Small tech startup. We didn’t have job descriptions. We didn’t need them at the executive level, right? There were only six of us. There was a COO in title, but most of the functions were split amongst other teams. Then, some unexpected challenges cropped up:

Who leads the management team meetings?

Why is the CFO involved in setting the KPIs for the customer success team?

Who does the Legal team report to?

Should HR report directly to the CEO?

We wanted to scale. We didn’t want bureaucracy. Many companies face this situation. You need to make sure at least the CFO role is clearly defined in order to be effective. At the end, we’ve included a quick checklist to help your management team clarify these roles.

1. Your CFO role depends on the size of your company

The “finance part” of tech startups and scale-ups is relatively straightforward. There is no inventory. Your profit margin is high. And, the critical focus is effective growth rather than optimization. As such, you have a lot of time in the beginning (up until IPO prep) to handle finance and cover several other tasks. This saves the company money and consolidates control of your operational and finance numbers.

Generally, in smaller companies (Seed->B+), the CFO should oversee a broad range of finance, operations, and analytics. As the company grows, the CFO role should narrow, with more emphasis on exacting financial tasks and optimization.

Here are the suggested scopes for each level of Strategic CFO.

Pre-Seed to Series-A Round:

The finance leader is a generalist, and typically won’t have the CFO title. They wear multiple hats, often performing roles in operations, HR, and legal due to the lean structure. The company’s focus is on proving the business concept.

Scope:

Budgeting and cash flow management. Make sure the company is aware of the bets you are taking and how much runway you have left.

Lightweight financial forecasting models. Help guide early decisions by quantifying options and analyzing potential outcomes.

Oversee most operational areas. This can vary by company but usually includes payments, payroll, CRM, and early-stage accounting systems.

Investor support takes center stage. Collaborate with the founders on pitch decks, financial models, and due diligence for funding rounds.

Compliance and risk mitigation. Manage tax filings, payroll processes, and insurance policies. If there is a legal component, have them report to you.

KPIs and accountability frameworks. They should be simple, clear, and effective, focusing on essential metrics like burn rate, CAC, and customer growth.

Management Team: Founders, Finance, Product, Revenue

Series B+

The CFO becomes a strategist, establishing scalable processes while managing complexity as the company grows. This means you will need to spend more time on growing while surviving. You may want to increase your FP&A and Treasury headcount at this time.

Scope:

Advance financial forecasting. Integrate growth scenarios and clearly list out strategies to optimize unit economics.

Upgrade your tooling. With scale, the benefits of systems become obvious (ERP, FP&A, HRIS, CRM, etc). Your team should lead the implementation of these processes due to your expertise.

Structure investor relations. Send regular updates and implement tailored communication strategies to your various external stakeholders.

Manage your Cap Table. Balance equity allocations, plan for future rounds, and manage employee stock option pools.

Align the team. With a large workforce, strong communication from leadership across the company will take an increasing amount of work.

Management Team: Founders, Finance, Product, Sales, People, Marketing

IPO Prep:

The CFO becomes a specialist, concentrating fully on financial reporting, compliance, and investor communication for the public market. You will need to spend most of your time (and offload appropriate tasks to other leads) on “traditional finance” work. You may need to bring on higher level specialists in all of your functions to align your company to public expectations.

Scope:

Adapt reporting to meet public standards. Ensure statements comply with GAAP/IFRS and meet institutional investor expectations.

Formulate regulatory compliance. Establish audit committees and strengthen internal controls to prepare for SOX readiness.

Prioritize the IPO roadmap. Manage S-1 filings, roadshows, and due diligence alongside external advisors.

Tailor investor relations to institutional investors. Provide detailed, consistent communication to build trust with a broader audience.

Focus on traditional finance metrics. Emphasize debt-to-equity ratios, liquidity, and reinvestment planning.

Management Team: CEO, Finance, Product, Revenue, Marketing, People, Operations, Legal, Strategy

These are very different roles. And, as often happens, you may add additional finance expertise as you grow either to satisfy investors or give additional expertise when it comes to an IPO. Always be open to this change.

Tip: It is quite a natural transition for an early CFO to shift into the COO role, in order to make room for someone who has previously gone through an IPO.

2. How does this work with individual relationships

This will vary over time, but generally, this guidance is appropriate for mid-sized companies. The following is the middle ground.

The CFO and CEO: Partners in strategy

You serve as the CEO’s closest deputy to ensure strategic goals are grounded in reality and carried out effectively.

The CEO owns the vision; the CFO makes it actionable. Your job is to translate the CEO’s vision into a detailed plan, aligning resources, best practices, and priorities to turn strategy into results.

The CEO owns accountability; the CFO enforces it. While the CEO is ultimately responsible for the business, you ensure clear ownership of priorities through budgets/OKRs/big rocks, surface key issues quickly, and keep initiatives on track.

The CEO owns the board meeting; the CFO owns the preparation. You manage the board deck and its prep, ensuring it’s consistent and clear, so the CEO can focus on big-picture storytelling.

Brainstorm big issues. Set aside regular time with the CEO to tackle critical topics like fundraising strategies, market pivots, or M&A opportunities.

Be a sounding board for investors and external communications. Act as the CEO’s go-to partner for investor discussions and help shape external messaging with precise financial insights.

Talk scenarios. Provide financial models that outline various scenarios, helping the CEO understand trade-offs and make data-driven decisions.

The CEO is your main stakeholder, regardless of the size of the business.

The CFO and Revenue: Effective growth vs. growth at all costs

You set the financial framework for effective growth while the revenue leader focuses on execution.

Revenue owns achieving targets in negotiation with the CFO. Collaborate with Revenue to ensure goals are ambitious, achievable, and aligned with effective spending. Scaling successfully depends on the success of these conversations.

The CFO owns commission plans; Revenue executes them. You design commission structures to drive desired behaviors, while the revenue leader introduces and implements them effectively.

Revenue owns acquiring customers; the CFO provides the data. The revenue team owns the training, the day to day, and the revenue strategy that will produce results. Through your data teams, you need to provide the high-quality data and insights to empower this work.

It is critical that both teams are aligned. The biggest mistake finance leaders make is forcing targets on a sales leader, who then returns at the end of the quarter claiming they were unrealistic in the first place. The second biggest mistake is taking a hands-off approach to how targets will be achieved, which should be defined and tracked as input metrics.

The CFO and Product: Aligning building with revenue

You work with Product to align roadmaps with other teams’ strategies, ensuring strong growth from efficient spend.

Product owns the tech strategy; the CFO interlocks the financial impact. While Product develops roadmaps and drives innovation, you assess the cost and potential revenue of the roadmap.

Product owns release; the CFO leads accountability. Product will lead major releases, but you will need to ensure the timelines align with the rest of the business as marketing, sales, customer success, and revenue efforts all have a part to play in new product releases. Note: Missed product deadlines can be a major cause of revenue miss.

The CFO owns data analytics and is a service provider to Product. This may be somewhat controversial, but having the CFO own analytics ensures a strong connection between product, customers, and financial results.

Collaborate on systems and tools. Together, implement tools that the company uses on a daily basis. Verify that they integrate well.

In the early stages, your role in unifying data across the business positions you as the natural leader, with Product as a key consumer of your services.

The CFO and People: Talent vs. budget

You work with the People team to ensure the right headcount for the organization.

The CFO manages headcount budgets, while People owns the strategy for filling those roles. Maintain a balance between affordability and competitiveness, ensuring hiring aligns with financial constraints.

The CFO owns compensation, while People consults on market rates. You ensure the salary structure is logical for your business, while People ensures it meets market conditions and supports employee satisfaction.

People drives hiring, talent strategy, and performance management; the CFO provides accountability. Ensure that talent initiatives are aligned with broader company objectives and financial goals.

People owns day-to-day people operations; Finance owns compliance and payroll. While People oversees payroll policies and submissions, you ensure payments and compliance are handled effectively.

The People team is one of your greatest allies in holding employees accountable by enforcing reviews, probation periods, and upward feedback.

The CFO and Marketing: Controlled spend vs. immediate leads.

Your role with marketing is to ensure that investments in campaigns deliver measurable results, balancing short-term returns with long-term growth.

The CFO provides data analytics support through the full pipeline. Provide financial insights into campaign ROI, conversion rates, and overall marketing efficiency to help Marketing make informed decisions.

Marketing owns campaign decisions; the CFO evaluates efficiency. Let Marketing drive creative strategies while you focus on measuring and improving their financial effectiveness.

Both monitor customer acquisition costs (CAC). Always keep CAC front and center and within acceptable limits by providing guidance on spending and campaign prioritization.

There is a time delay in marketing spend and results. But, you should be able to keep an eye on initial spending by looking at what immediate results new marketing spend had. How many leads did it create?

Tip: Build campaign level funnel reports (by campaign, from MQL->Logo) maintain control over the company’s marketing expense.

The CFO and Operations: Strategy vs. optimization

In your partnership with operations, you drive the strategy while the COO ensures it’s executed efficiently.

The CFO focuses on the overall plan; the COO optimizes internal processes. Develop long-term financial strategies while the COO ensures daily operations align with these goals.

The CFO sets the KPIs; the COO makes them happen. You define the metrics that matter, and the COO drives execution to achieve those targets.

The COO owns the day-to-day; the CFO takes a long-term view. While the COO manages operational efficiency, you evaluate the impact of current activities on future growth.

Hold regular alignment meetings. Schedule consistent check-ins to ensure operational realities match strategic priorities.

A COO shouldn’t come in until a much later stage. Having two separate teams attempting to run a single operational model can create unnecessary confusion. The split can make sense later, but if you don’t have inventory, deliveries, etc…

3. Exercise: Clarify Roles in 3 Steps

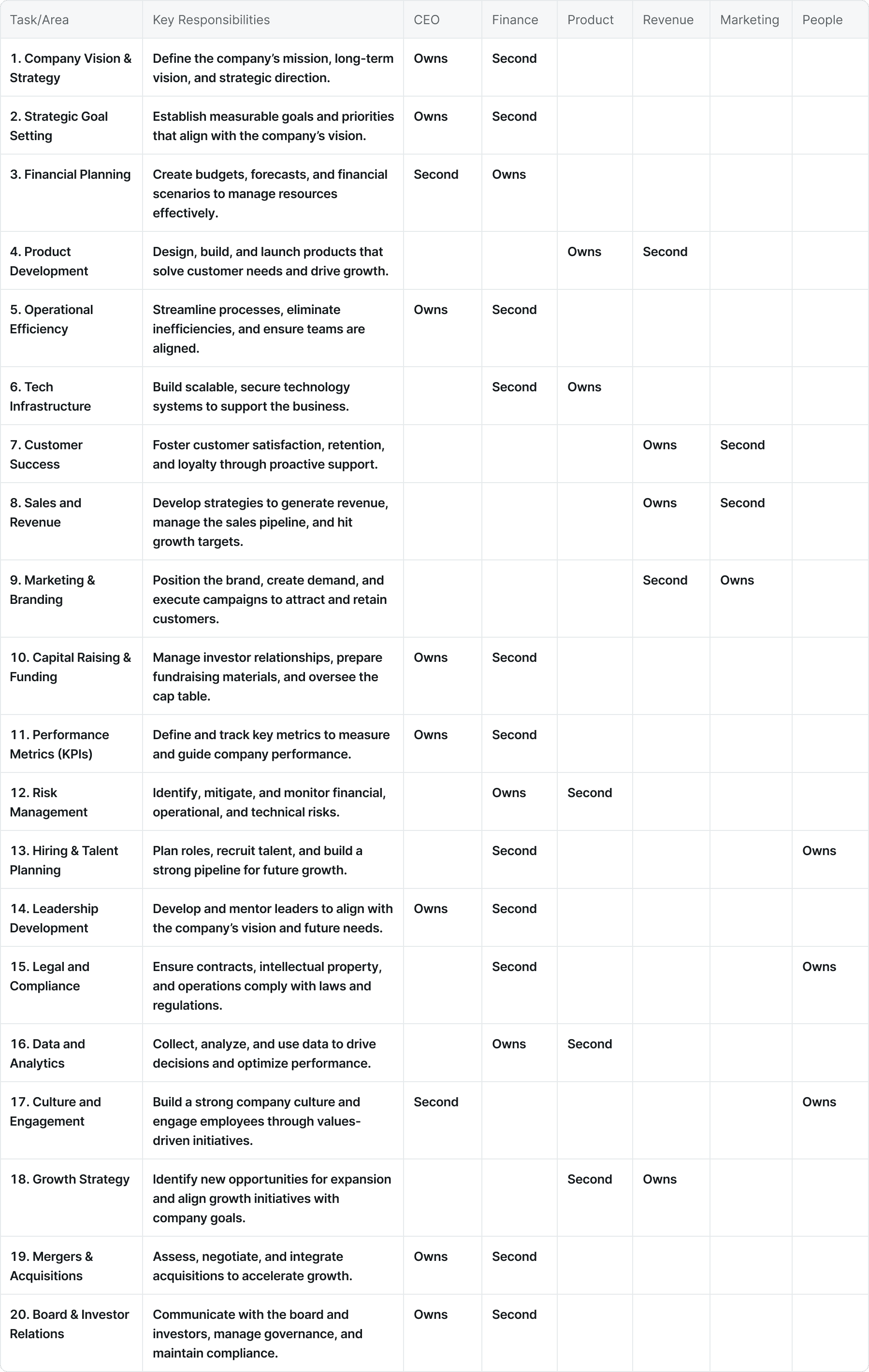

To break everything down a bit (that was a lot), we created this chart to show the key parts of each function of an organization. There is no need to go through some very complicated process. Just read through it, and make sure that you are clear on what each member of the management team owns.

To do the exercise:

Map the Responsibilities: Use the chart below to clarify who owns each area and who plays a supporting role.

Fill the Gaps: Identify areas with unclear ownership (e.g., Legal, Analytics, Culture). Assign temporary responsibility.

Align and Confirm: Review the updated roles as an executive team to ensure clarity and agreement.

In conclusion

The CFO role evolves as the company grows. Early on, the technical finance responsibilities are relatively straightforward, giving you the opportunity to contribute to other critical areas of the business where you can leverage your broad mandate and expertise in data to become a strategic business partner across the organization.