The best FP&A teams aren’t working behind the scenes, lost in a spreadsheet somewhere in an office far far away. The best FP&A teams are front and center, playing the crucial supporting role of strategic business partner.

Julio Martínez, Abacum Co-founder and CEO, came together with FP&A Educator, Christian Wattig, recently to discuss forecasting approaches that drive business decisions. As part of that discussion, they highlighted three key strategies for better business partnering:

Setting the scene with detailed scenario planning

Weekly forecast meetings (that don’t steal the show)

An honest performance: uncovering forecast bias

In this article, we’ll take a look at each strategy and how you can put them into action. Don’t miss out on their full conversation for detailed insights into decision-driving forecasts.

1. Setting the scene with detailed scenario planning

“Meaningful discussions with stakeholders is what multiplies impact .”

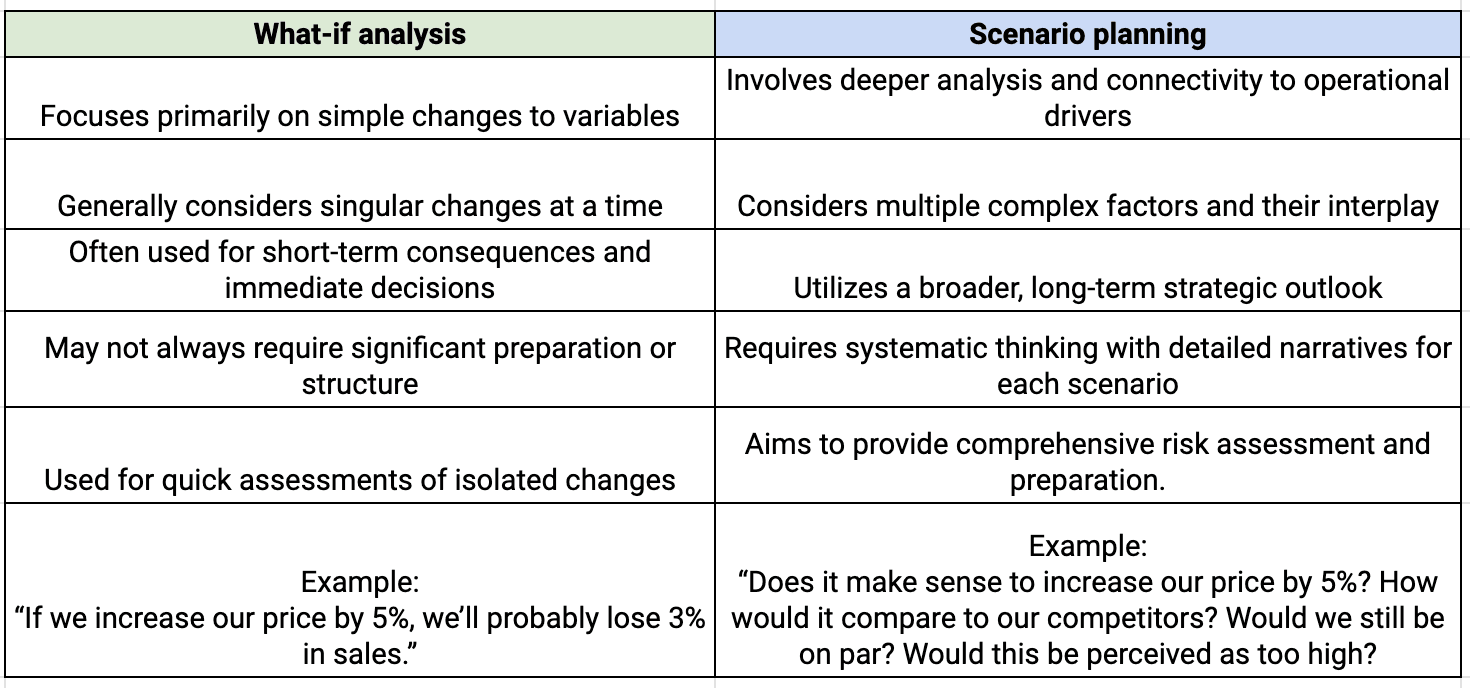

First things first, let’s take a step back and consider what scenario planning actually is. And, importantly, what it isn’t. A point that Christian makes very clear is that scenario planning and what-if analysis are two different things.

Here are Christian’s best practices for successful scenario planning:

“First, you want to make sure to limit the number of scenarios. Three to five scenarios is a good starting point. Then you want to develop comprehensive stories for each scenario. It needs to be rich and detailed. It should describe not just what happens, but how and why it happens. Avoid extremes because you want to only look at plausible scenarios. And, most importantly, test your assumptions. ”

The key thing to remember about scenario planning, Julio says, is that your scenario is only as powerful as the discussions you have with stakeholders. Scenario planning in itself won’t drive better decisions: “You need to be close to the business, having those conversations and presenting those scenarios. That’s how you multiply its impact.”

2. Weekly forecast meetings (that don’t steal the show)

“You need rituals to anchor your relationship with the business.”

A weekly forecast meeting?! We know what you’re thinking: I don’t have time to sit in more meetings, never mind the persuasion skills needed to convince my business partners to spend more time on forecasting.

Don’t worry though, a weekly forecasting meeting doesn’t have to be a big deal. Here’s how:

Don’t invite your business partners to a new weekly meeting, ask for an invitation to theirs.

Listen, get the news from the business, then spend the last 15 minutes talking about forecasting.

Don’t update the forecast every week, use an FP&A tool to do a quick and easy pacing exercise.

Ask: based on current sales figures, how much more do we have to deliver to hit our monthly goal? And is that realistic given how many days we have left?

Don’t prepare slides, simply share your screen and keep the conversation as informal as possible.

Use what you learn weekly about what’s going on in the business to inform your monthly forecast.

Christian explains: “If you meet weekly, it’s easier to separate signal from noise and look at what matters. You also increase your forecast accuracy because you have more time to think about the inputs you’re getting from the team when you update your monthly forecast a few weeks later.

If you have more conversations around what was surprising in the business and what to consider for the forecast, you’re bringing transparency, visibility, accountability. It builds trust with the broader team.”

“FP&A teams have to become business partners to have an impact.” adds Julio. “And you need rituals to anchor that relationship with the business. Keep the preparation light but go prepared to add value at those meetings in an efficient way, having analyzed the data without killing it.”

3. An honest performance: uncovering forecast bias

“Finance has to help people to forecast what they actually think.”

Forecast bias refers to a systematic error, something that persists over time and skews your forecast results. In other words, consistently overestimating or underestimating. By understanding what these biases are, and how to avoid them, you strengthen your position as a business partner, driving better decisions through more accurate forecasts.

Here are some of the most common forecasting biases:

Not factoring in unknown risks

This is a common bias when it comes to sales forecasts. You see a robust pipeline of opportunities and overestimate the figures. Why? Because you can’t possibly know for certain that none of those opportunities will fall through. The same goes for project timelines; these forecasts are easy to underestimate because there are so many things that can unexpectedly go wrong.

To avoid this bias, always include a buffer in your forecast for unknown risks.

Misinterpreting historical data

Of course you’re using a data-based forecasting approach, and that’s great, but sometimes the historical data you use is easy to misinterpret. There will often be one-offs that impact historical data but which won’t be repeated and it’s tricky to determine what these are.

Try an out-of-the-box machine learning model to overcome this kind of forecast bias.

External pressure and politics

One of the most common causes of forecast bias, says Christian, is actually external pressure and politics. Because people have a natural desire to present favorable results, they also have a tendency to be overly optimistic in their forecasts. They don’t want leadership to think that they’re pessimistic or lack confidence in their ability to deliver.

“We want people to put what they actually think in the forecast. Finance has to help people uncover these biases because often they’re not aware that they’re there. You need to address this by asking the right questions, comparing forecast to forecast, and measuring that accuracy over time. Then show people the data and say, let’s figure out what we need to adjust.”

More forecasting insights

Don’t miss out on all the business partnering insights that Christian and Julio shared during the live webinar. Watch the video to get their expert advice on combining bottom-up and top-down forecasting, rolling forecasts, driver-based forecasting, and more.

We host new webinars all the time, featuring experienced CFOs, FP&A experts and business leaders from around the globe. Make sure you sign up to stay up to date.