At the center of every business function, a healthy cash flow dictates whether or not a business can continue operations, make strategic investments, support surprise expenditures, and so much more. The cash flow your organization brings in should be carefully measured against your expenditures via the cash flow statement.

A business’s cash flow statement serves as a vital measurement of the health of the business; having enough cash on hand is critical in managing inflation, navigating business downturns, and investing back in the business. On a global scale, inflation has been a centric business challenge since the pandemic, causing businesses to rely heavily on cash reserves and making cash flow statement monitoring more important than ever.

With the right cash flow statement template, maintaining a healthy cash flow becomes intuitive. By implementing a sophisticated process around cash flow management, your organization can move from reacting to cash events to directing them from the very start.

What is a Cash Flow Forecast?

A cash flow forecast encompasses all the cash an organization anticipates coming in within a period – cash inflows – and the cash that will likely be spent – cash outflows. It’s the consolidation of all future cash flows, rolling transaction-level detail into a summary view that can be used to make business decisions and highlight cash issues that exist within your company’s operations.

From the smallest startups to the largest business enterprises in the world, cash flow statements are considered critical financial statements. Business leaders are tasked with correctly forecasting their company’s cash flow in order to maintain a line of visibility to cash reserves, financial health, and overall liquidity of the business.

Usually, a cash flow forecast is created with a specific period of time in mind; you might see monthly, quarterly, and annual cash flow forecasts in different settings.

How Do You Create a Basic Cash Flow Statement?

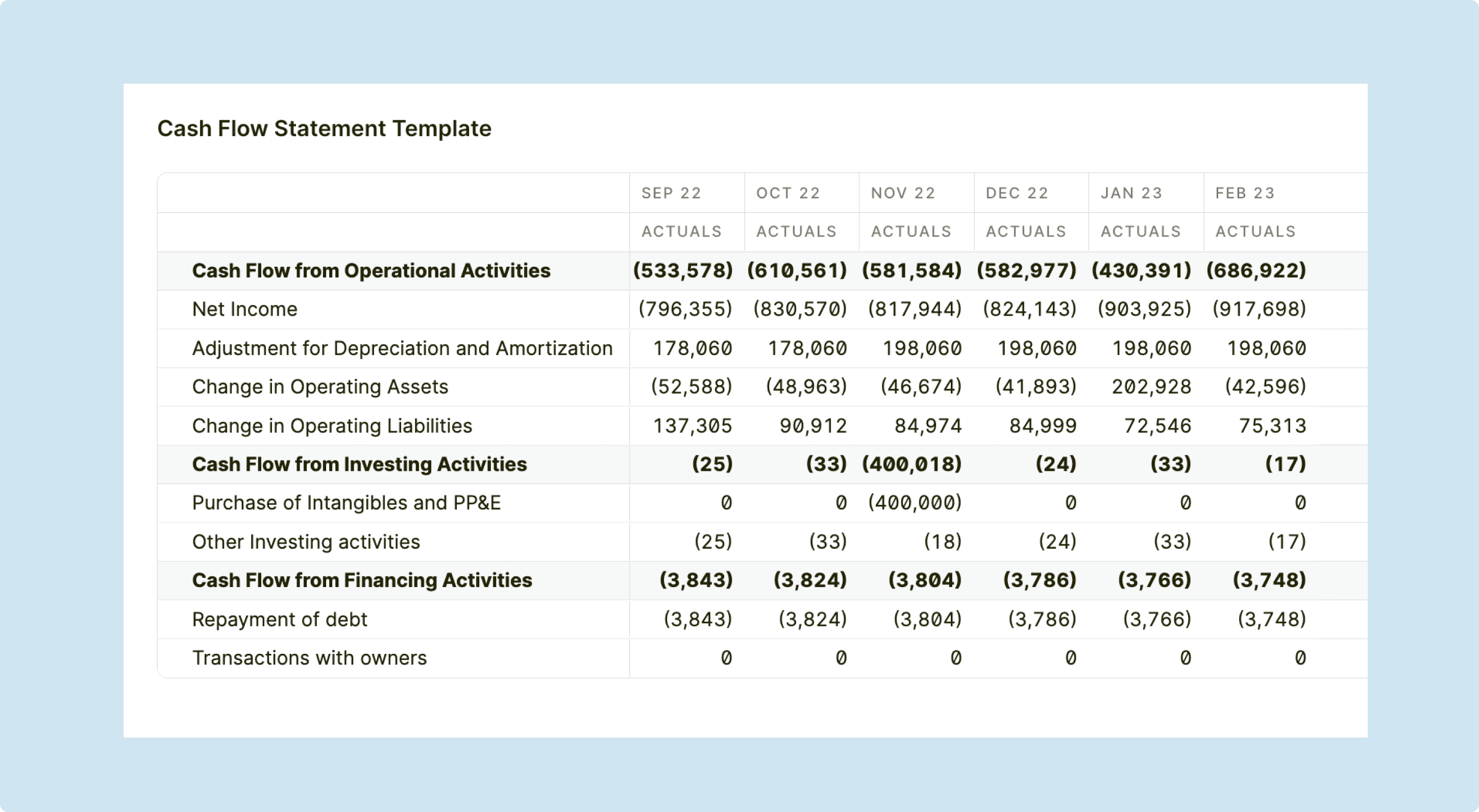

When looking at most cash flow statements, you’ll see three main sections:

Cash from Operational Activities

Cash from Investing Activities

Cash from Financing Activities

Each of these categories can be broken down into more detailed line items such as depreciation, operating expenses, loan repayments, and more.

Many organizations choose to utilize Excel or Google Sheets when creating cash flow statements, but in isolation, these programs can be clunky, hard to customize, and have limited functionality. When you use Abacum in conjunction with your existing business systems, a world of possibilities opens up in terms of line item management and analytical capabilities.

FP&A Tip: Cash flow statements may look slightly different for public companies vs. private companies. Privately held companies will include fewer stock-related transactions like dividend payments or stock buybacks, which are very prominent in publicly-traded companies.

How to Make a Cash Flow Statement Template?

If you’re looking to DIY a free cash flow statement template, you’ll need to have all the cash-related transactions of your business for that specific period. Then, you separate each line item into one of the above categories, mapping your source system data in a way that creates a complete cash flow picture.

Our team at Abacum worked to address some of the biggest pain points of analyzing cash flow statements. As FP&A experts ourselves, we know what it’s like to fumble through multiple data systems, struggle with analyzing unreliable data, and experience errors due to tedious processing or manual calculations. Our solution, Abacum, created a seamless cash flow statement template that has more processing power and analytical capabilities than anything that came before it.

With Abacum, though the platform itself is more sophisticated, there is actually less of a lift required from FP&A teams to complete the cash flow statement template. There will be upfront work required to ensure all mappings are correct, but once that’s complete, all you’ll need to do is input any business-specific customizations, and the rest is largely automated.

Once you have your cash flow statement template set up through Abacum, monthly, quarterly, and even annual analytics are at the tip of your fingers, just a few clicks away.

The Importance of Cash Flow for Mid-Market Companies

As we mentioned, cash flow is critical to businesses at all stages. Just like small business operations and large companies, mid-market organizations rely on cash flow analytics for a multitude of reasons.

At one time or another, cash flow will be critical in the following business activities:

Securing Investors

If you’re ever trying to secure investments or forge partnerships, cash flow will be central to the conversation. Before they’ll give you a large chunk of change, investors want you to prove that your business leaders can manage cash effectively. A few poor cash decisions can cause a business to go belly-up, so investors look at current cash flow metrics for reassurance that they’ll see a return on their investment.

Managing the Business

Daily business operations rely on cash to function. If you need to pay a vendor, import a new batch of raw materials, or incur shipping fees for your product, you need cash! Lines of credit only go so far; the second you stop paying your bills, everything will fall apart, and your business could seize up in a matter of weeks.

Making Investment Decisions

During times when cash flow isn’t as healthy as it could be, business owners and other leaders may take a look at cash flow projections and decide to cut back on major business investments for a period of time. By reducing large expenditures – say, for instance, deciding to repair a piece of machinery instead of replacing it as planned – the cash position of a business may slowly recover.

Obtaining Business Loans

If you’re looking to increase your accounts payable without enough cash for repayments, creditors won’t work with you. The amount of cash you have on hand should make lenders feel confident that your business owner is a good steward of money, but if cash reserves are dangerously low, it becomes clear that that is not the case.

FP&A Tip: Before attempting to secure a business loan or work with a new line of credit, do your own stress testing on major metrics in your business. Is cash flow healthy? Do you honor repayment terms? Is revenue hitting expected targets? If the answer to any of these questions is “no,” then you’ll know exactly what to focus on and fix before applying for a new loan.

Categories of Cash Flow

The components of your cash flow statement template should line up with the components of your statement of cash flows, and with Abacum, it’s done automatically.

We’ve split our electronic cash flow statement template into all the main categories you’ll need, with a focus on:

Categories of Cash Flow created in Abacum

Cash from Operational Activities

When looking at cash from operating activities, FP&A teams should be considering all cash inflows that came from sales and all cash payments that are used to operate the business. Negative operating cash flows may be payments made to acquire materials, employee payroll, and even rent & utilities payments.

FP&A Tip: When a long-term asset depreciates, it’s considered a non-cash expense, but there is an adjustment line item for depreciation and amortization that needs to go on your cash flow statement. That line item is housed here, under cash from operating activities.

Cash from Investing Activities

This portion of a company’s cash flow statement encompasses cash inflows and outflows related to investment activities. If you’re making large capital expenditures such as purchasing real estate, investing in new equipment, taking on any long-term assets, or adjusting your organization’s investment portfolio itself, those transactions will be captured here. When you sell securities or receive dividends from investments, positive cash flow will be added to this category.

Cash from Financing Activities

When assessing cash flow from financing activities, the movement of funds between the organization, its owners, investors, and lenders is recorded here. Everything from debt repayments to new stock issuance will roll up into cash from financing activities.

Working with Abacum’s Cash Flow Statement Template

If you’re ready to transform how your organization manages cash, investing in a tool like Abacum will make that transformation journey intuitive, simple, and quick. When starting out with the tool, businesses will need to make mapping adjustments and add customized fields as needed, though our cash flow statement template encompasses many of the line items you’ll need for ample visibility.

Once the back end is verified and approved by FP&A leaders, the cash flow forecast and cash flow actuals are placed side-by-side in an optimized cash flow statement format. Adopting a new technology platform comes with a learning curve, but at Abacum, we dedicated our team to ensuring that the learning curve is as small as possible. In a matter of days, your organization can be up and running on not only cash flow but many other critical business analytics such as balance sheet and income statement components.

With the cash flow statement template, we implemented features that make our tool more valuable to your FP&A team and business partners than most other tools on the market. We know you’ll love these features just as much as we do.

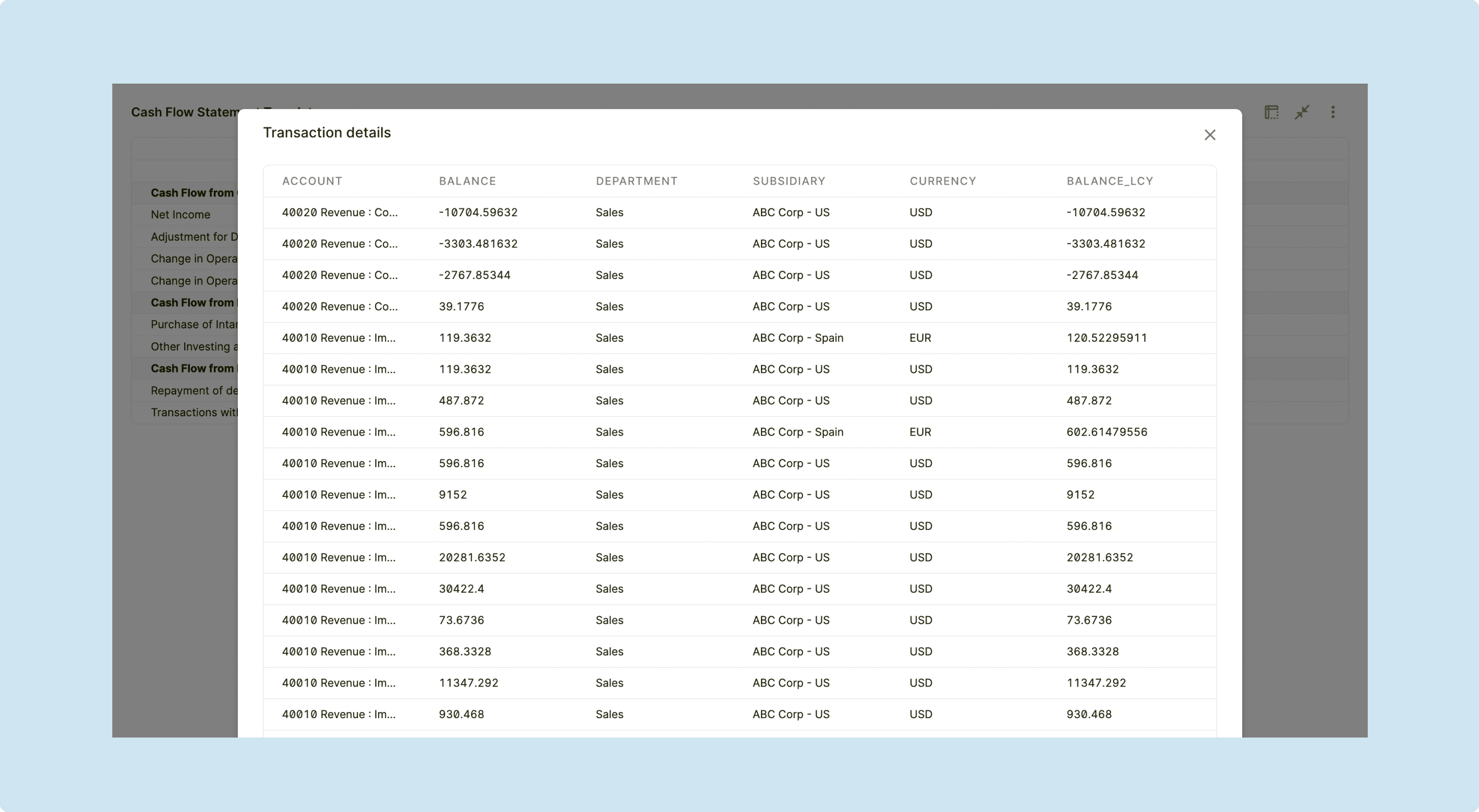

Drill-Down Capabilities

The primary view of our statement of cash flows is summarized at a high level, but we designed the tool so that you can drill down into transaction-level details within seconds. If you’re not sure why your “debt repayments” line item is showing a certain value, you can click on that line and get a detailed view of all the transactions that are rolling up into it.

Drill-Down Capabilities created in Abacum

You may notice a small mapping error, or you might be getting early visibility into a payment issue. With quick analysis capabilities, you can solve problems before they start compounding and negatively impacting your cash balance or business performance.

Managing Assumptions

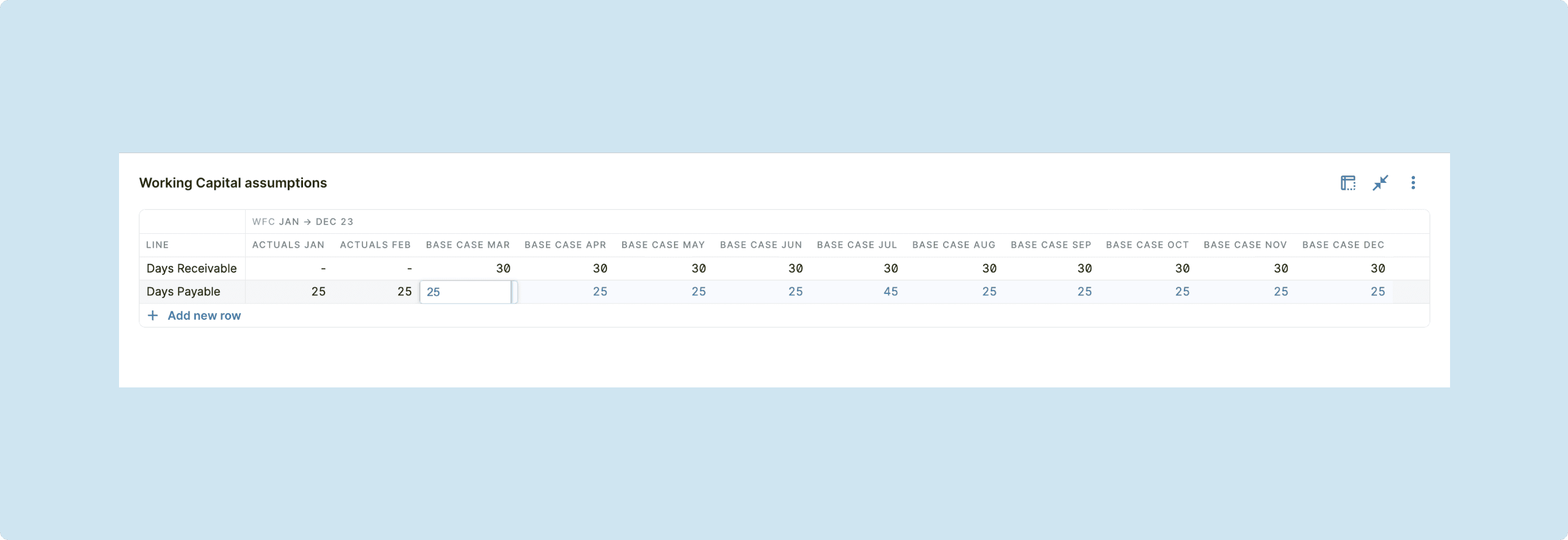

In our interactive cash flow template, managing your working capital assumptions is easier than ever. You can link your days receivable forecast and your days payable forecast to the actual days based on cash inflows and outflows. With updated working capital assumptions, your operating runway becomes clear, flagging any areas that need help early on.

Working Capital Assumptions created in Abacum

Forecast vs. Actuals

A forecast means nothing if it doesn’t get compared to actuals. We work with many businesses that house their forecasts and actuals in different systems, leading to downstream issues when FP&A tries to analyze performance. With Abacum, no matter how many systems you store data in, we bring it together into one place, reducing the amount of time your teams will spend chasing down data and tying systems to one another.

Understanding Cash Flow Leads to Better Cash Management

The cash flow statement, along with a company’s balance sheet and income statement, provides some of the most critical insights regarding overall financial health. If a business lacks liquidity or makes poor cash decisions, the financial health of that business isn’t what it should be. Investors, business owners, partners, lenders, suppliers, and so many more upstream and downstream entities are constantly looking for red flags; too many red flags in your business could impact their business, making your company undesirable to do business with.

When you get a better handle on important metrics such as cash flow, you start to get the visibility you need to fix problems before they become apparent to your business partners. If you can react more quickly by getting to the root of an issue with a couple of clicks, your cash reserves will reflect that. Don’t be fooled into thinking cash flow isn’t just as important as monitoring liabilities and revenue because, at its core, cash flow is the collation of those already-imperative business metrics.

Why Choose Abacum?

Abacum’s cash flow statement template isn’t the only tool on the market that will help streamline your cash management process, but it is one of the best. Our team is made up of FP&A professionals that know the challenges that come with managing cash flow, and we solved for all of them.

Our tool can connect to any ERP, CRM, or other source data system including an Excel template, pull in the relevant information, and change it from a flurry of numerical data to business insights. All the information you need to make cash-related business decisions will be in one, easy-to-navigate spot.

If you have concerns about tailoring the tool to your business needs, reach out to our team today! We know not every business operates in the same way and we’ve created a platform that can absorb customizations better than any other tool available to mid-market businesses.