When it comes to monitoring the financial health of your business – whether you sell SaaS solutions or make cleaning supplies – the three most important financial documents are the income statement, balance sheet, and cash flow statement. Since these financial documents are tracked on a regular basis and updated as new information comes in, ensuring that they are efficient, accurate, and actionable is paramount to business success.

These main financial statements, along with other financial metrics, provide a holistic picture of your business. Your balance sheet assesses the liabilities and assets that your business has, the cash flow statement showcases the cash inflows and outflows that occur in a specific time period, and the income statement highlights the income vs. the expenses of your organization.

Relying on a pre-constructed financial statement template for each critical financial statement can reduce the amount of time your FP&A team spends collecting data, combining it into a certain view, and providing insights. With the right income statement template, everyone from C-Suite Executives to business analysts can gain a clear understanding of how your revenue is stacking up against the spending that happens in a given period.

Using Abacum’s FP&A software will open up doors for your organization in terms of financial data accuracy, analytical capabilities, and time-saving benefits. We’ve created a free income statement template that comes with our tool’s offerings; it’s ready to use and can be tailored to fit your exact business needs. If you’re ready to take your business to the next level, whether you’re moving from a small business to a mid-market organization or something beyond, this is the right starting point.

What is an Income Statement?

An income statement, often referred to as a profit and loss statement, pulls together all the information needed to determine if your company is making a profit or losing money.

You can check out our profit and loss statement template if that’s what your organization uses to assess net income.

The income statement template starts with overall revenue numbers. This line item represents the money coming in from sales, and ultimately, the higher your sales revenue number is, the better off your business will be.

From there, an income statement details the cost of sales as well as the total expenses including R&D, selling and marketing, and general and administrative. Once all of the expenses are accounted for within the income statement template, business leaders will get a final net income or net loss number, depending on if the revenue covers the costs of doing business.

To summarize, every income statement should include the following:

Revenue

Cost of Sales

Gross Profit

Total Expenses (R&D, G&A, and S&M)

Depreciation & Amortization

Net Income/Loss

How to Create an Income Statement?

Income statements can be developed in offline tools like an Excel template or using Google Sheets, but quite frankly, those tools and practices are a bit outdated for business today. Instead of manually linking your ERPs and other financial data systems to Microsoft Excel, choose a tool that does all the heavy lifting for you.

Get rid of VLOOKUP formulas, data dumps, and clunky reporting, and opt for a new, automated approach by using a solution like Abacum.

With Abacum, creating an income statement template is incredibly easy. Your FP&A team can connect to as many data sources as needed and define the dimensions and mapping based on your specific business logic. Once all the required data is mapped correctly, Abacum’s interface will automatically update every time the data is synced with the platform. If you’re looking at an annual income statement or a monthly comparison, you can set the required parameters and have profit & loss analytics at your fingertips.

Who is Responsible for Creating Company Income Statements?

Most of the time, the FP&A team within an organization works diligently to create company income statements. These income statement templates can be used during the month-end close, throughout annual planning sessions, or on an ad-hoc basis. If your business has different departments or business units, it’s common to see FP&A delegates for each of the business units working together to create a holistic, summarized view.

Although revenue numbers come from your sales team and operating expenses can come from all over the organization, it is the FP&A team’s job to pull all financial data together to create a cohesive picture of your organization’s financial performance.

FP&A Tip: Processes like the income statement template creation are fantastic examples of how critical business partnering is for the FP&A function. In order to understand the business details behind each number, working with sales experts, marketing specialists, and R&D teams is more important than ever. Companies can no longer live in functional silos; be sure to do the culture-shifting work to bring all your functional leaders together.

Income Statements at all Business Stages

Income statements are critical components of the financial picture of a company at every stage. From early business planning to going public, income statements relay a multitude of key business metrics.

Often, they are the first financial statements that investors, shareholders, and business partners will look at when deciding how to manage their relationship with your company.

Shareholders will start to raise red flags if your income statement is showing that your monthly income is less than your total expenses. This indicates that you aren’t bringing in the total sales that were anticipated, that your business isn’t managing total costs well, or a mixture of both.

In the early days of doing business, securing funding from investors will be nearly impossible if you’re showing a net loss period over period with no end in sight. Remember, they want to see a return on investment and that only happens if you have a positive net income.

Along with your balance sheet template and the cash flow statement template, the income statement was developed as an objective method of communicating the financial position of your company. Data doesn’t lie, and today, most people involved in your business will want the data to do all the talking.

FP&A Tip: If you’re looking for ways to manage your cash more effectively, our founder, Julio, provides his thoughts here! With 25+ years of experience, he has a wealth of knowledge to share.

Building Your Income Statement

Although your income statement may have certain specifications or nuances because of how your business is structured, there are a few key elements that every income statement needs. These elements should be accurate, all-encompassing, and easy to analyze.

With the right level of granularity and insightful summarized views, FP&A teams and their business partners will have the right foundation for all bookkeeping and financial analysis needs.

Revenue

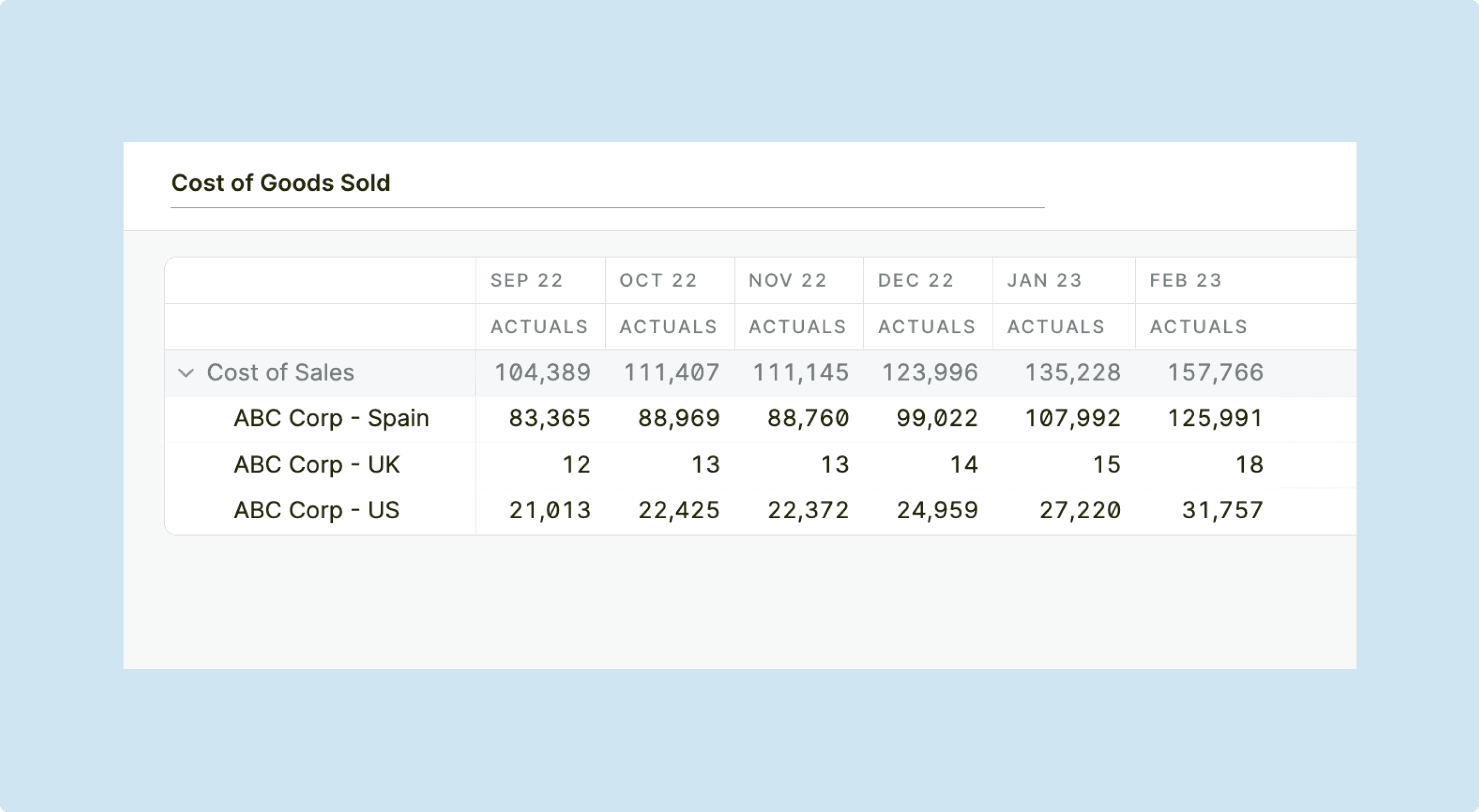

In any income statement example, you’ll see that the first section of the income statement is revenue. The revenue section accounts for all sales coming in. Many businesses will break this section down slightly by detailing revenue from different business regions or business subsidiaries. With a bit more detail, you can quickly see if there are any business areas that are underperforming or in need of extra support. Cost of sales – sometimes called the cost of goods sold (COGS) – is then deducted from total revenue to highlight the gross profit within a specific time period.

Cost of Sales created in Abacum

Expenses

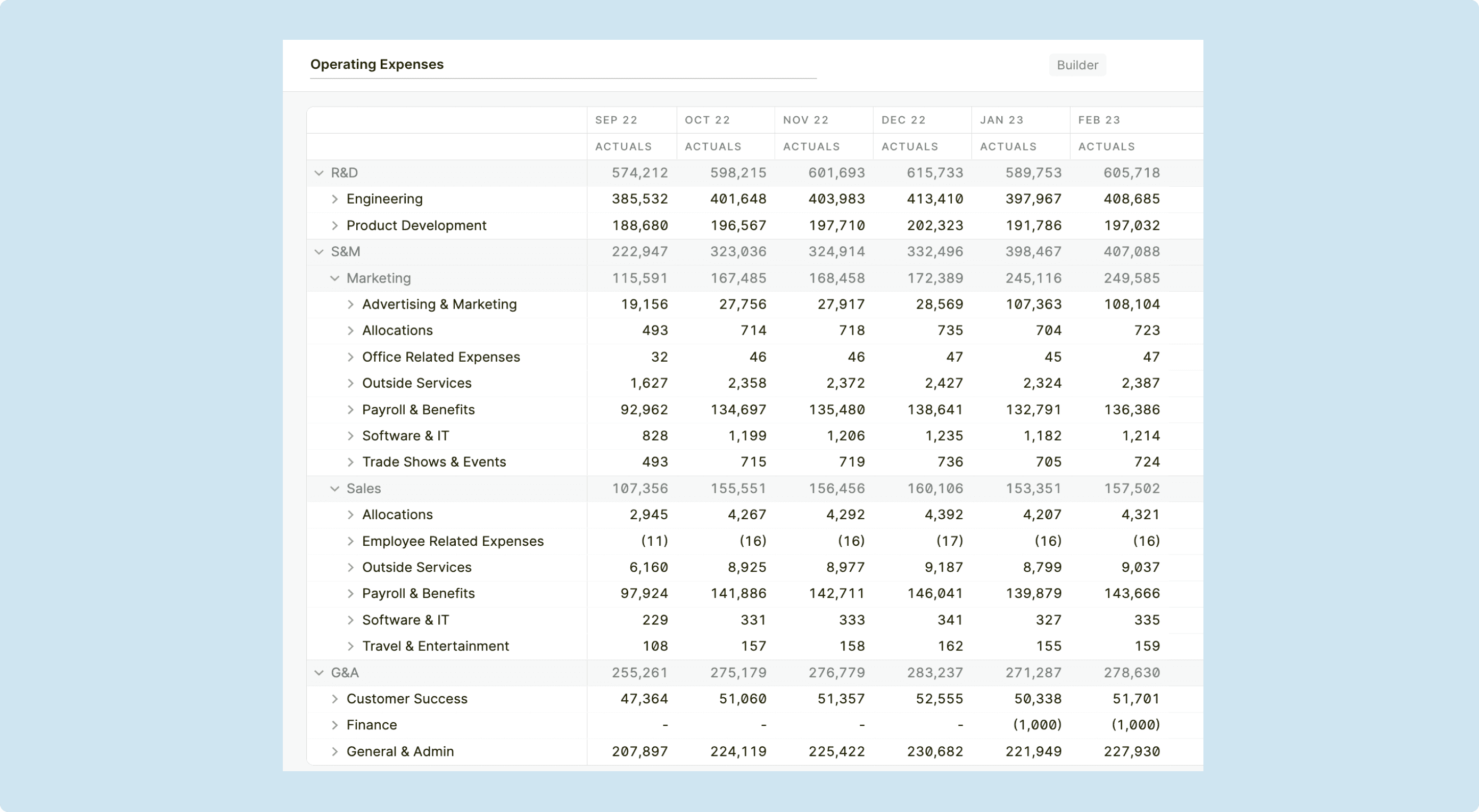

After the revenue section is populated, an income statement needs to detail all of the total expenses in that same period. These expenses, which can range from the cost of marketing campaigns to the cost of new equipment, are often summarized within 3 categories: Research & Development, Selling & Marketing, and General & Administrative. At this point, your organization’s Earnings Before Interest, Taxes, Depreciation, and Amortization – EBITDA – is clear.

Business Expenses created in Abacum

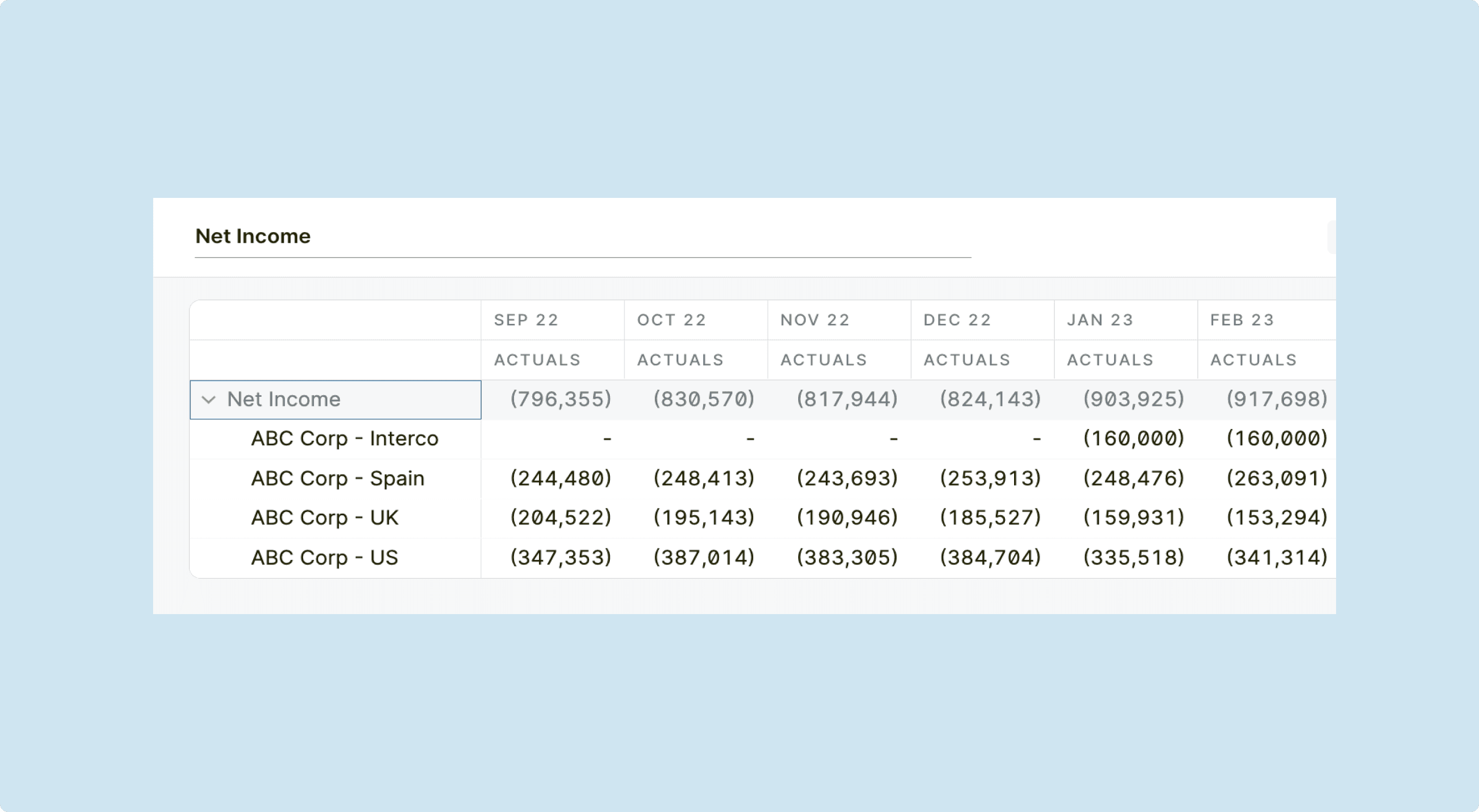

Net Income (Profit/Loss)

Putting the “income” in income statement, the net income line item on your income statement template will show a positive or negative number, representing a net profit or net loss, respectively. If you have too many periods in a row where your bottom line is a net loss, it’s a massive signal that your business is in trouble.

Net Income (Profit/Loss) created in Abacum

What is the Income Statement Formula?

To determine the net income of your business, use this simple formula:

Of course, the components of this formula are not always simple, but once you have a clear line of sight to each variable in the equation, determining your net income is quick and easy.

FP&A Tip: If your net income is unfavorable, or just not as favorable as you’d like, start looking into levers that your FP&A team can pull to make changes. Is the outcome a result of low sales numbers, signaling an issue in that department? If so, the FP&A team should be notifying sales, collaborating on a plan of action, and monitoring future progress. If revenue isn’t the problem, what cost levers can the finance function adjust to reduce expenses?

Assess Your Existing Income Statement Process

The first step to improving any business process is getting a clear understanding of the current process. Taking a fine-tooth comb through every step of building your business’s income statement can highlight areas for efficiency opportunities, process bottlenecks, and any data errors that continue month after month.

When assessing your current state, ask the following questions:

How many people are involved in the creation of the income statement? Are there ways to reduce this number?

How much time does it take on a monthly basis to finalize your income statement template?

Where does the source data come from? Are there multiple systems or sources that need to be utilized to get a complete snapshot?

Does your organization’s process entail a lot of manual steps?

Once there is a clear picture of what happens today, methods of improvement will become clear. With the tools available on the market today, FP&A analysts shouldn’t be spending hours running reports, constantly updating clunky Excel templates, and trying to figure out total discrepancies from one system to the next.

Abacum’s Income Statement Template

Abacum isn’t your traditional accounting software; our full-stack FP&A solution offers a wide range of built-in features, advanced capabilities, and financial data analytics. Along with our cash flow statement template and our balance sheet template, Abacum’s income statement template will change how you do business – yes, it really is that powerful!

We created an income statement template that connects directly to your source data systems, uses a simple mapping mechanism to directly funnel financial data to the right place, and automatically refreshes. With this template, you and your business partners will always get the most up-to-date income information available. You can quickly toggle between any given period, create custom visualizations, and even implement an in-tool approval flow that ensures critical data is seen by all necessary leaders before being published.

Abacum’s Cutting-Edge Features

When you use Abacum, the benefits don’t stop at an automated income statement that updates automatically.

As your familiarity with our tool grows, you’ll find advanced features that will make you question how you ever did business without them.

A few of our favorites are:

Unique Data Visualizations

With the income statement template (A.K.A. the profit and loss statement template), we built an intricate graph visualization to showcase expenses by department over time. This is one of the many features that will help you manage your day-to-day operations while also providing a complete picture of performance over time. If Engineering is spending astronomically more money than your customer success team, you’ll be able to see when spending spikes happen and drill into what’s causing them.

Drill-Down Capabilities

If 10 years ago, someone told you that you’d be able to click on your R&D expenses and get a transaction-level list of everything that made up the final number, would you have believed it? Now, it’s the norm when you use Abacum. Every line item in a summarized template is clickable, allowing you to understand abnormal data faster than ever before.

Actuals vs. Forecast

For many businesses, getting a side-by-side view of forecast and actuals is complicated and tedious. They are forced to take multiple data sets, often from different systems, and compare them in an offline file. However, with Abacum, we combine your source systems on the back end, creating an actuals vs. forecast view that is constantly updating as you make changes.

FP&A Tip: When adopting a new tool, be sure to train your business partners on how to use it on their own. The self-service capabilities when it comes to reporting and analytics are a major time saver for your FP&A teams. For example, instead of creating a monthly report to send to marketing, let marketing go into the tool with view-only permissions, and they can see the data anytime they want.

Abacum Will Change the Trajectory of Your Business

It can feel intimidating to deploy a new tool or system, especially if your business landscape already includes a multitude of systems. Rest assured, Abacum is different. It will not be “just another system” that requires maintenance and manual effort without providing any real value. We take some of the most advanced FP&A processes and make them automated, accessible, and actionable. The income statement template alone will provide endless value, but when paired with all of the features we offer, Abacum will change how your business performs.

Are you ready for a better understanding of your business health?

Then fuel your business with real-time financial data about cash balances, expense categories, sales, and more. Our FP&A team can create financial statements based on all your data sources, ensuring that your finance team is the hero of your small business or mid-market enterprise.