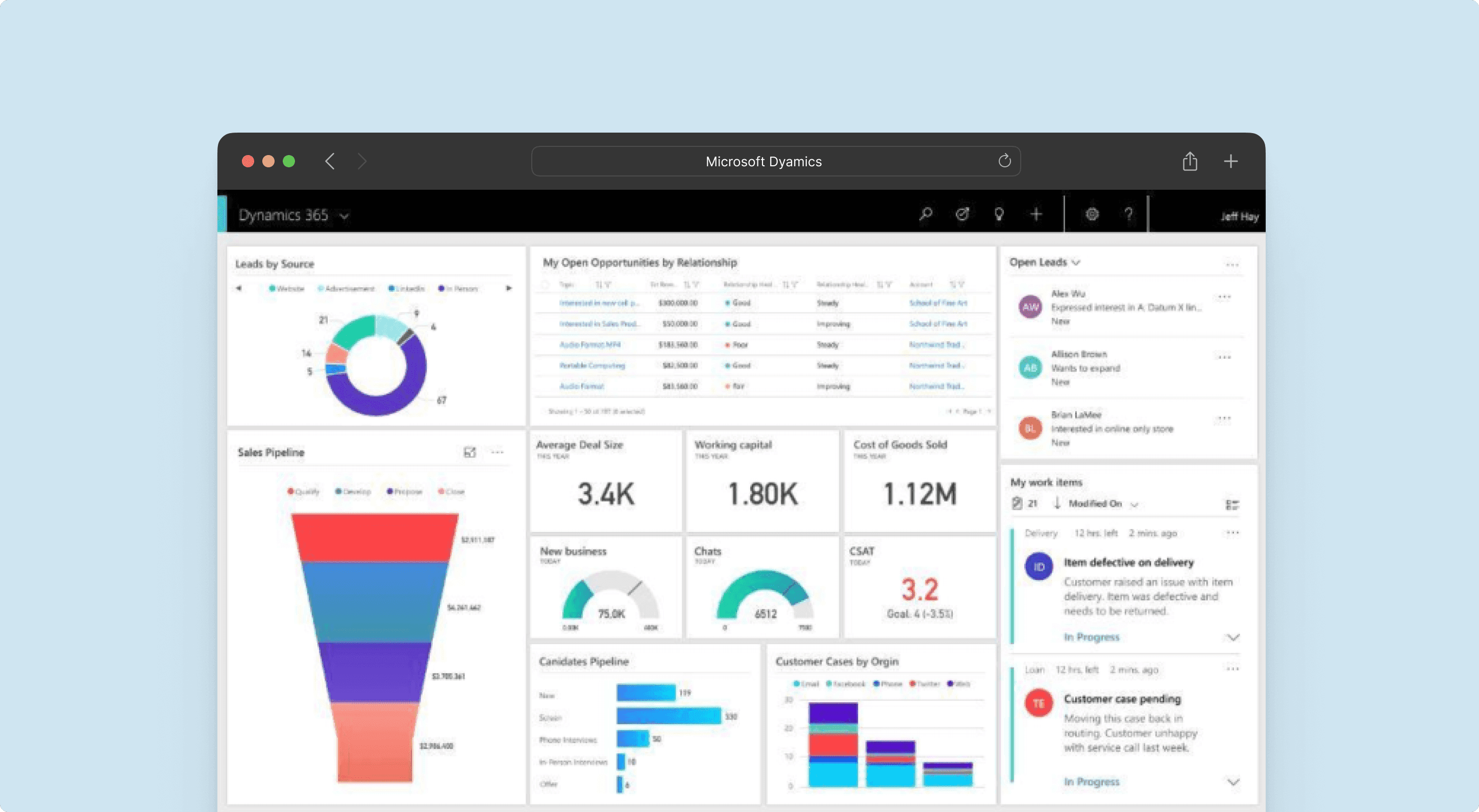

2. Microsoft Dynamics

G2 / Capterra ratings (September 2023): 3.8/5 / 4.4/5

Summary: At its core, Microsoft Dynamics is an accounting software and customer relationship management tool. And while those are their main value propositions they have continuously built modules on top in order to support more use cases. Among these, they have developed a finance module that empowers businesses to efficiently and proactively manage their financial operations. Through real-time visibility, seamless integrations, and advanced forecasting capabilities, organizations gain the necessary tools to effectively oversee their finances.

Key features: Flexible budgeting scenarios, automated calculations, and real-time updates enable finance teams to make informed decisions and easily adapt company budgets as needed. With Microsoft Dynamics, finance teams can effectively manage their budgets and drive financial agility within the organization.

Who is this tool for: We believe that this tool is best suited for mid-market customers that have Microsoft Dynamics as their ERP. With this, they can leverage that the data is already within the platform and use the finance module.

Support options: Customers seem really happy with their support options and heavily rely on them as Microsoft Dynamics has a steep learning curve. For this, they provide an in-depth documentation page and a highly regarded support team.

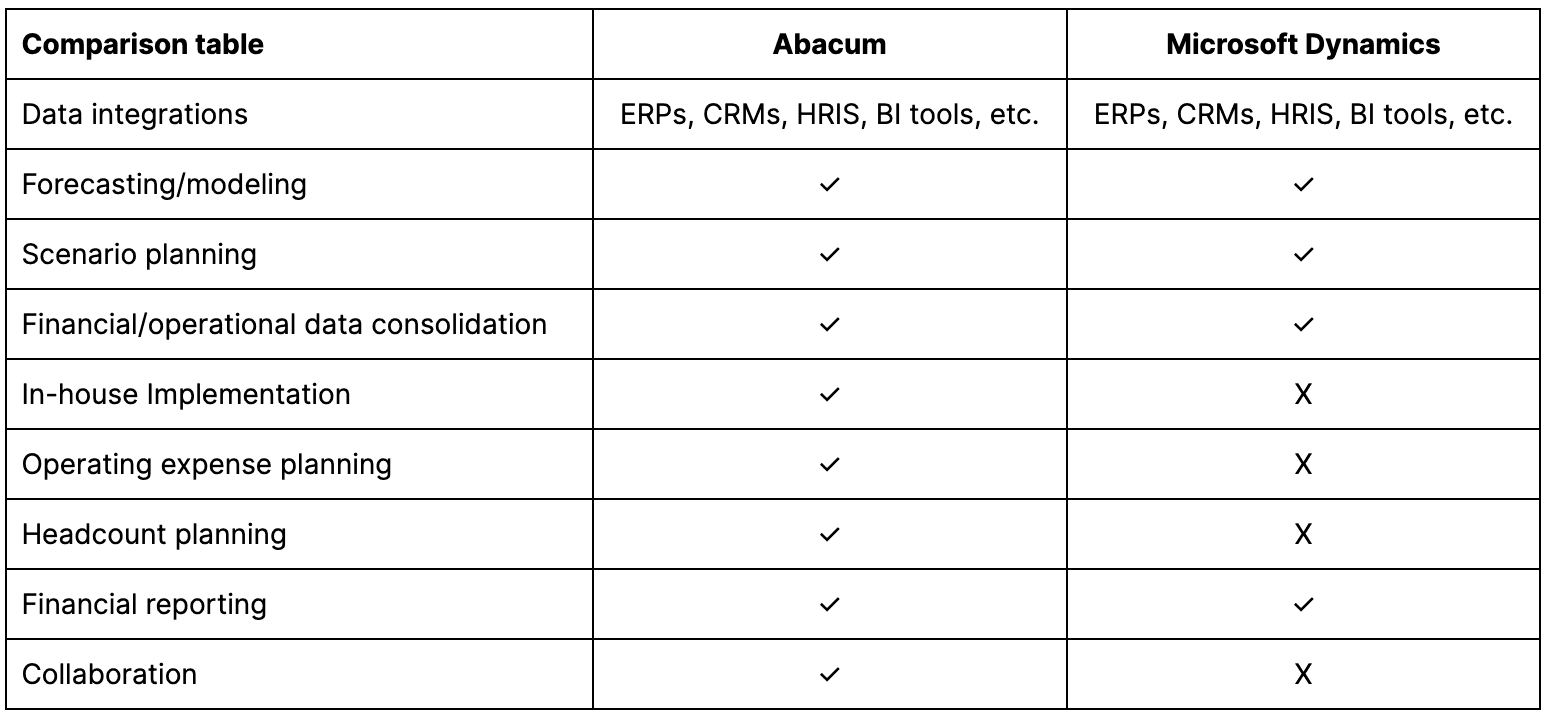

How does Abacum compare with Microsoft Dynamics:

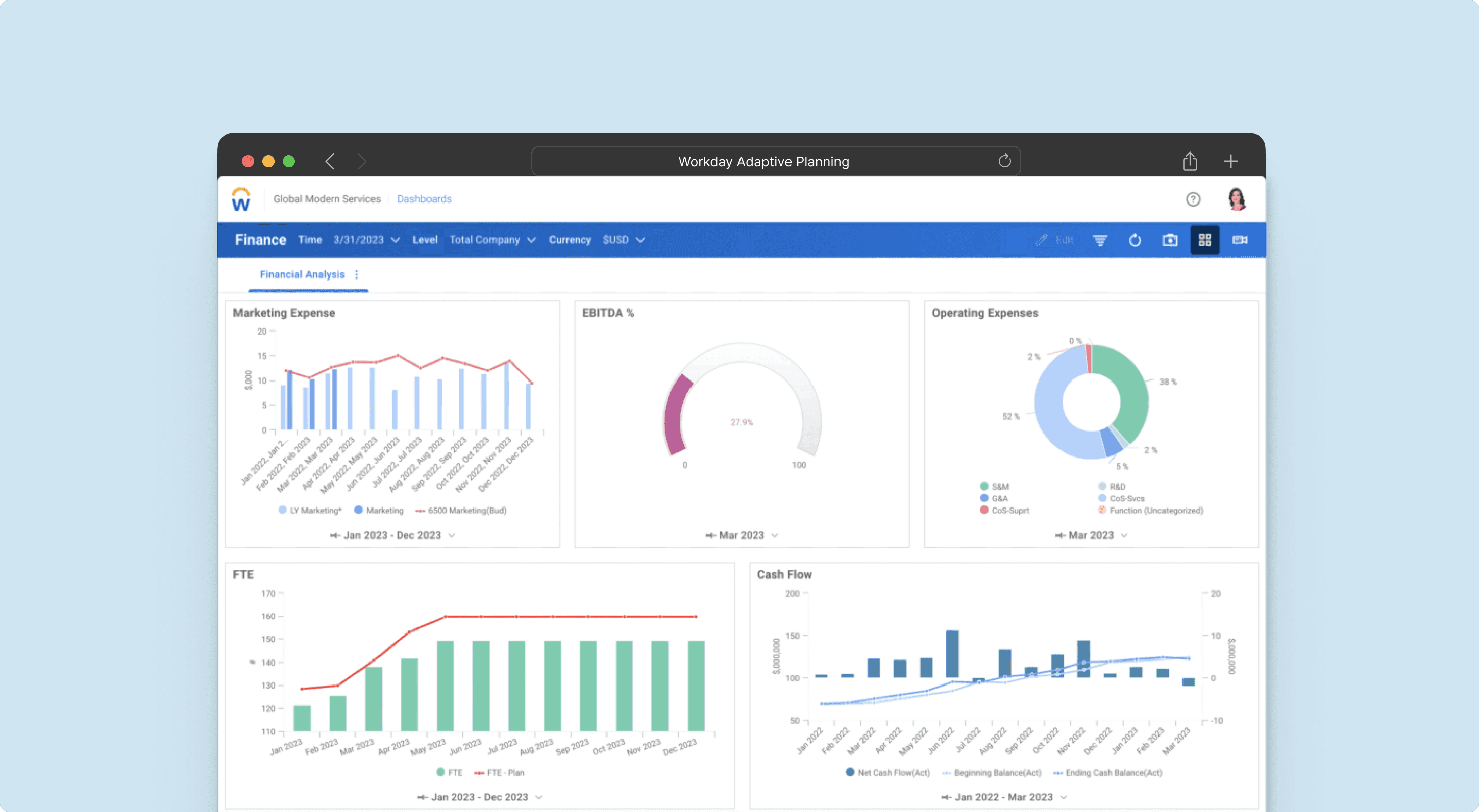

3. Workday Adaptive Planning

G2 / Capterra ratings (September 2023): 4.3/5 / 4.5/5

Summary: Workday Adaptive Planning enables agile decision-making with powerful modeling and analytics. It empowers enterprise organizations to confidently adapt to changing business conditions in a user-friendly cloud-based application.

Key features: Multiple dimension modeling, Workday Adaptive Planning OfficeConnect which makes it easy to create reports in Microsoft Office by connecting your existing Excel reports to Workday Adaptive Planning, version control, formula validation, or cash-flow-based planning are some of the features that stand out to customers.

Who is this tool for: Workday Adaptive Planning stands out as the best suited for large enterprises (>700 employees) requiring a comprehensive tool that can effectively handle extensive data. Its exceptional capability in managing large datasets distinguishes it from other applications.

Support options: Although there are learning resources available, they could use some improvement as some users felt it fell short.

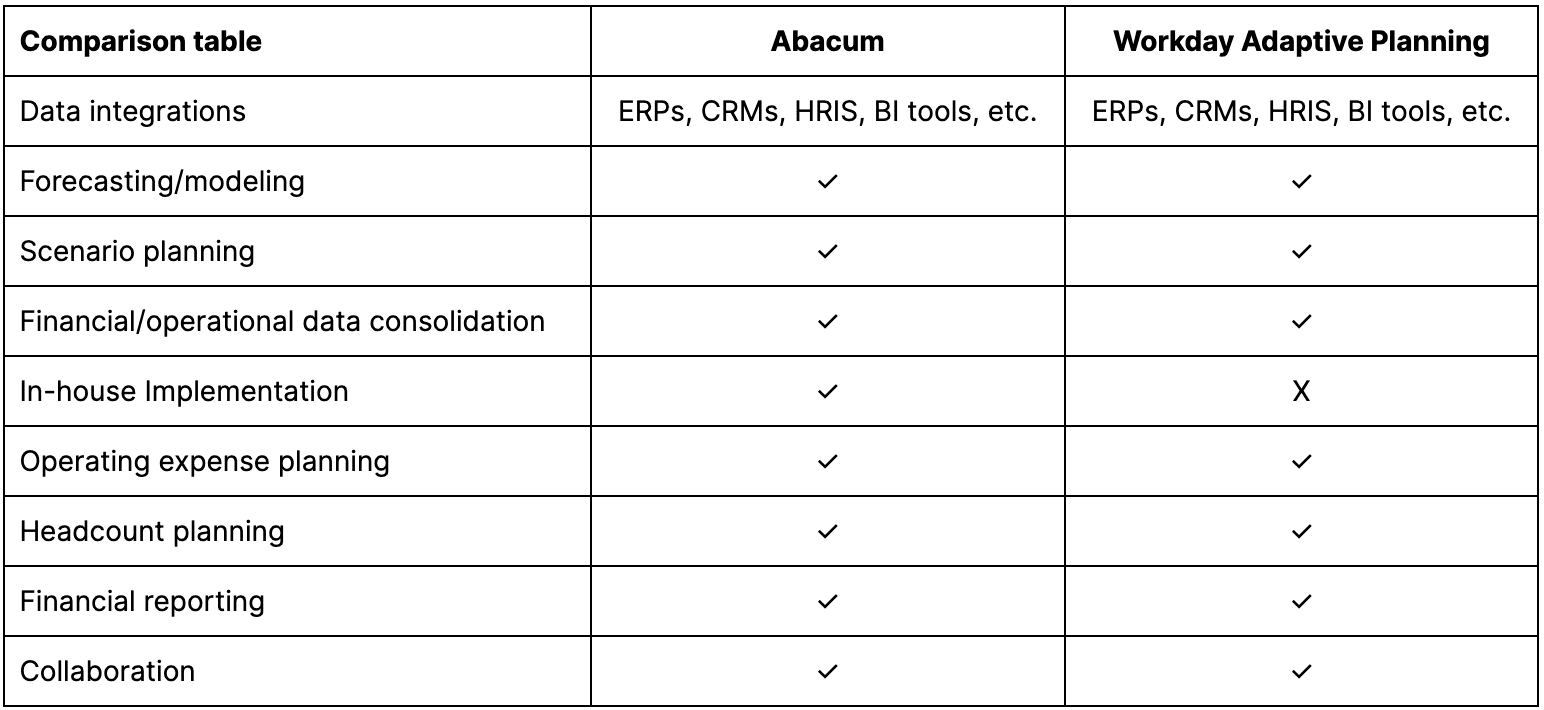

How does Abacum compare with Workday Adaptive Planning:

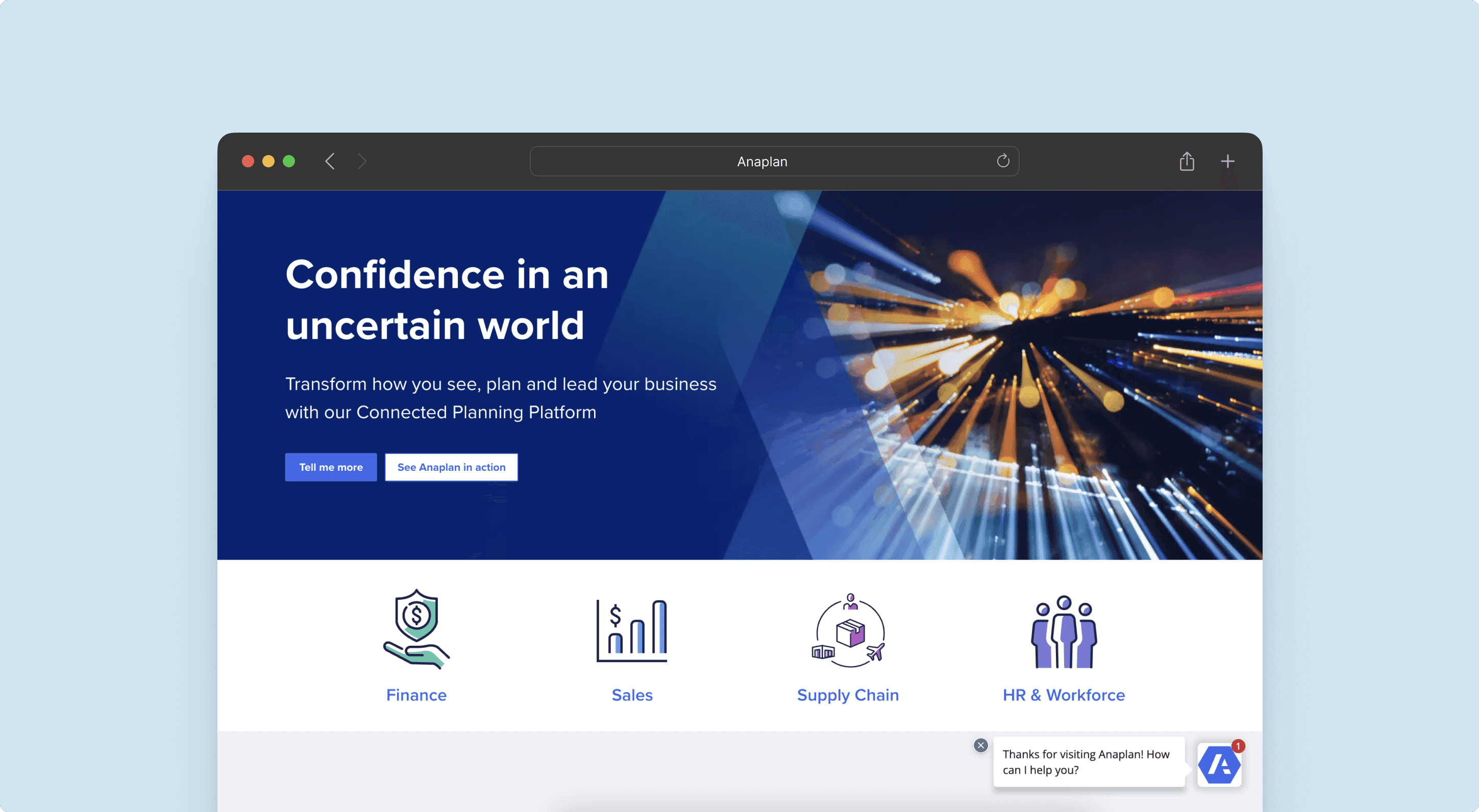

4. Anaplan

G2 / Capterra ratings (September 2023): 4.6/5 / 4.5/5

Summary: Anaplan is a dynamic planning platform that enables data-driven decision-making and adaptability to market changes. With its flexible architecture, organizations can streamline planning processes and drive agile operations for better business outcomes.

Key features: Very robust and strong calculation engine, ability to plan at any level of granularity, real-time collaboration, modeling, and simulations.

Who is this tool for: Anaplan is best suited for large enterprises (>1000 employees) where their current processes have become overly complicated and smaller solutions can’t handle their complexity.

Support options: When it comes to implementing they work with third-party consultants. On top of this, some customers also complain about their support team and lack of help. They seem to have a great community that is full of support and responsive to requests for assistance.

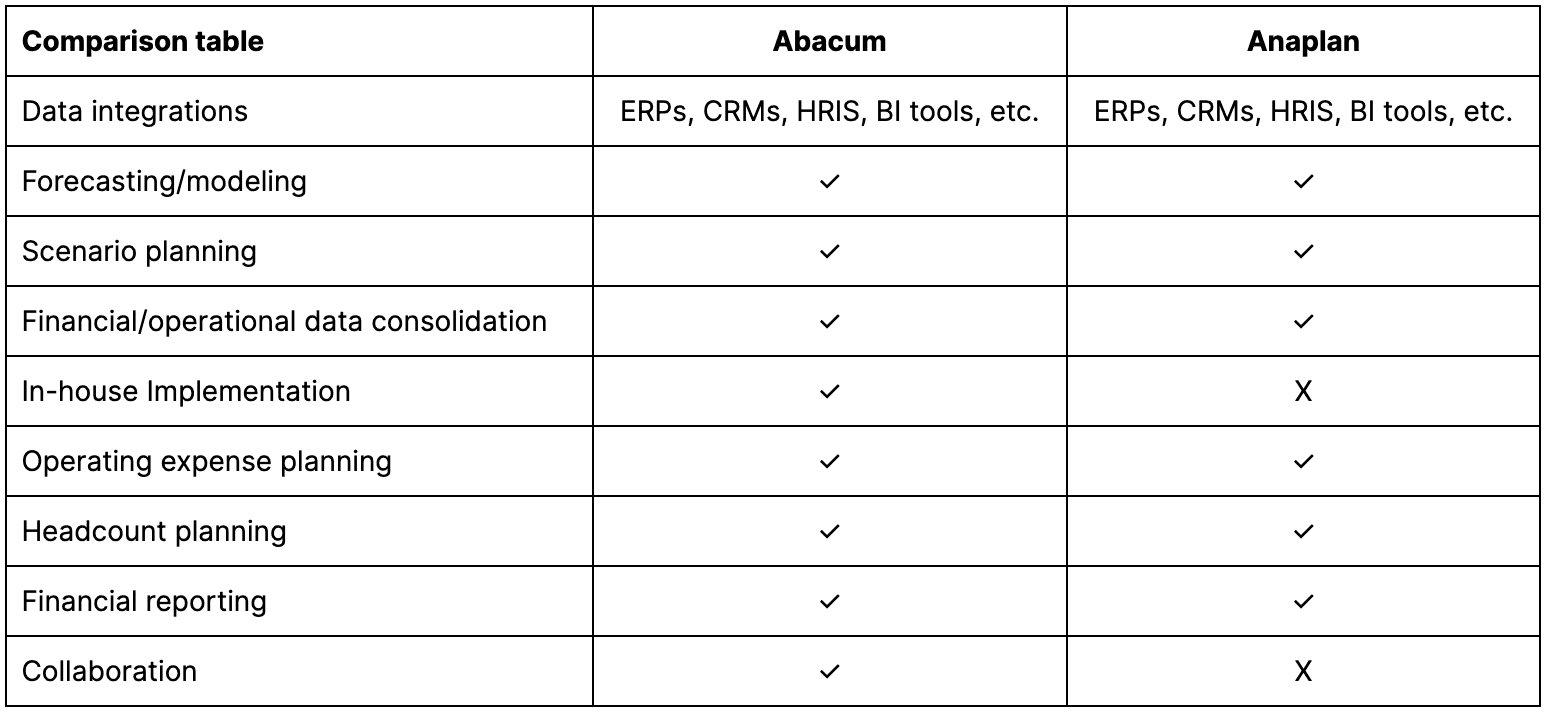

How does Abacum compare with Anaplan:

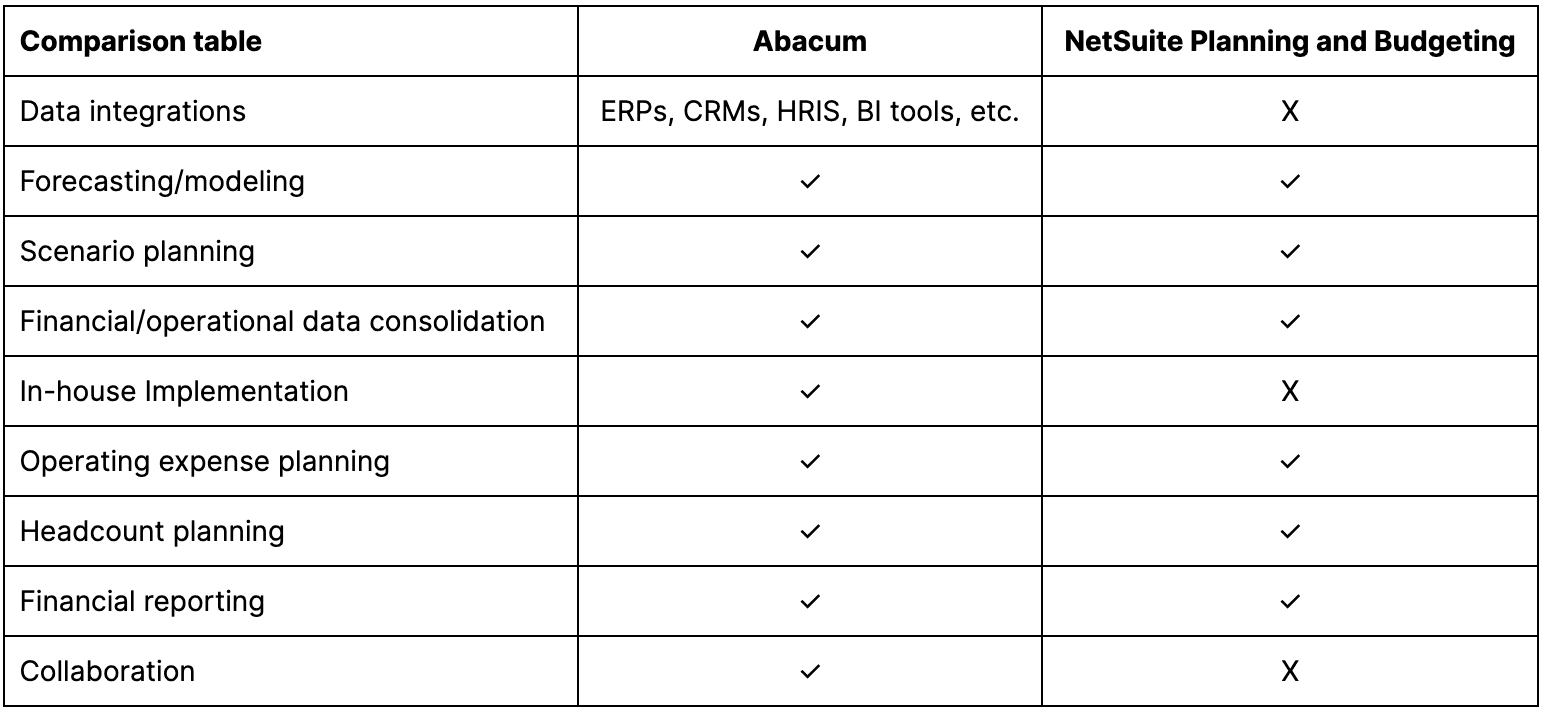

5. NetSuite Planning and Budgeting

G2 / Capterra ratings (September 2023): 4.0/5 / 4.1/5

Summary: NetSuite Planning and Budgeting streamlines finance operations by automating planning, budgeting, and forecasting processes. It enables efficient plan creation, what-if scenario modeling, and report generation. Tries to minimize manual tasks, so finance teams can focus on strategic analysis, driving impactful insights, and improving the company’s financial position.

Key features: The premier ERP that can integrate with your business bank accounts and provide customizable reports.

Who is this tool for: The tool is best suitable for businesses with NetSuite as an ERP. On top of it, it will be necessary to acquire the budgeting and forecasting pack.

Support options: They have a resource center with highly in-depth knowledge in all aspects of their product as well as best practices for different industries. Clients also seem really happy with their customer service support option.

How does Abacum compare with NetSuite:

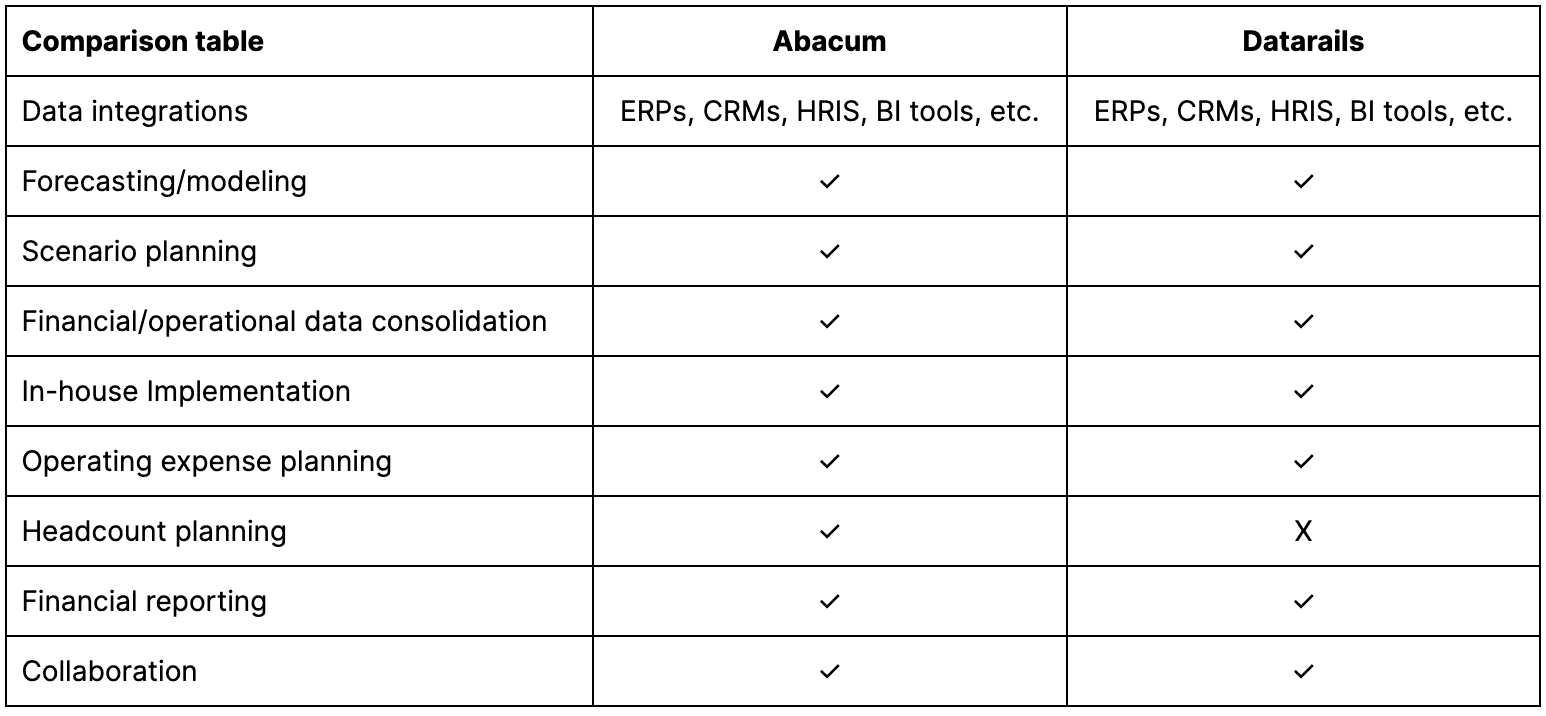

6. Datarails

G2 / Capterra ratings (September 2023): 4.7/5 / 4.8/5

Summary: Datarails is a comprehensive financial planning and analysis platform that seamlessly automates financial reporting and planning processes. It offers the convenience of working with familiar Excel spreadsheets and financial models, empowering finance teams to leverage their existing skills and maximize productivity.

Key features: It provides templates for both reporting and forecasting, data collaboration, robust version control, audit trail, or analysis in excel feature are among its highlighted features.

Who is this tool for: More tailored towards the smaller side of SMBs as well as fractional CFOs, where they will be able to have a client portal for all their customers.

Support options: It provides an academy with in-depth resources about its product, as well as customer support.

How does Abacum compare with Datarails:

7. Xero

G2 / Capterra ratings (September 2023): 4.3/5 / 4.4/5

Summary: Xero is a user-friendly accounting software solution that simplifies financial tasks and seamlessly integrates with banks for AI-powered reconciliation. With a centralized platform, users can efficiently manage all their accounting needs, saving valuable time on mundane tasks.

Key features: Among its key features we would highlight bill payments, expense claims, bank connections, payment acceptance, project tracking, and fixed asset management.

Who is this tool for: Xero is best suited for small to mid-market businesses to which QuickBooks might be a bit too basic and a bit too small for NetSuite.

Support options: They provide guides, courses, and a lot of knowledge on their product. On the other hand, their customer support seems to receive mixed reviews.

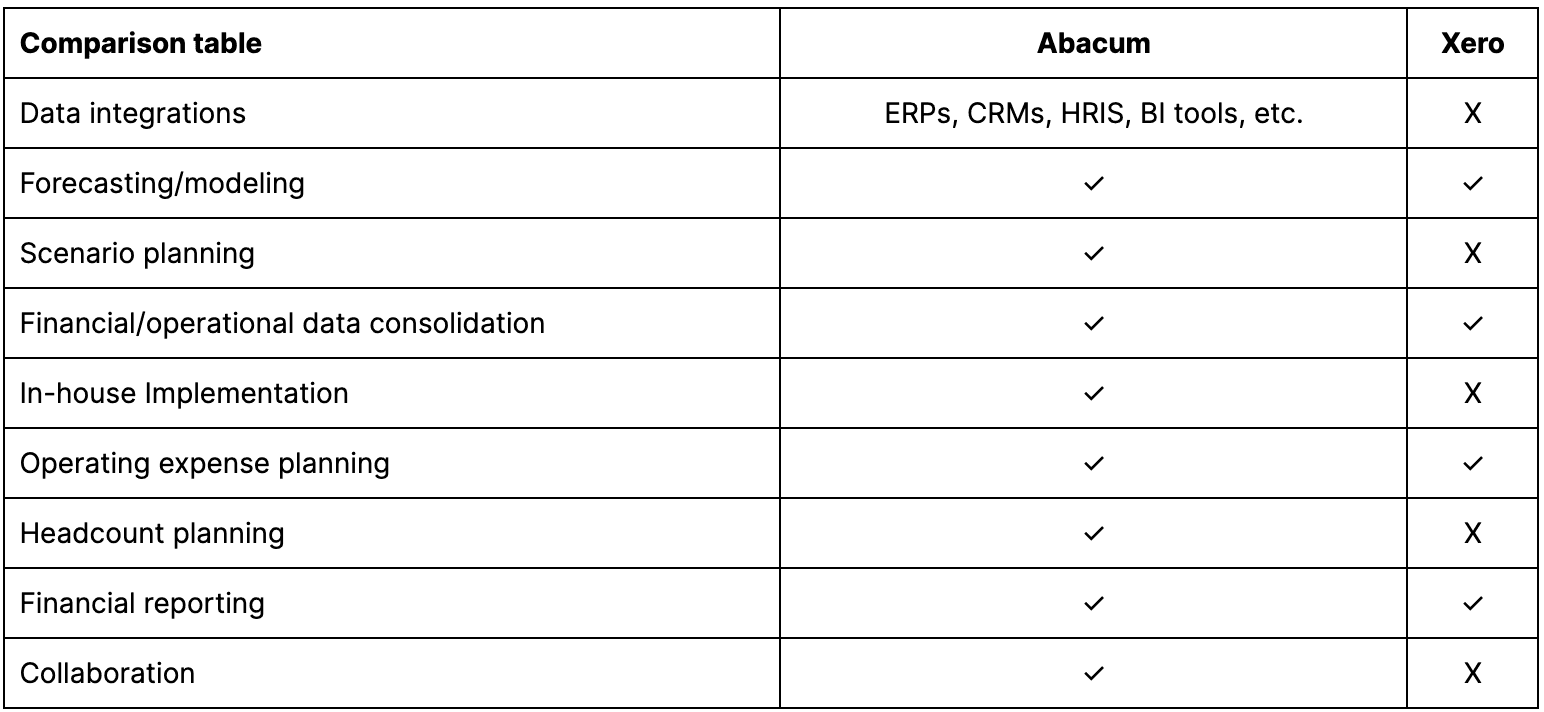

How does Abacum compare with Xero:

8. QuickBooks Online

G2 / Capterra ratings (September 2023): 4.0/5 / 4.3/5

Summary: QuickBooks Online is a cloud-based accounting software. It provides a comprehensive suite of features aimed at simplifying crucial financial tasks such as budgeting and forecasting, expense tracking, invoicing, and financial reporting. By leveraging QuickBooks, users can efficiently manage their finances and streamline their business operations.

Key features: One notable feature of QuickBooks Online is its planning tool. It allows users to set up and monitor different scenarios for their plans, track variances, and gain insights into the financial performance of the business.

Who is this tool for: Perfect for small businesses and self-employed individuals, QuickBooks offers an intuitive and user-friendly budgeting solution. It caters to diverse industries, providing an affordable and accessible accounting software option for businesses seeking simplicity and functionality.

Support options: They possess a comprehensive support page, with information about “how-to”, and new features. They will also provide training for their users.

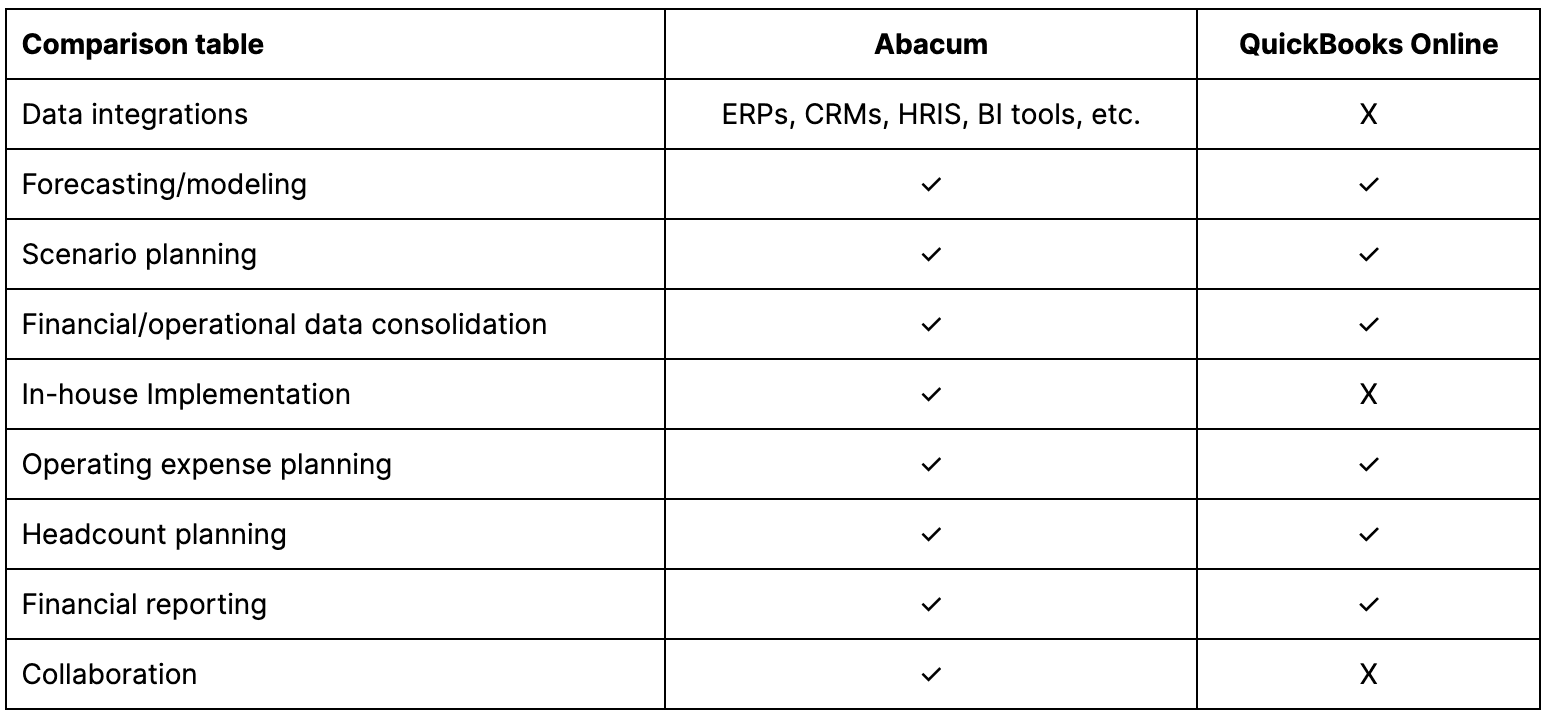

How does Abacum compare with QuickBooks Online:

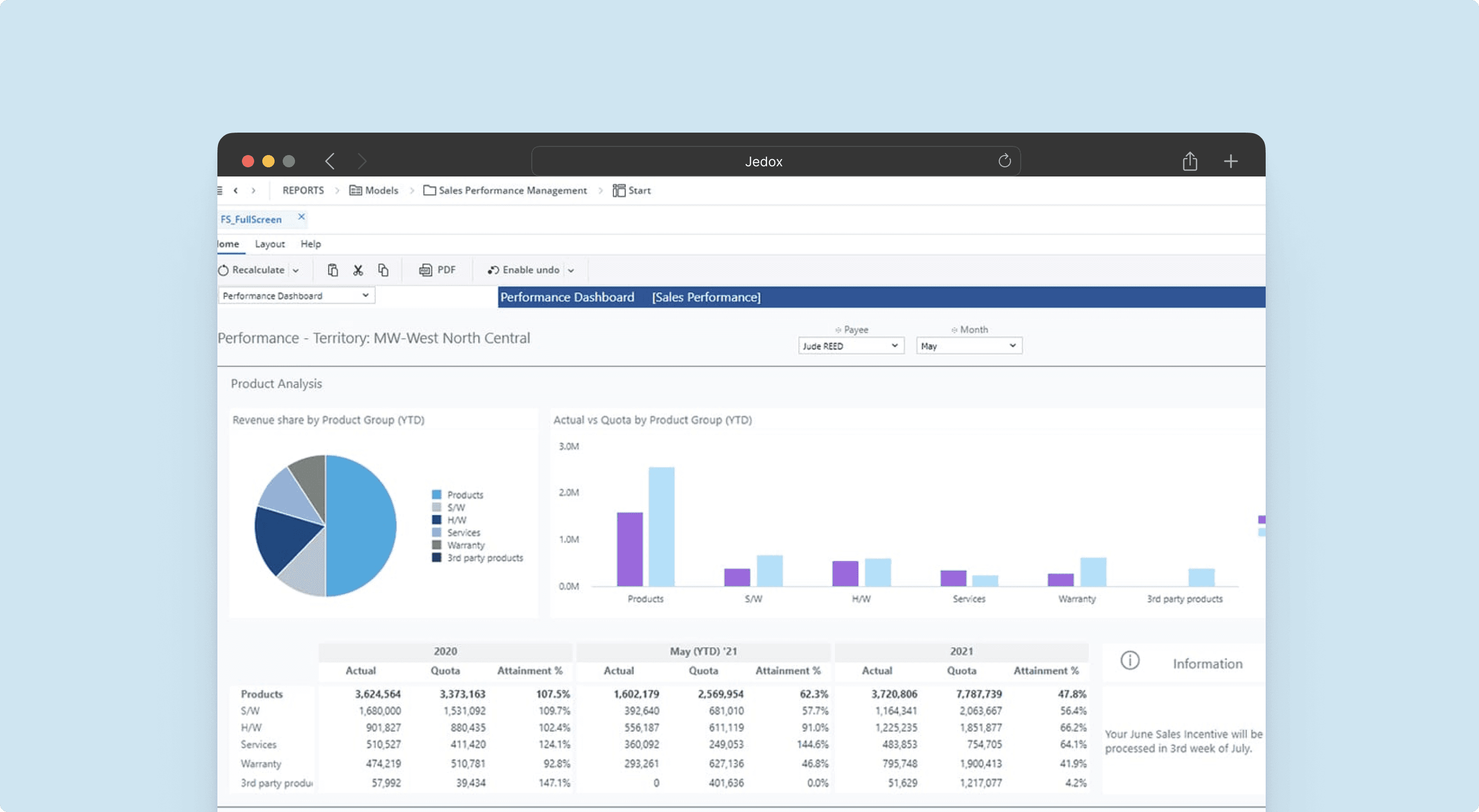

9. Jedox

G2 / Capterra ratings (September 2023): 4.3/5 / 4.4/5

Summary: Jedox is a dynamic planning and performance management platform that empowers organizations to exceed expectations with their plans.

Key features: Some of Jedox’s key features are different permissions for different users, a robust ETL process, the ability to run some code in order to automate some tasks, or an Excel add-in.

Who is this tool for: Its target customers typically include finance departments, planning teams, and decision-makers within enterprises who seek a flexible and comprehensive planning and performance management solution.

Support options: They have a wide range of support options that span from an academy to training videos, training calendars, and even training centers. On top of that, they provide the usual support function.

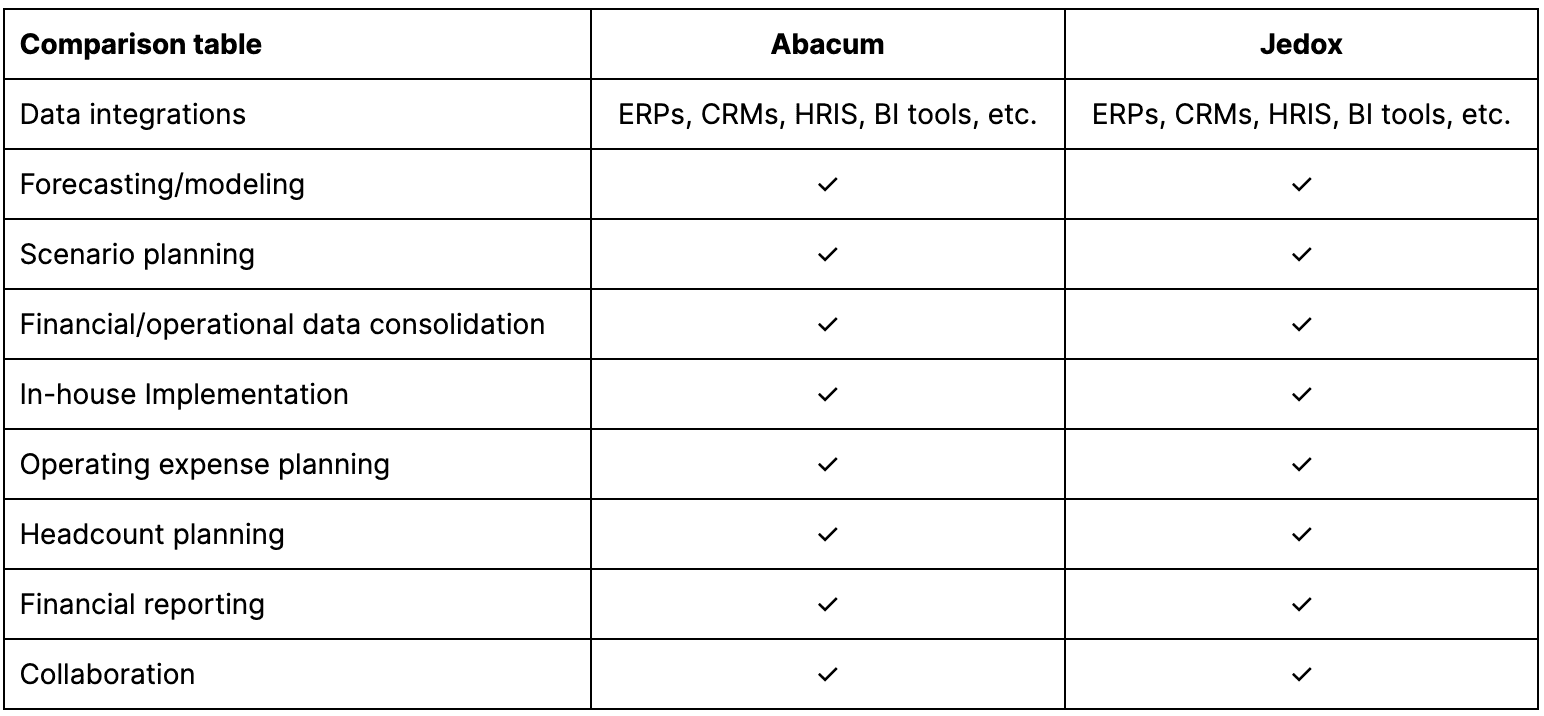

How does Abacum compare with Jedox:

10. OneStream

G2 / Capterra ratings (September 2023): 4.6/5 / 4.8/5

Summary: Intelligent finance platform that simplifies financial operations. It streamlines corporate performance management (CPM) processes, including planning, financial close & consolidation, reporting, and analytics, all within a single, adaptable solution.

Key features: It has powerful features including consolidations, expanded financial reporting, account reconciliations (RCM), and the utilization of OneStream XF. OneStream XF is a highly flexible solution, enabling the creation of customized reports and dashboards with ease. The platform also excels in task automation and offers the functionality of report books, making it a comprehensive and versatile financial consolidation and planning platform.

Who is this tool for: The tool is best suited for enterprises that are ready to take their reporting and Corporate Performance Management workflows to the next level.

Support options: OneStream offers a highly esteemed support portal, highly valued by its customers. The portal includes a comprehensive knowledge base featuring readily accessible and searchable FAQs, real-life examples of “how to” scenarios, and detailed documentation with step-by-step instructions covering all aspects of the product. Additionally, customers benefit from timely updates on new feature releases. The platform also includes a Community Message Board that fosters collaboration among customers and service professionals.

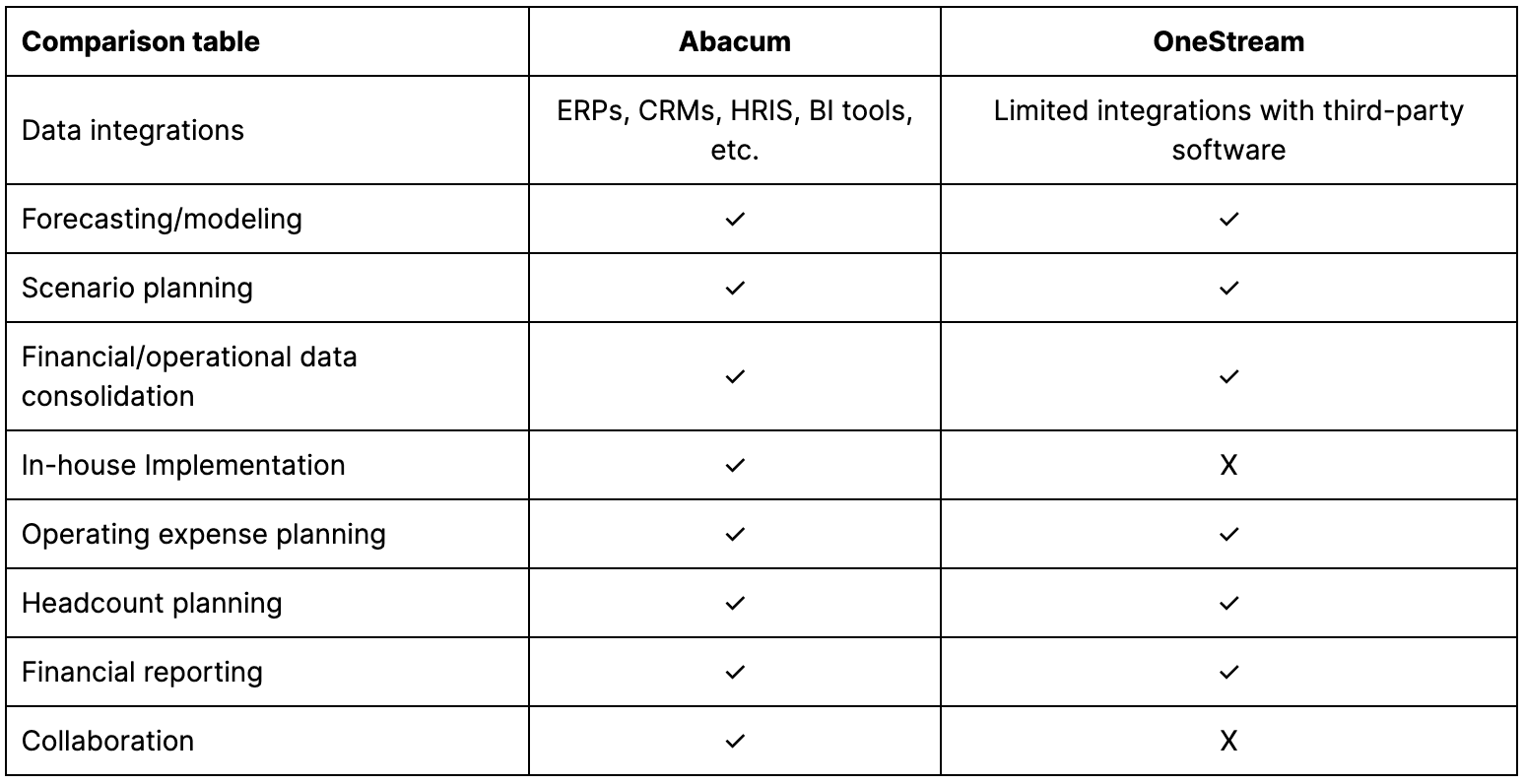

How does Abacum compare with OneStream:

Elevate your financial planning with Abacum!

Abacum is your comprehensive financial planning platform designed to automate your workflows and provide real-time insights, allowing you to devote more time to strategic planning.

Abacum offers a comprehensive financial planning solution tailored for mid-sized companies, to automate their workflows, provide real-time insights, and completely change they way they plan, forecast, and strategize.

If you’re uncertain about the ideal financial planning tool for your business, Abacum is the ultimate choice. It stands as the foremost planning software for mid-market companies in diverse industries.

Here are the main reasons why you’ll appreciate Abacum for financial planning:

Streamlined Implementation: Abacum’s dedicated implementation team ensures you receive continuous support and training, enabling you to complete your financial planning process on time.

User-Friendly Experience: Abacum prioritizes user-friendliness and intuitiveness. Unlike other tools that require technical expertise from budget owners, Abacum offers intuitive workflows that are accessible to all users, even non-financial ones.

Integrated Financial Planning: With Abacum, you can enjoy a seamless and unified financial planning experience with data integrations that free you from the hassle of manual data consolidation.

Real-time Forecasts: Abacum lets you stay ahead of the curve by making sure your forecasts are always up to date with the most current data.

Customized Planning Templates: Abacum offers customizable templates that provide an intuitive way to prepare your financial plans without compromising on the depth and clarity of information.

Exceptional UX and UI: Abacum boasts an outstanding user experience (UX) and user interface (UI), driving widespread adoption among stakeholders across your organization.

Advanced Features: Abacum empowers FP&A teams by automating data wrangling, integrating with diverse data sources, and facilitating data reconciliation. This ensures your team can focus on critical tasks and utilize various budgeting/forecasting methods such as top-down and bottom-up approaches.